Article Links

Timeline

When will this be released?

Release Date: 03/13/2025 from 05:00 – 06:30 pm PDT, PST.

Is there downtime for this release?

No.

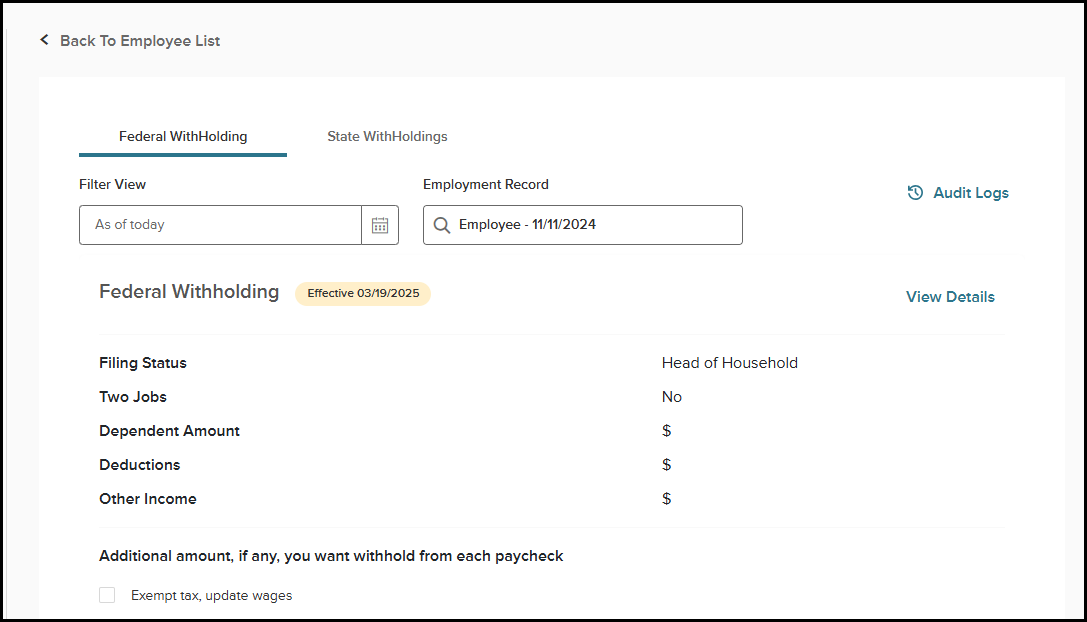

Federal and State Tax Withholding on Separate Tabs

With this release, we have moved the Federal and State Withholdings data to their own tabs on a single page. Previously, they were side-by-side on one page. When you land on the page, you'll start on the Federal Withholding tab. From there, click the State Withholding tab to switch.

Federal Withholding

State Withholding

Value

This enhancement reduces confusion by limiting the amount of data processed simultaneously. It allows you to focus on one type of withholding at any time.

Audience

Payroll managers and employees.

