Article Links

Timeline

When will this be released?

Release Date: 04/03/2025 from 5:00 – 6:30 pm PDT, PST.

Is there downtime for this release?

No.

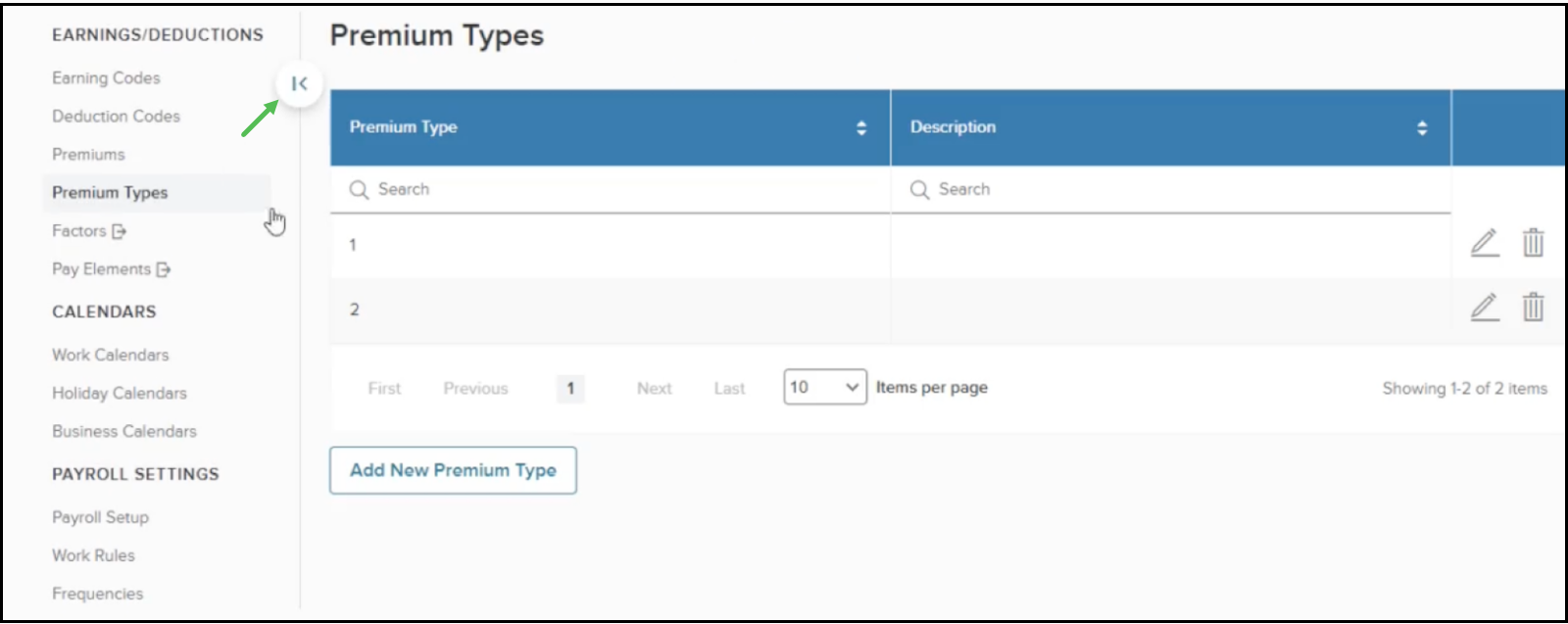

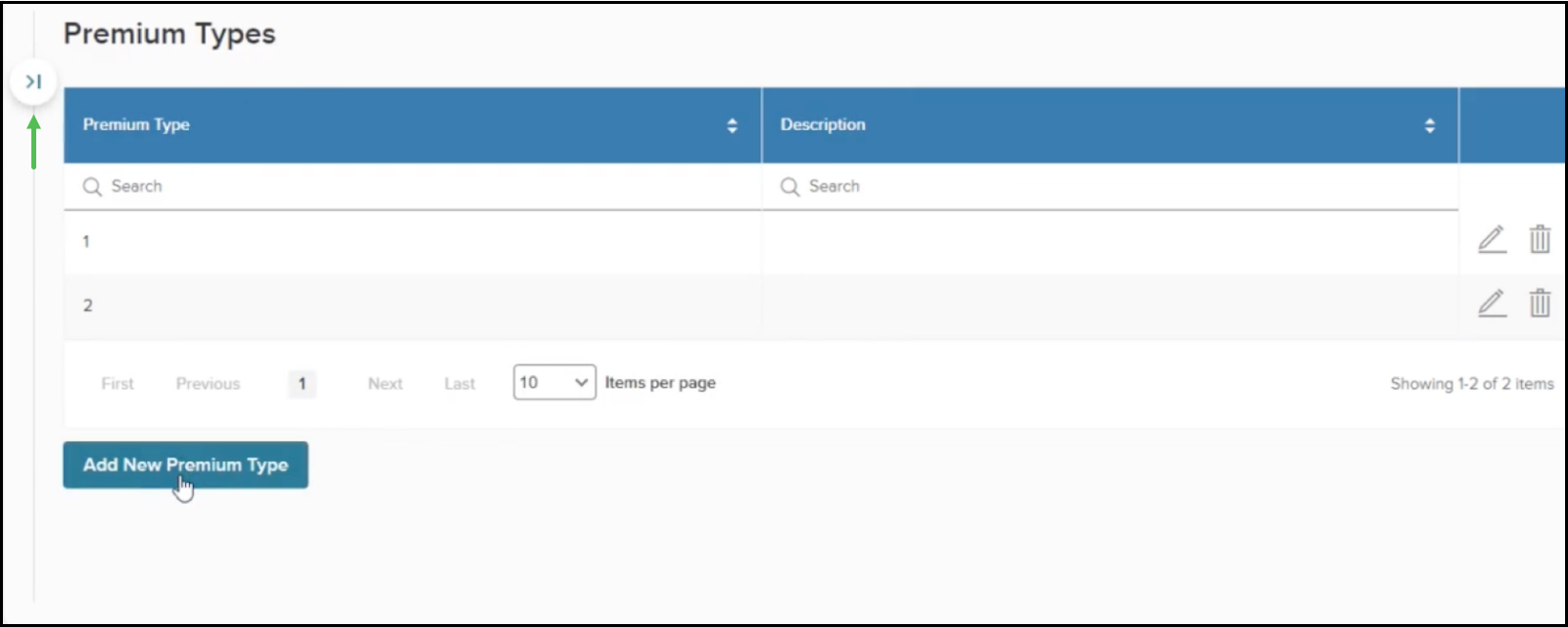

Collapsing and Expanding Setup Menu

With this release, the setup menu in the left navigational bar will expand and collapse. This will be similar to the behavior that exists on the Unified Suite.

When Expanded

When Collapsed

You will see the changes on these pages.

| Page Title | Page Code |

|---|---|

| Premiums | PREMIUM_SETUP |

| Premium Types | PREMIUM_TYPES |

| Payroll Setup | PAYROLL_SETUP |

| Frequencies | FREQUENCIES |

| Bank Accounts | BANK_SETUP |

| GL Accounts | GL_ACCOUNTS |

Value

Enhancing consistency across the application while improving usability through a more spacious and intuitive user interface.

Audience

Admins.

