Article Links

Timeline

When will this be released?

UAT Preview Window: Tuesday, January 20, 2026

Production Availability: Thursday, February 19, 2026

Is there downtime for this release?

No.

New Feature/Enhancements

The Winter Release for Payroll introduces the following new features and enhancements. We also encourage you to review the Monthly Release Notes from the past quarter, which include additional updates and modifications to support year-end and new-year tax changes.

Pension Reporting Enhancements

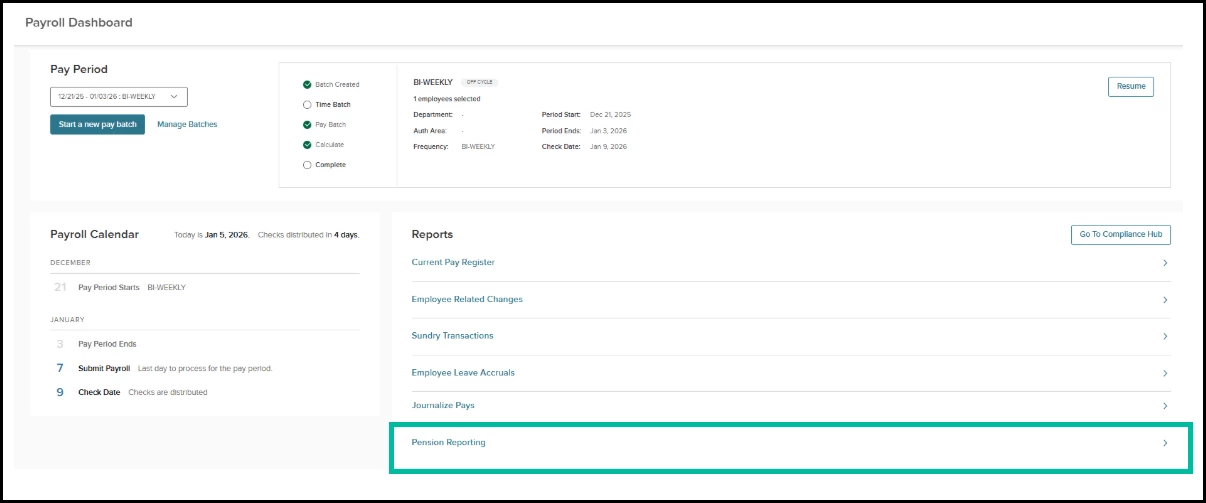

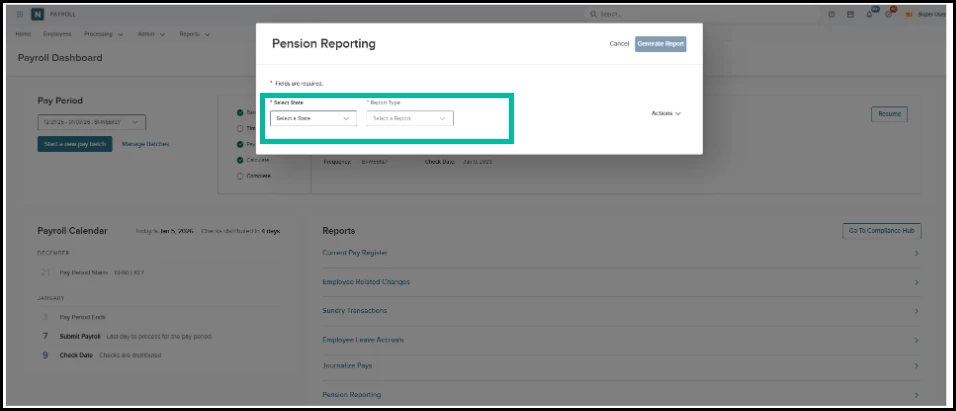

This release updates the pension reporting process, allowing you to run the following pension reports through the new, modernized user interface in the Payroll Dashboard:

- Florida Retirement Report (PEFRS)

- Nevada Pension Report

- New Mexico PERA

- New York State and Local Retirement

- Ohio Public Employees Retirement System

- Oregon State PERS

- Washington State PERS

Value

Accessing multiple pension reports from a single location in the Payroll Dashboard reduces the number of steps required to generate and review pension data.

Audience

Payroll Administrator

Example

To run a pension report, the Payroll Administrator navigates to the Payroll Dashboard, selects Pension Reporting, and then chooses the desired state and report.

W-2 State Reporting Enhancement

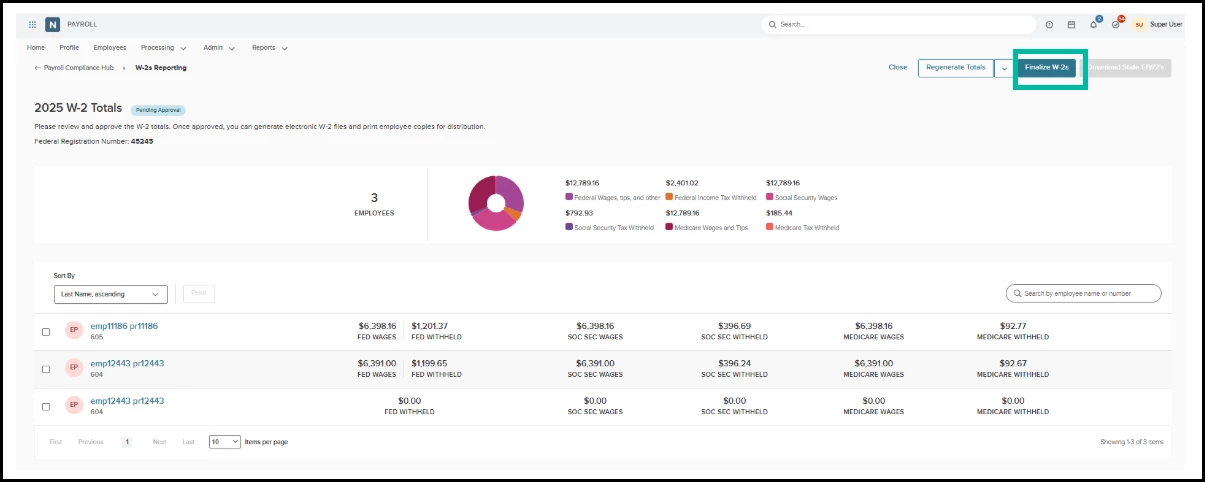

Previously, finalizing W-2s automatically generated the electronic Federal W-2 file, but required you to run each state file separately. With this release, finalizing W-2s now generates the electronic W-2 files for both Federal and State at the same time.

Value

Generating both Federal and State files in a single step streamlines the process, reduces filing time, minimizes the risk of errors by eliminating extra steps, and creates a more efficient year-end reporting workflow.

Audience

Payroll Administrator

Examples

When you select Finalize W-2s, the system generates the electronic W-2 files for both Federal and State simultaneously.

Appendix: Bugs Resolved

No additional bug fixes outside of the maintenance releases. Please refer to the maintenance release notes for details.

Related Resources

- Article: Coming soon!