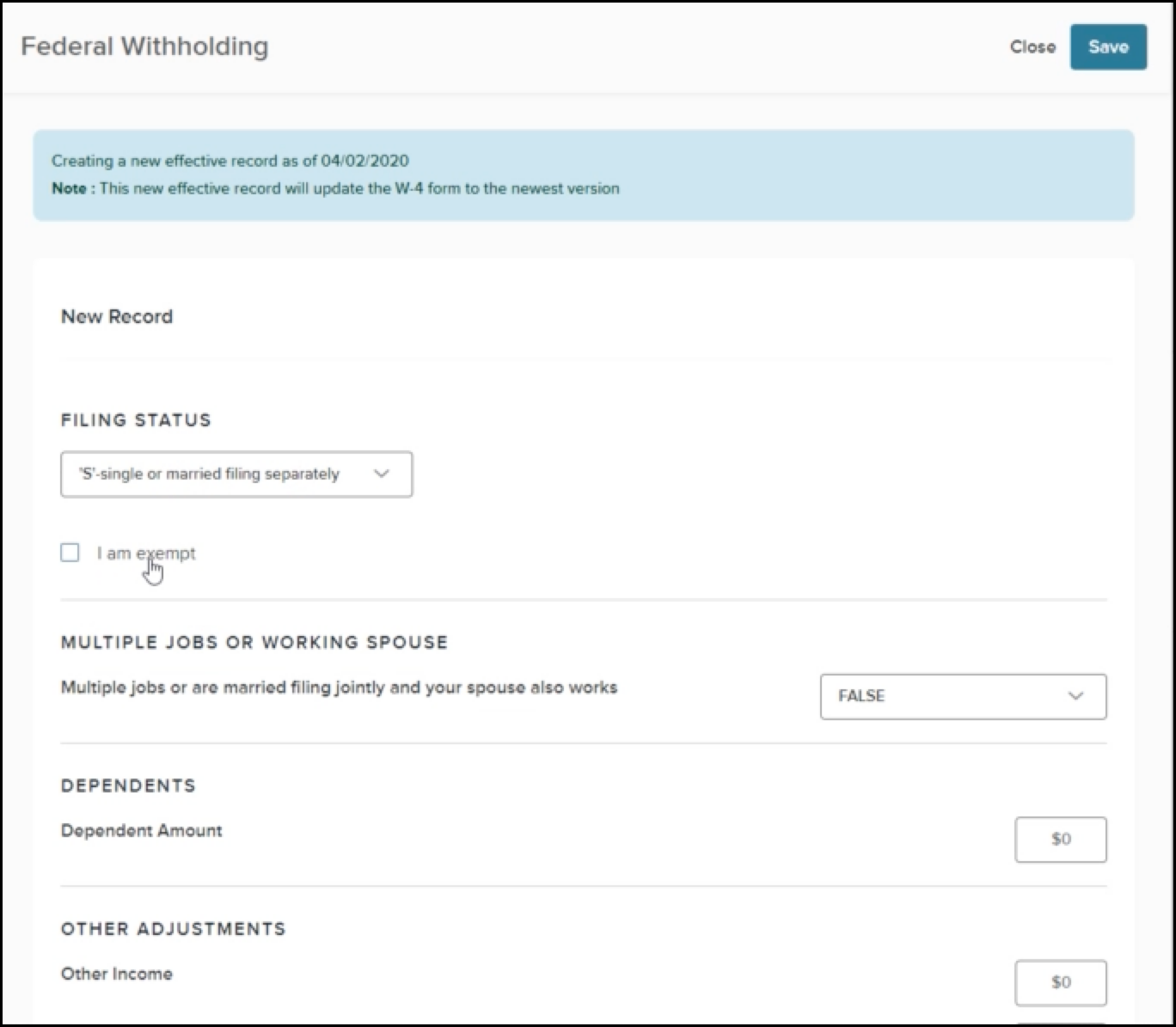

Updated Field Names on Federal and State Tax Withholding Screens

With this release, we’ve modified the names of some fields on the Federal and State Withholding pages. Here are the changes.

Post-2020 Federal Withholding

| Field | Old Value | New Value |

|---|---|---|

| FILING STATUS | FILING STATUS | Filing Status |

| Multiple jobs or are married filing jointly, and your spouse also works | The possible responses for this field were True and False | The possible responses for this field are Yes and No |

| Extra Withholdings | Extra Withholdings | Additional amount, if any, you want withheld from each paycheck |

| I am exempt | I am exempt | Exempt tax, update wages |

Pre-2020 Federal Withholding

| Field | Old Value | New Value |

|---|---|---|

| FILING STATUS | FILING STATUS | Filing Status |

| Extra Withholdings | Extra Withholdings | Additional amount, if any, you want withheld from each paycheck |

