Article Links

Timeline

When will this be released?

UAT Preview Window: September 23, 2025, 4 AM PDT

Production Availability: October 30, 2025, 4 AM PDT

Is there downtime for this release?

No.

Year-End Enhancements

W-2 Consent

Employees can now opt in to receive their W-2 forms electronically. By granting electronic consent, employees permit their W-2s to be delivered digitally instead of through physical mail. Once consent is given, W-2s will be provided in a digital format via Employee Self Service.

Primary Value

Implementing an electronic consent process for W‑2 forms can offer several benefits for an employer. Key advantages include:

-

Cost savings: By providing W‑2s electronically, employers can significantly reduce or eliminate printing and mailing costs.

-

Faster delivery: Employees receive their W‑2s more quickly and can access them online as soon as they are available, rather than waiting for paper copies to arrive through the mail.

-

Ease of administration: Automated systems streamline the process of generating and distributing documents, reducing manual handling and the administrative burden associated with paper distribution.

-

Improved accuracy and security: Electronic delivery reduces the risk of mailing errors or lost documents while allowing for more secure transmission and storage of sensitive data.

-

Environmental impact: Digital delivery cuts down on paper usage, aligning with more sustainable and eco-friendly business practices.

Audience

Both the Administrator and Employee

Examples

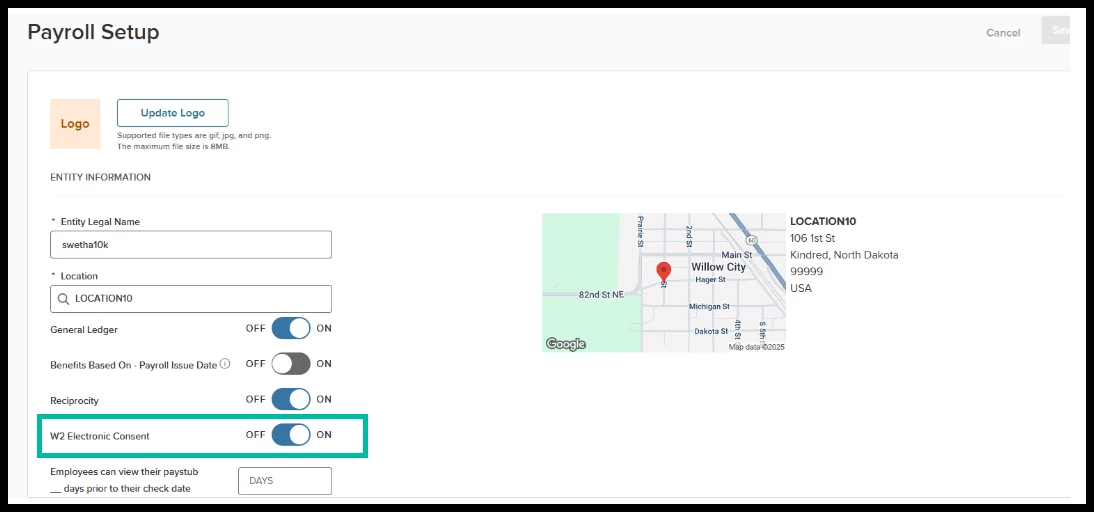

The administrator must enable this feature by turning on the W2 Consent toggle in Payroll Setup. Once enabled, employees have the option to receive only an electronic copy of their W-2 instead of a mailed hard copy.

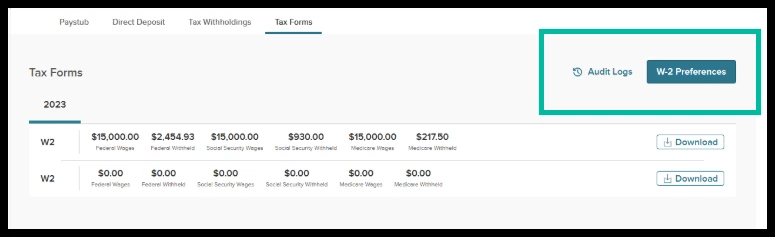

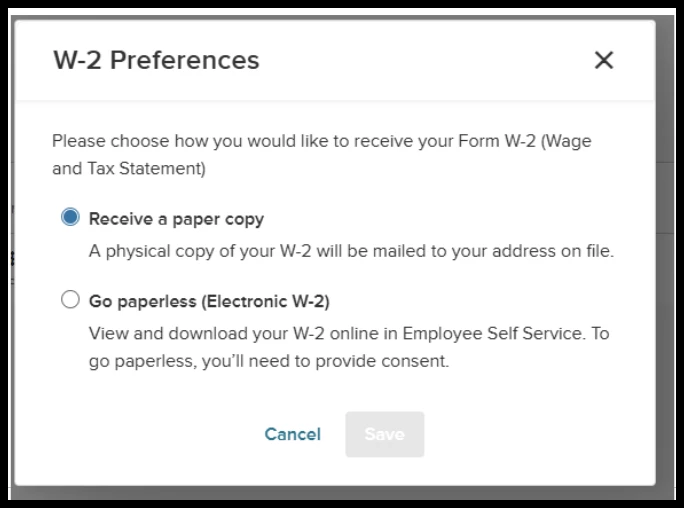

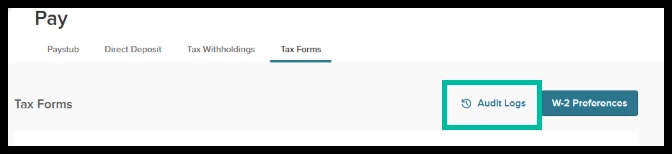

To set this preference, employees go to Employee Self Service > Pay > Tax Forms and select the W-2 Preferences button. A pop-up window then provides two choices: receive a paper copy or receive an electronic copy. By default, the selection is to receive a paper copy.