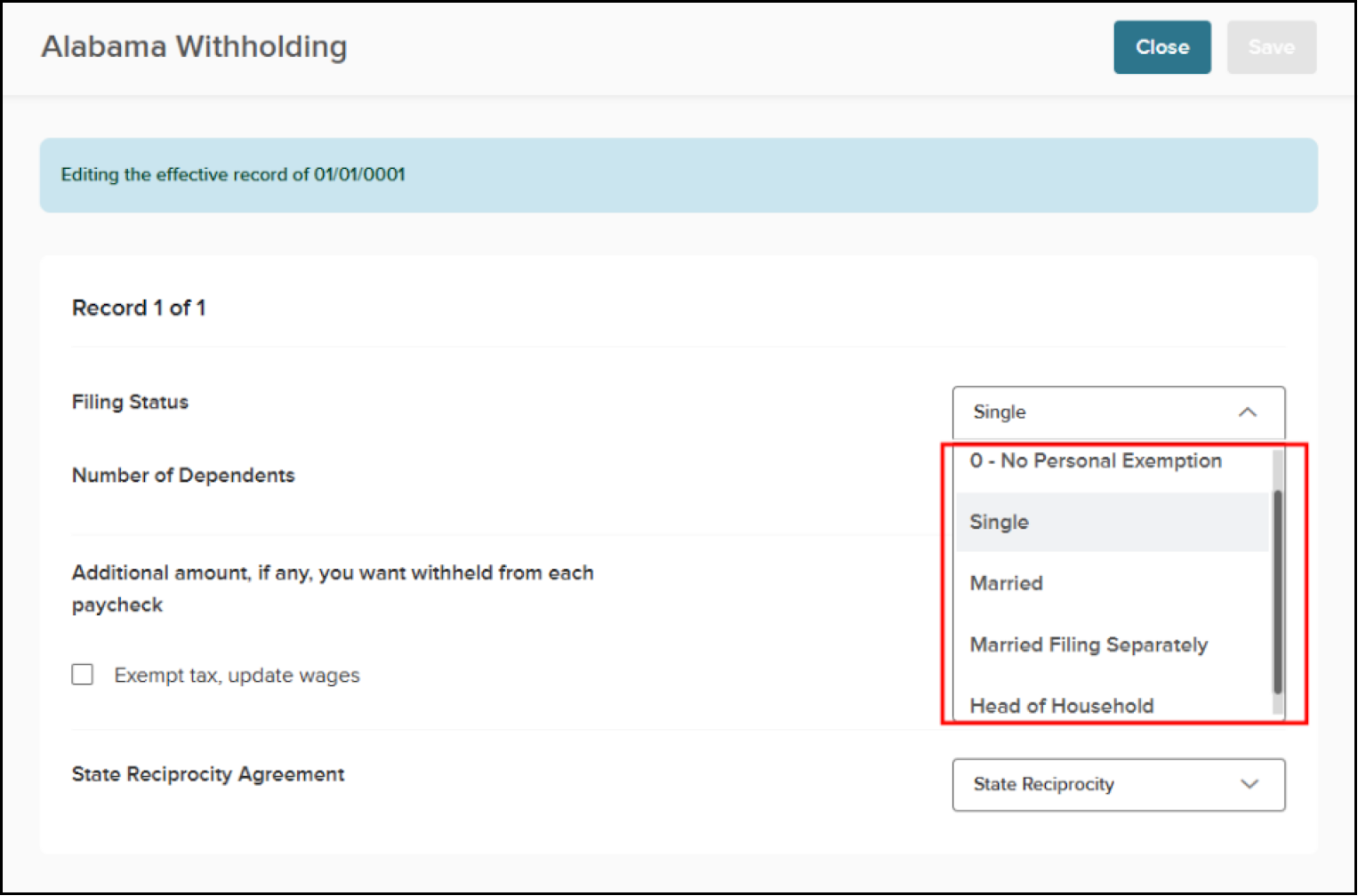

Tax Card Sort Order Changes

With this release, the tax cards will now show the most frequently used options at the top of the dropdown list.

The example for Alabama Withholding below shows this change in the Filing Status dropdown list.

Value

Create a more streamlined experience by bringing the frequently used items to the top of the list.

Audience

Admins and employees.

Editing Restrictions for Custom Tax Category

With this release, only super admin users will be able to add or edit custom tax categories. If you're not a super admin, you won’t be able to add or edit a tax category if the value is already assigned. This change applies to both the Earning Codes (IPPCEL) and Deduction Codes (IPPCDL) pages.

This restriction also applies when you're importing PC codes. If you're not a super admin and try to change a custom tax category during the import, it won't go through. But if you are a super admin, the change will be processed.

Value

To ensure that only authorized users can change custom tax categories.

Audience

Admins.

Disable Editing of Type or Tax Category Value if the Record has a History

With this release, you will no longer be able to change the Type or Tax Category for an earnings or deduction pay component if it has any past pay amounts. However, super admin users are not affected by this restriction. This change applies to the Earning Codes (IPPCEL) and Deduction Codes (IPPCDL) pages.

Value

Protect the integrity of historical payroll data by preventing unauthorized changes to taxation and earning/deduction types associated with existing records.

Audience

Admins.

Set Up HSA Bank Accounts with a Checking Account

With this release, you can now create an HSA bank account with a checking account. To do this:

- Select open an employee, then click Direct Deposit in the Payroll section.

- Click Add Deposit Account to begin the process.

Previously, you could only set up accounts as Savings. With this change, even if the account is marked as an HSA, you’ll be able to choose Checking as an option.

Value

Enable you to link your checking account to your HSA, providing greater flexibility and convenience.

Audience

Admins and employees.

State Withholding Card Updates - Phase 2

With this release, we're continuing to make state tax withholding cards easier to use. We've completed the second of three phases in this process. For this release, we narrowed the forms down to only the most essential fields needed to collect employee information. You will see this change for these states.