| I am exempt | I am exempt | Exempt tax, update wages |

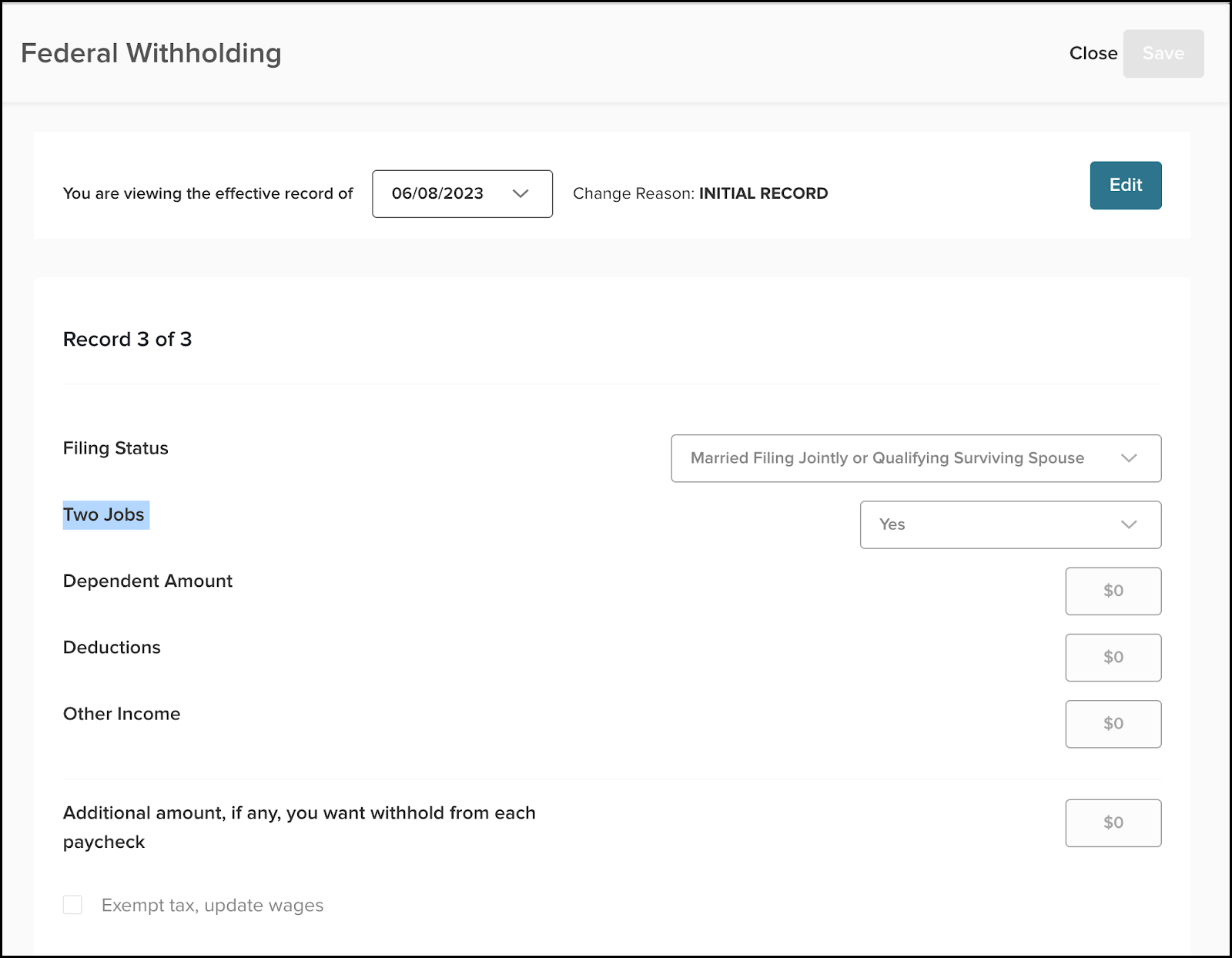

State Withholding

| Field | Old Value | New Value |

|---|---|---|

| FILING STATUS | FILING STATUS | Filing Status |

| Multiple jobs or are married filing jointly, and your spouse also works | The possible responses for this field were True and False | The possible responses for this field are Yes and No |

| Extra Withholdings | Extra Withholdings | Additional amount, if any, you want withheld from each paycheck |

| I am exempt | I am exempt | Exempt tax, update wages |

Value

Makes field names easier to understand.

Audience

Payroll managers.

