Article Links

Timeline

When will this be released?

January 16, 2025 from 5:00 – 6:30 pm PDT, PST

Is there downtime for this release?

No.

Employee Taxability Options in the Deduction Codes (IPPCDL) Page

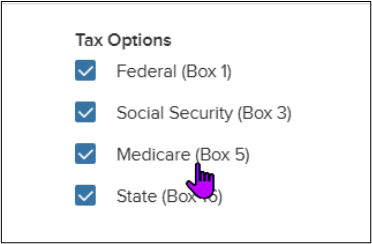

With this release, we've removed the taxability options available in the Tax Category dropdown for employer legislative deductions. These employer deductions include:

- 401(k) Plan $ and %.

- 403(b) Plan $ and %.

- 414(h) Plan $ and %.

- 457(b) Plan $ and %.

- Roth 401(k) plan $ and %.

- Roth 403(b) Plan $ and %.

- Roth 457(b) Plan$ and %.

The screenshot below shows the removed tax option selections.

Value

Allows our tax engine to determine the employer taxability implications.

Audience

Payroll administrators.

Automatically Link Time and Pay Batches When Sending Timesheets to Payroll

With this release, administrators will notice these changes.

Automatic Linking for Regular Payroll

When a timesheet is submitted for a pay period with only a Regular Payroll, our system will automatically link the pay transaction to the regular pay header batch.

Automatic Linking for Off Cycle Payroll

When a timesheet is submitted for a pay period with only an off cycle payroll, our system will automatically link the pay transaction to the off cycle pay header batch.

Identification and Linking with Both Payrolls

For a pay period that includes both regular and off cycle payrolls, our system will identify the regular pay header batch where the off cycle toggle is OFF. It will also link the pay transaction to the identified regular pay header batch.

Value

Ensures a seamless and efficient pay management experience and eliminates the need to manually correct batches using the Administer Batches (IPBE) page.

Audience

Payroll administrators.

Maine and Delaware Family Leave Insurance

With this release, we've added support for two more family leave insurance (FLI) withholdings, alongside the FLI withholdings we already manage in the payroll engine.

Value

For employers in Maine and Delaware, you now can automate the withholding of these family leave insurance deductions.

Audience

Payroll administrators.

Appendix: Bugs Resolved

| Scenario | Issue |

|---|---|

| Benefit deduction amounts are not getting revised. | If changes are made to the element setup for a benefit plan and a recalculate is conducted, there is no change in the deduction amount. |

Related Resources