| Florida | Louisiana |

| Georgia | Maine |

| Guam | Maryland |

| Hawaii | Massachusetts |

| Idaho | Michigan |

| Illinois | Minnesota |

| Indiana | Mississippi |

| Iowa | Missouri |

| Kansas | Montana |

| Kentucky | Nebraska |

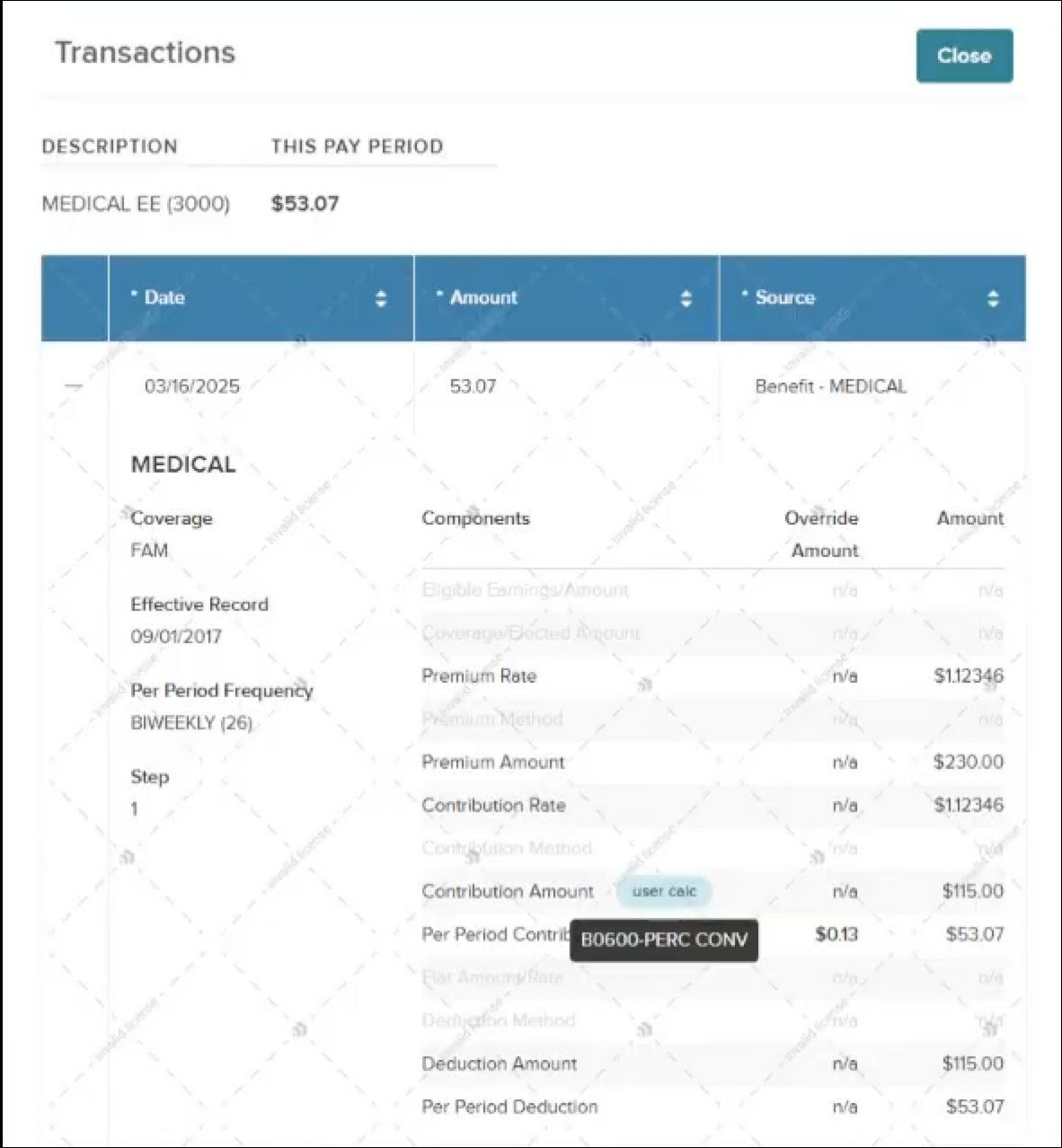