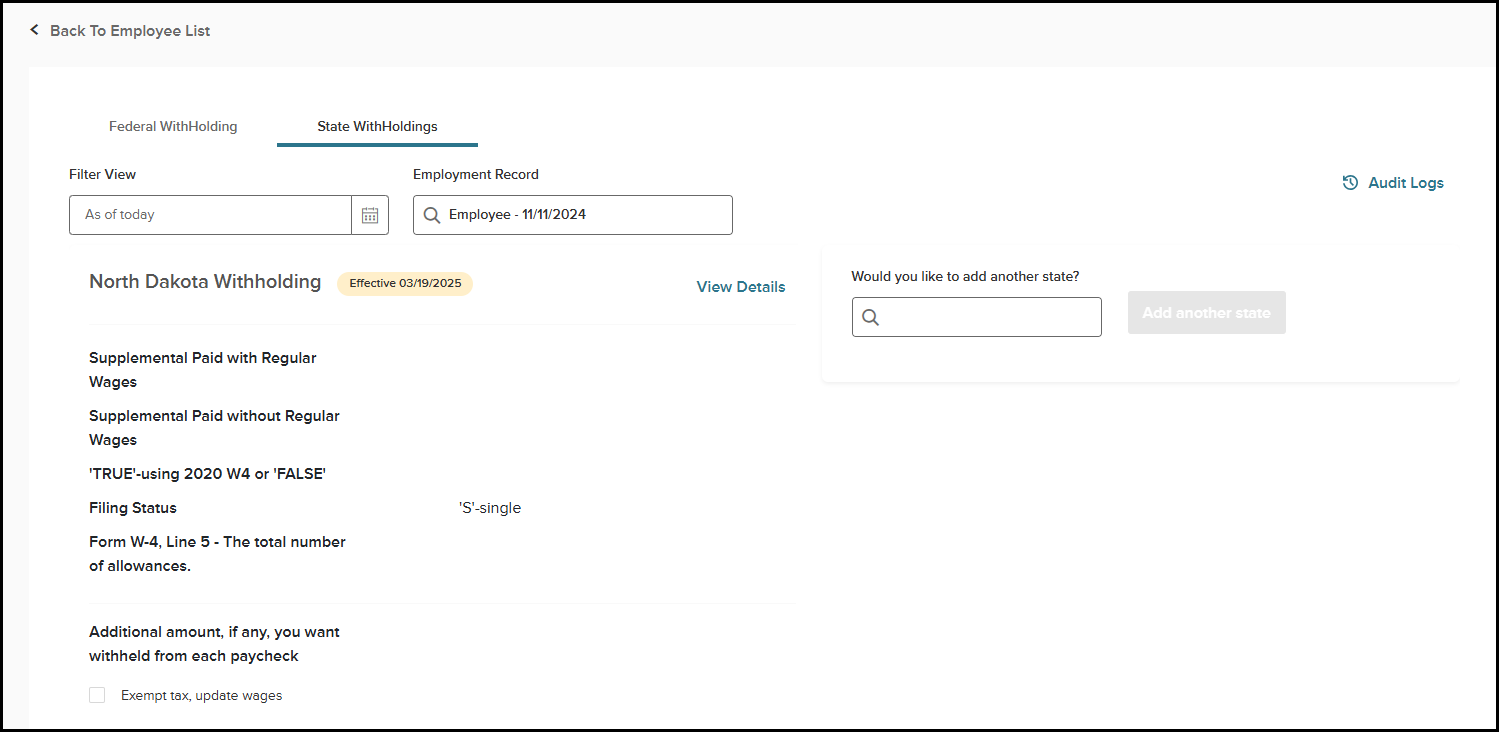

Section Headers on Federal and State Tax Withholding Pages Removed

With this release, we’ve removed the section headers on the pop-up menu when adding federal and state withholdings.

We’ve removed these section headers for federal.

- FILING STATUS

- MULTIPLE JOBS OR WORKING SPOUSE

- DEPENDENTS

- OTHER ADJUSTMENTS

The following screenshots show you what the pop-up menu looks like before and after the change.

Before Change

After Change

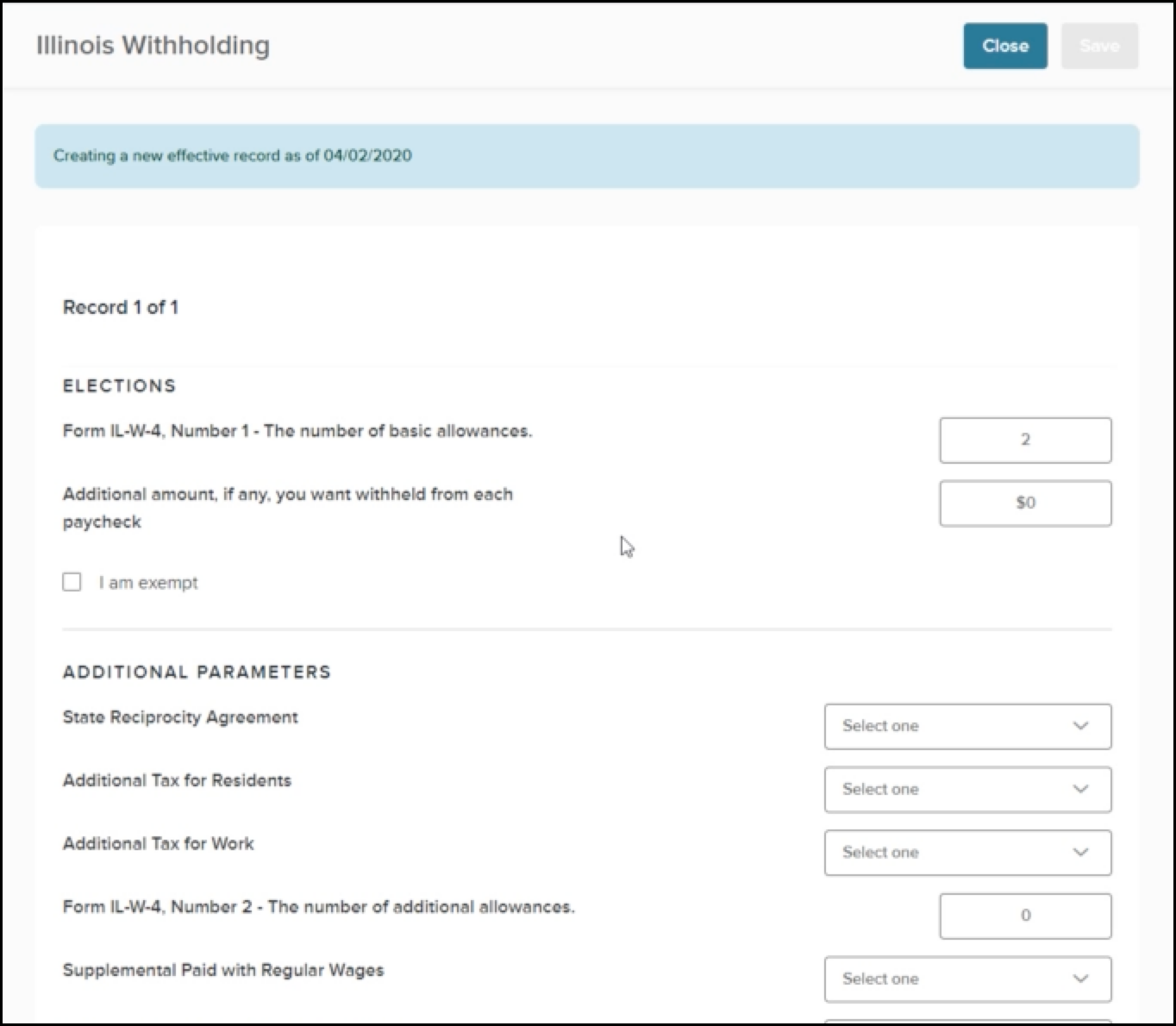

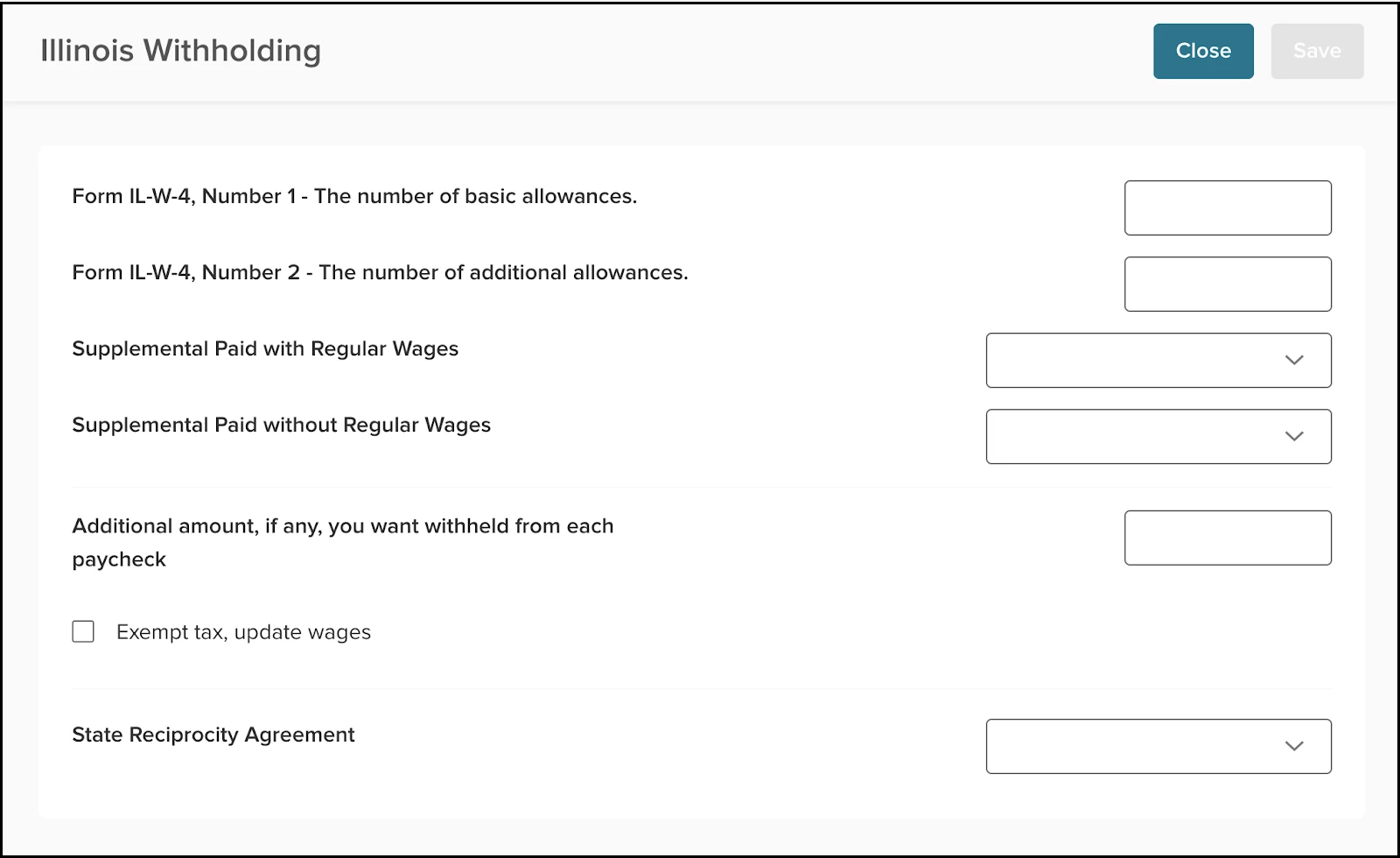

We’ve also removed these section headers for state.

- Elections

- Additional Parameters

Before Change

After Change

Value

Removing redundant section headers shortened the page, significantly reducing scrolling and allowing users to quickly find the needed information.

Audience

Payroll managers.

Removed Local Parameters from State Withholding

With this release, we’ve removed the LOCAL PARAMETERS section from the State Withholding.

The screenshot below shows you what the section looked like before this release.

Value

Removing these background calculation fields prevents confusion and errors. It helps create accurate results by helping to reduce mistakes.

Audience

Payroll managers.