Details Added to the Modify Benefits Pop Up Menu

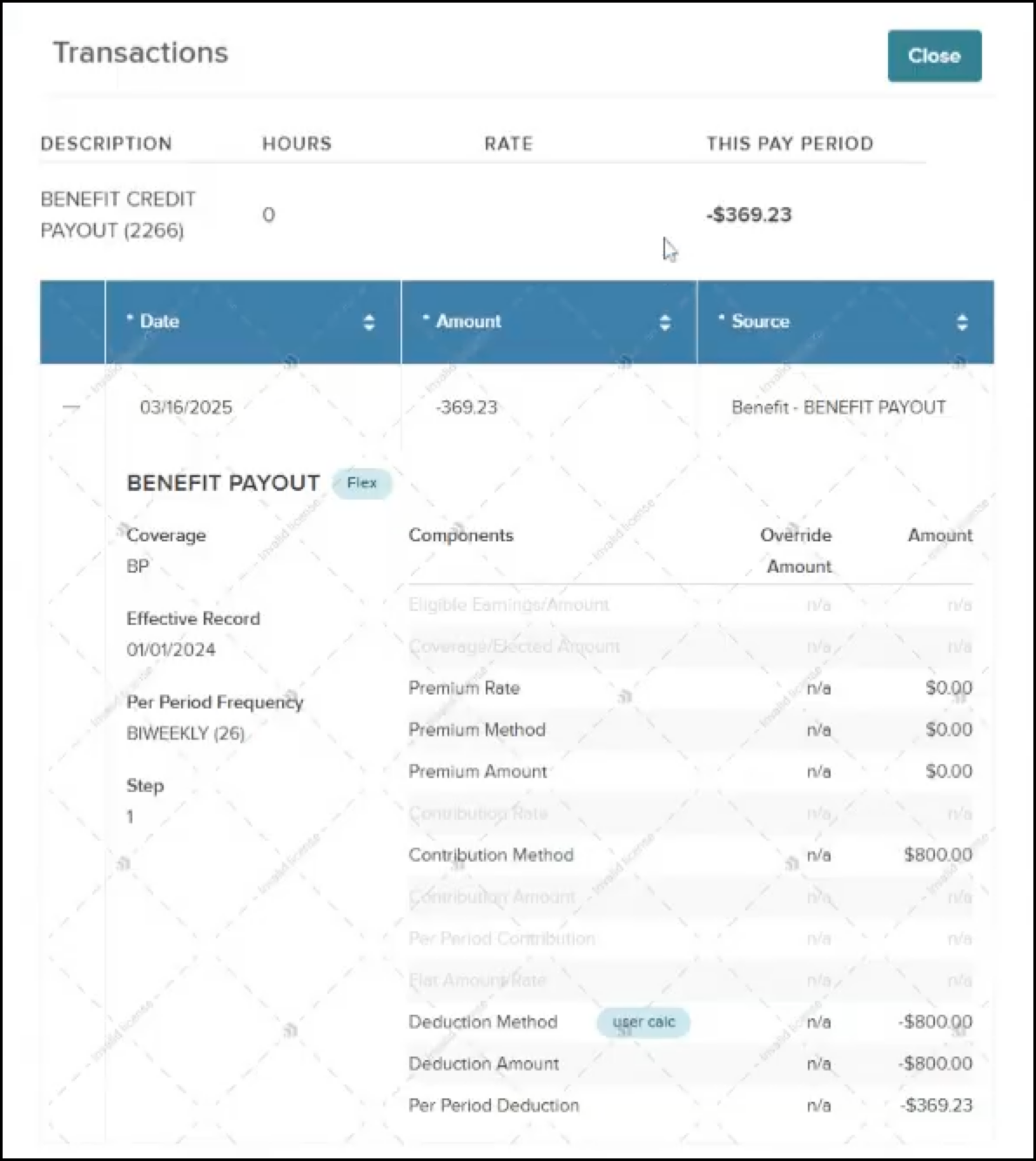

With this release, we’ve added more details to the Benefits pop up menu such as how the EE or ER deduction was calculated. The details are available where the following items will be added or modified.