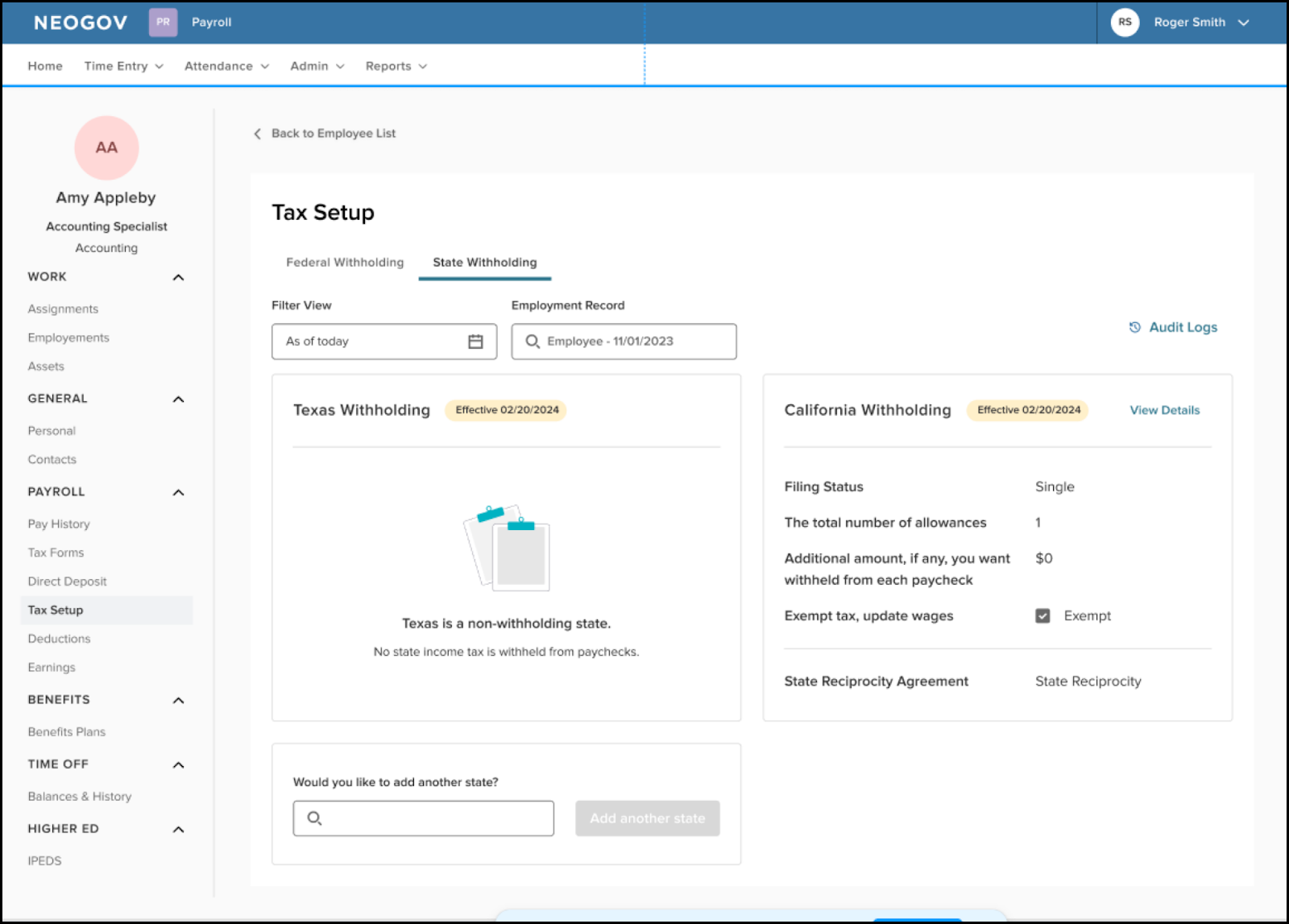

Added Verbiage to Non-Withholding States

With this release, all states that don’t have withholding will use this wording on their cards in the State Withholding tab: “XX is a non-witholding state.”

This change applies to Alaska, New Hampshire, Texas, Florida, South Dakota, Washington, Nevada, Tennessee, and Wyoming.

Value

This change clarifies why users can't enter withholdings for these states.

Audience

Payroll managers.

Miscellaneous Parameters on State and Federal Withholding Restricted to Employee-Level Fields

With this release, we’ve removed fields that do not apply to employees from the Federal and State Withholding pages. Previously, employees would see these fields because they were necessary for the underlying tax calculations, even though they weren’t meaningful to them. The fields shown varied from state to state.

This release begins with a phased delivery in these 10 states.

- Alabama

- Alaska

- American Samoa

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

Over the next two release cycles, we will remove the fields from the remaining 40 states.

Value

This change removes clutter and allows employees to see only the fields impacting their taxes, providing clarity and reducing confusion.

Audience

Payroll managers.