- The Premium Rate and Contribution Rate will show up to four decimal places.

- The override amount will explicitly state n/a instead of 0 for instances where none is in place.

- If there is an override amount, we’re applying a larger font to the number. This ensures that you are aware that there was an override and what the amount is.

- Hovering over the user calc icon next to the Contribution Amount will show you which user calc was used to come up with the calculation.

- We’re calling out the step that was used for the calculation.

- For calculations that are part of a Flex plan, We’ve added a Flex icon next to the Benefit Payout section.

The example below shows a calculation that is NOT part of a Flex plan.

The example below shows a calculation that is part of a Flex plan.

Value

Provides you with clarity and support in understanding how specific EE or ER deductions are calculated, enabling more effective troubleshooting and decision-making.

Audience

Admins.

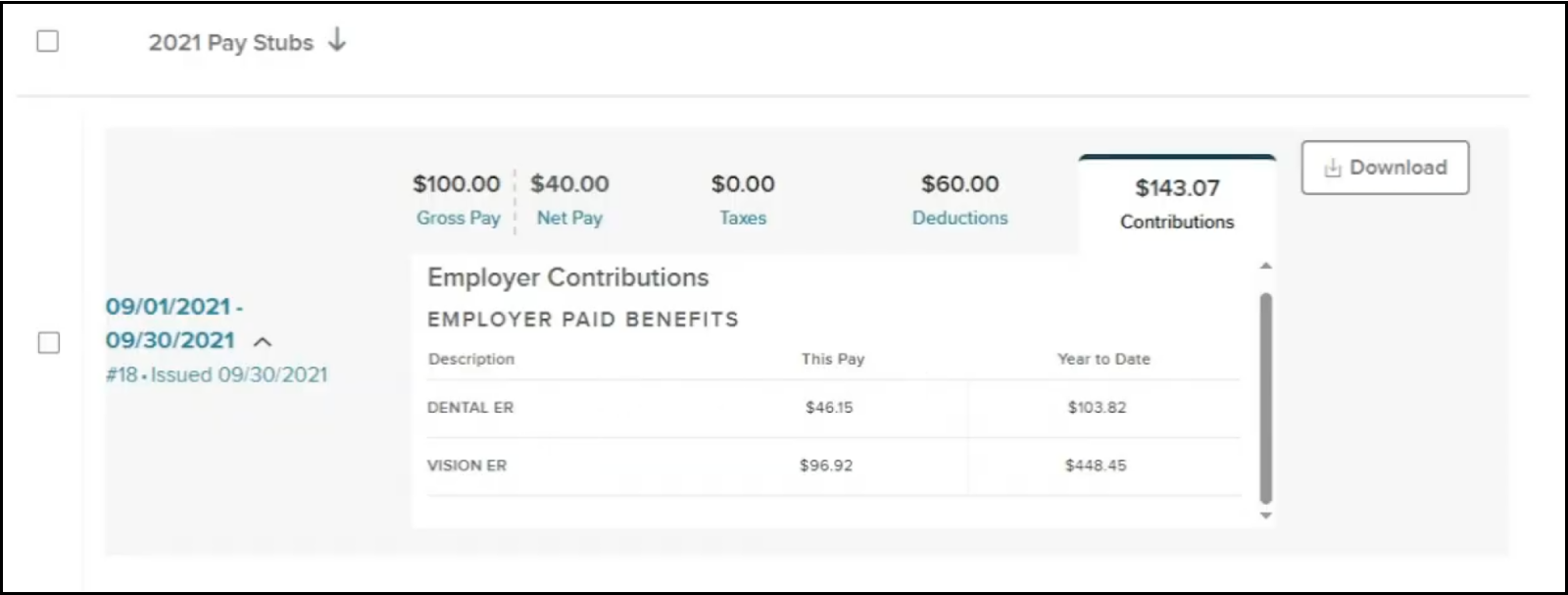

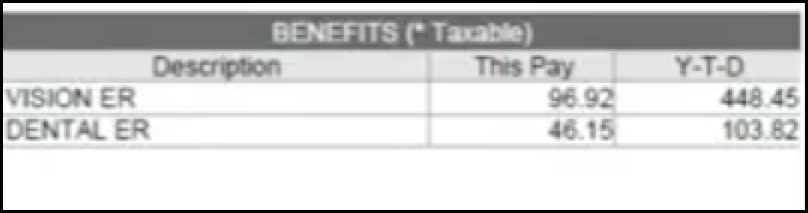

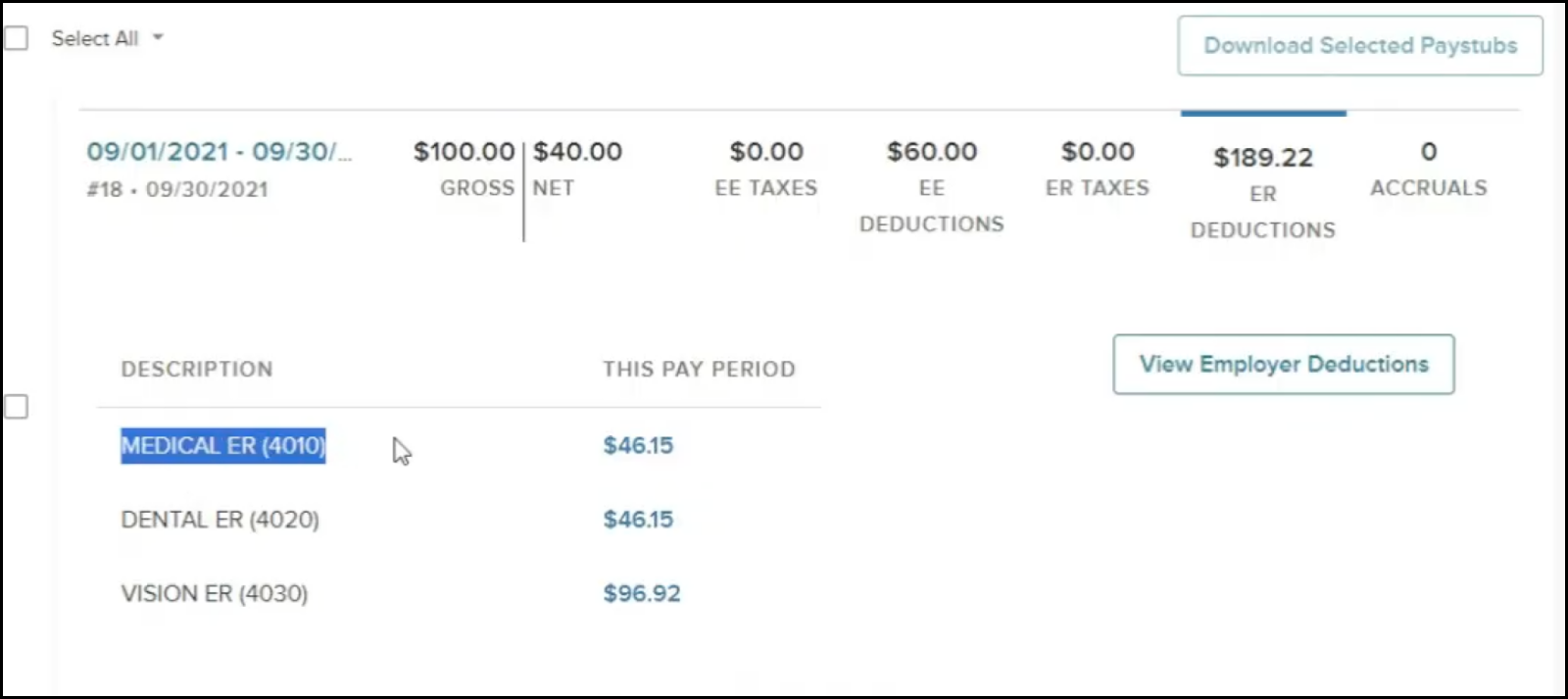

Improved Visibility Controls for Earnings and Deductions on Employee Paystub Outputs and Views

When an admin sets a deduction or earning to be hidden from the paystub, it currently disappears for both the employee and the employer. With this release, the employer will still be able to see it, but it will be hidden from the employee in the following views and outputs.

- Downloaded paystub.

- Pay details within Unified.

In the example below, the MEDICAL ER value is set to not be shown on the paystub.

The screenshot below shows that the value is not seen by the employee in Unified.

In the screenshot below, the same value is also not shown in the employee’s downloaded paystub.

In the screenshot below, the MEDICAL ER value is shown for the employer.

Value

Ensures that critical company information is accessible only to the employer.

Audience

Admins.

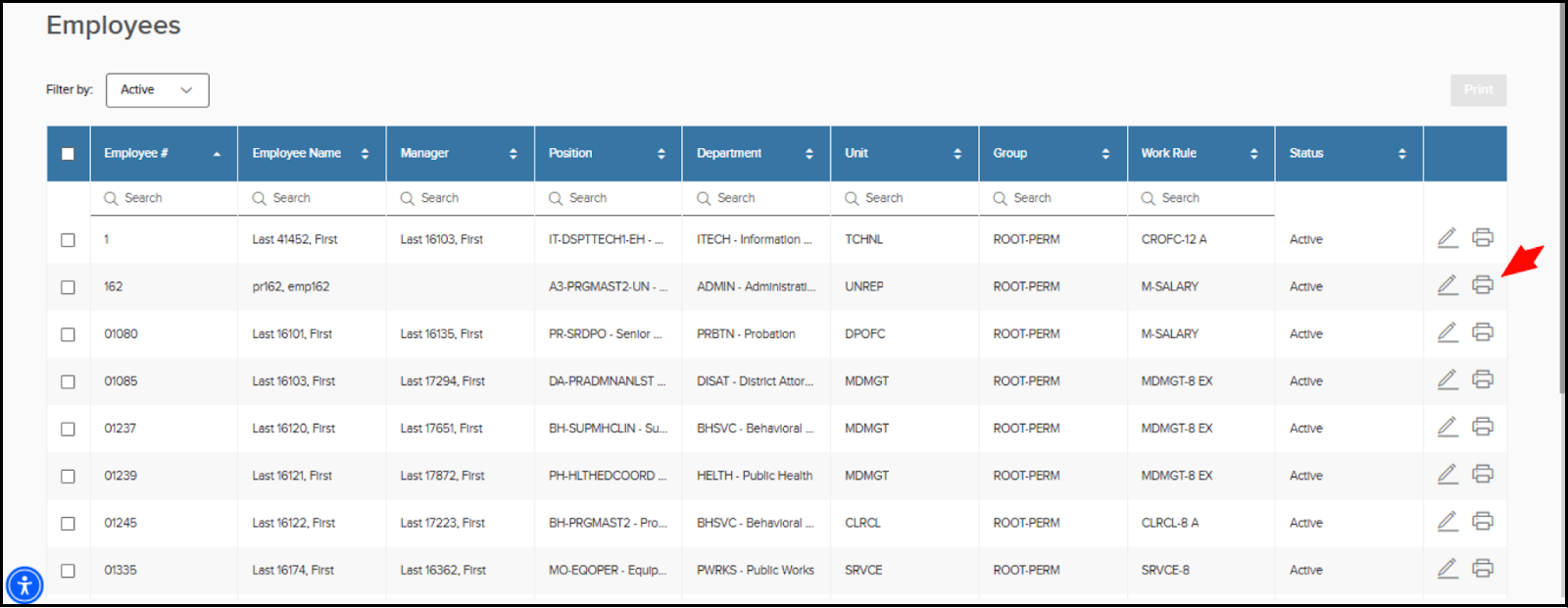

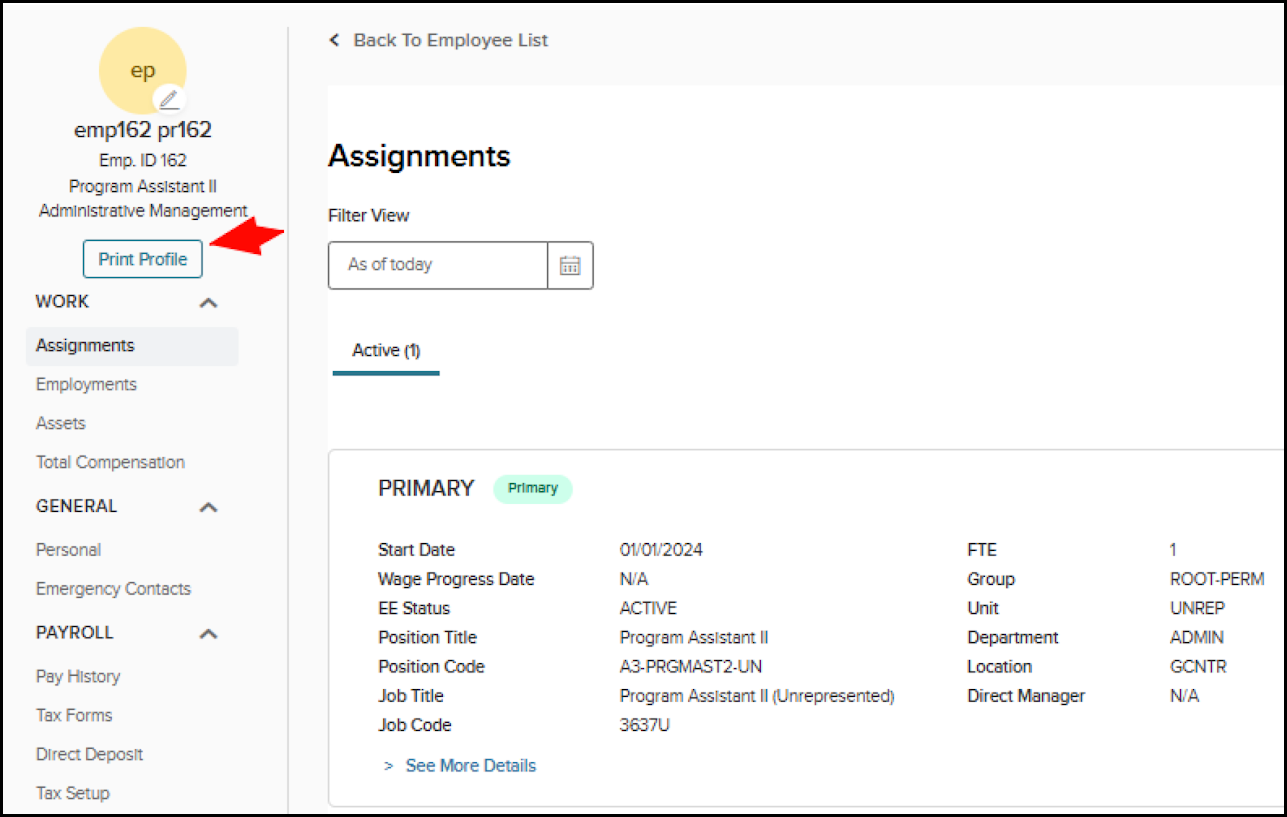

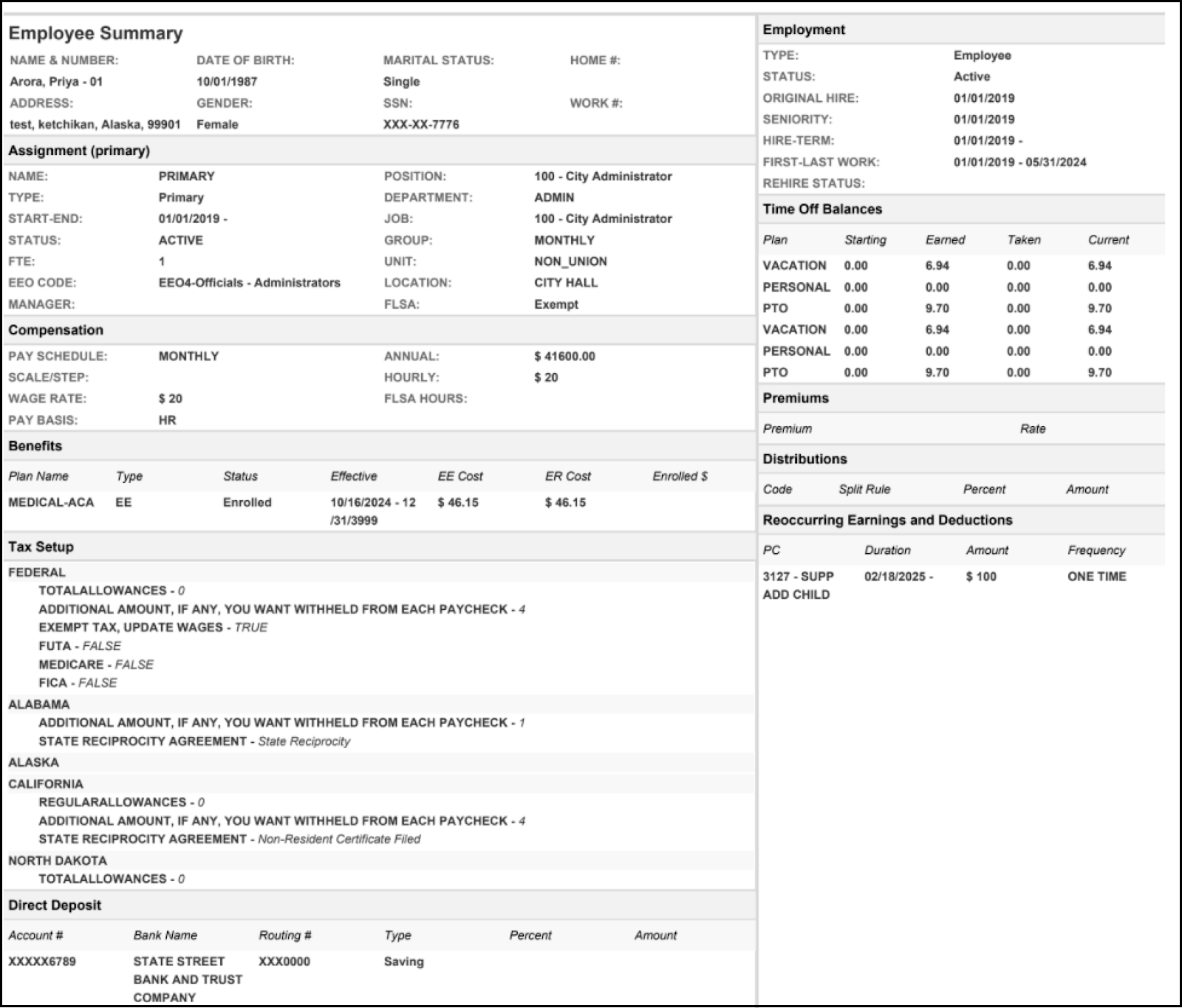

Employee Profile Report

With this release, you can access an employee’s profile report that summarizes all of their setup data in one sheet. You can access this report in two ways.

- Go to the Employees page (IPEPDL) and click the print icon in the far right column for the desired employee.

- Or, open the record for the desired employee and click Print Profile on the left side.

The screenshot below shows the generated report file.

Value

Easily access all employee information in one place, streamlining setup verification and troubleshooting without navigating multiple screens.

Audience

Admins.

Symmetry Tax Updates

The STE 2025-R03a Symmetry release includes the changes from the 2025-R03 and 2025-R03a releases. The changes apply to these states.

| Kentucky | Montana |

| Louisiana | Pennsylvania |

| Maryland | Ohio |

| Massachusetts | West Virginia |

For more information, reference these documents.

Appendix: Bugs Resolved

| Scenario | Issue |

|---|---|

| The field names on the PA Requests summary and Audit Logs pages don’t match the fields that are on the tax withholding cards. |

| Trying to add/edit an employee’s state withholdings for Washington and New Hampshire. | Unable to edit because these states were flagged as non-withholding. Therefore, users were not able to add/edit any withholdings for these states, such as WFML, for employees in Washington state. With this change, they can submit withholdings for these two states. |