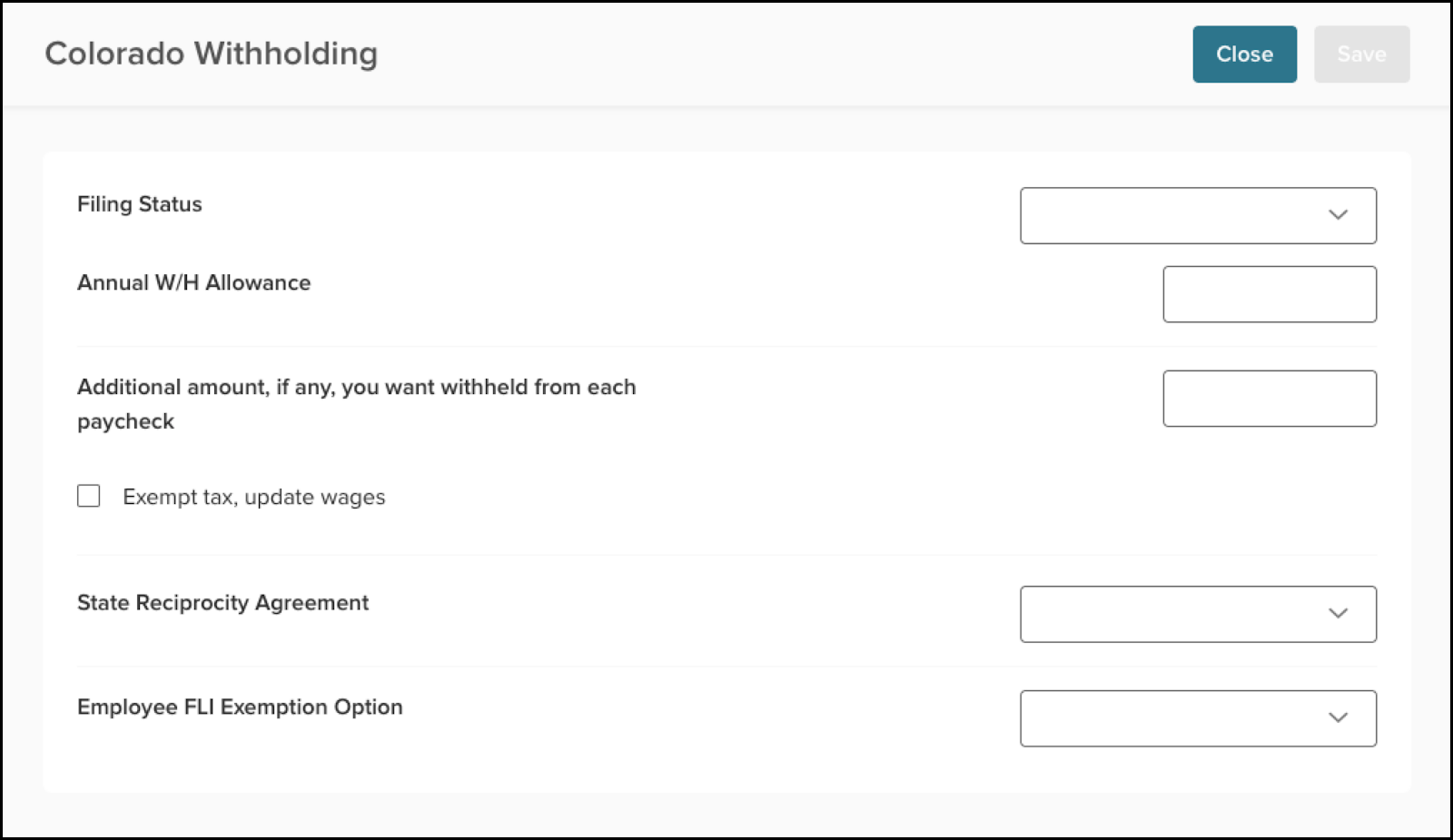

Employee-Level Exemption for Family Leave Insurance (FLI)

With this release, we only ask about the employee’s exemption status when setting up state withholding for a state that offers FLI. Previously, we asked whether the employer and employee were exempt. This release uses the employer-level setting to determine the employer's exemption status.

Value

We rely on the company-level exemption status setting to streamline the process and improve accuracy instead of asking employees who cannot provide this information.

Audience

Payroll managers.

New Employer FUTA Tax Method: Exempt Tax but Calculate Taxable Wages

This release has added the new FUTA tax method (0 Tax/Upd Wage). This method allows you to not calculate FUTA on employees but still track taxable and gross wages.

Value

Allows you to track taxable and gross wages for other compliance and recording reasons without calculating FUTA.

Audience

Payroll managers.

Appendix: Bugs Resolved

| Product | Scenario | Issue |

|---|---|---|

| Analytics & Reporting | Report missing data. | Some reports generated blank or missing wage rates in a specific field. |