When employees click the W-2 Preferences button, a pop-up window opens, allowing them to select their preference.

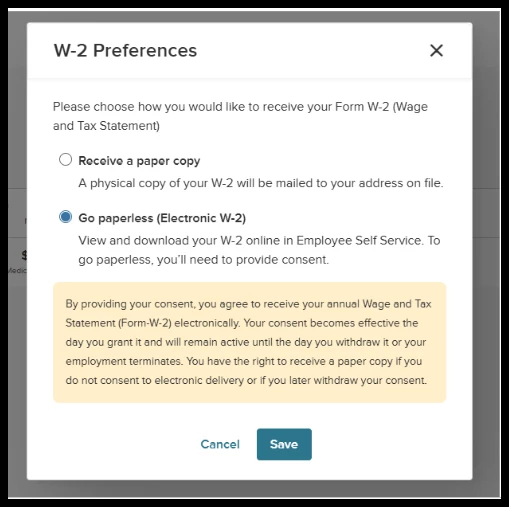

When employees choose the paperless option, they will see additional text related to the consent process, including information on what happens if they terminate.

Note: If an employee is terminated, any previous consent is disregarded, and a paper W-2 is issued.

Any time an employee changes their preference, the system records the date of the change in the Audit Log on the Tax Forms page. While payroll administrators can view the employee’s preference on their tax form page, they cannot edit it due to legal requirements.

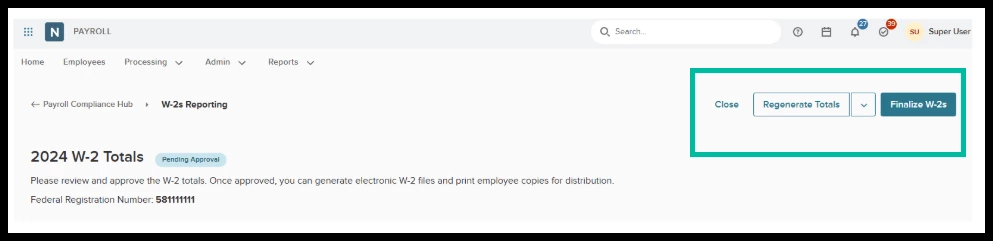

To enhance recordkeeping, the W-2 CSV file available from the “Regenerate Totals” dropdown in W-2 Reporting has been updated with two additional fields to identify:

-

W-2s for workers who have consented (when the W-2 Electronic Consent toggle is turned on).

-

W-2s for workers who have consented but have a termination status.

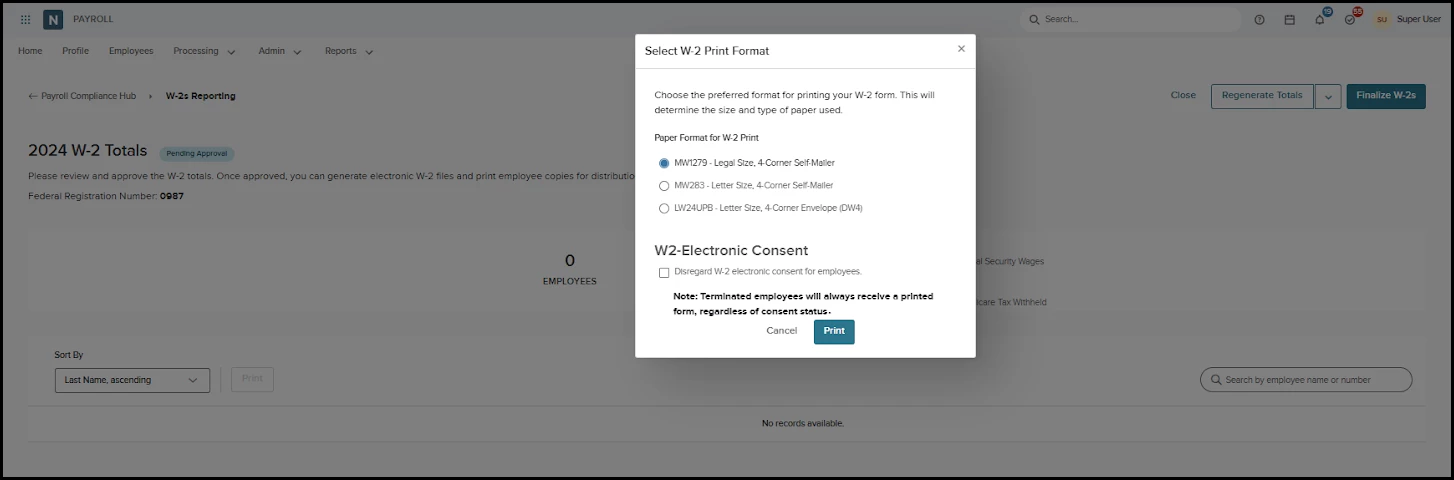

In the event of an emergency, you can override the W-2 electronic consent process on the Select W-2 Print Format page by selecting the “Disregard W-2 electronic consent for employees” checkbox. This action will issue paper W-2 forms to all employees, regardless of their consent preferences.

Note: Terminated employees will always receive a printed form, regardless of consent status.

If the administrator chooses to stop offering the W-2 Electronic Consent Process, they can switch off the “W2 Electronic Consent” toggle on the Payroll Setup page. Upon doing so, they will receive this message:

“You are deactivating the employee W‑2 Consent process. This action is irreversible and will automatically deactivate your employees’ consent status. If you re‑enable this option, employees must provide consent again. Because the IRS has specific rules and notification requirements, we recommend reviewing IRS Publication 15‑A before proceeding.”

Produce the US Year-End Summary Report Change

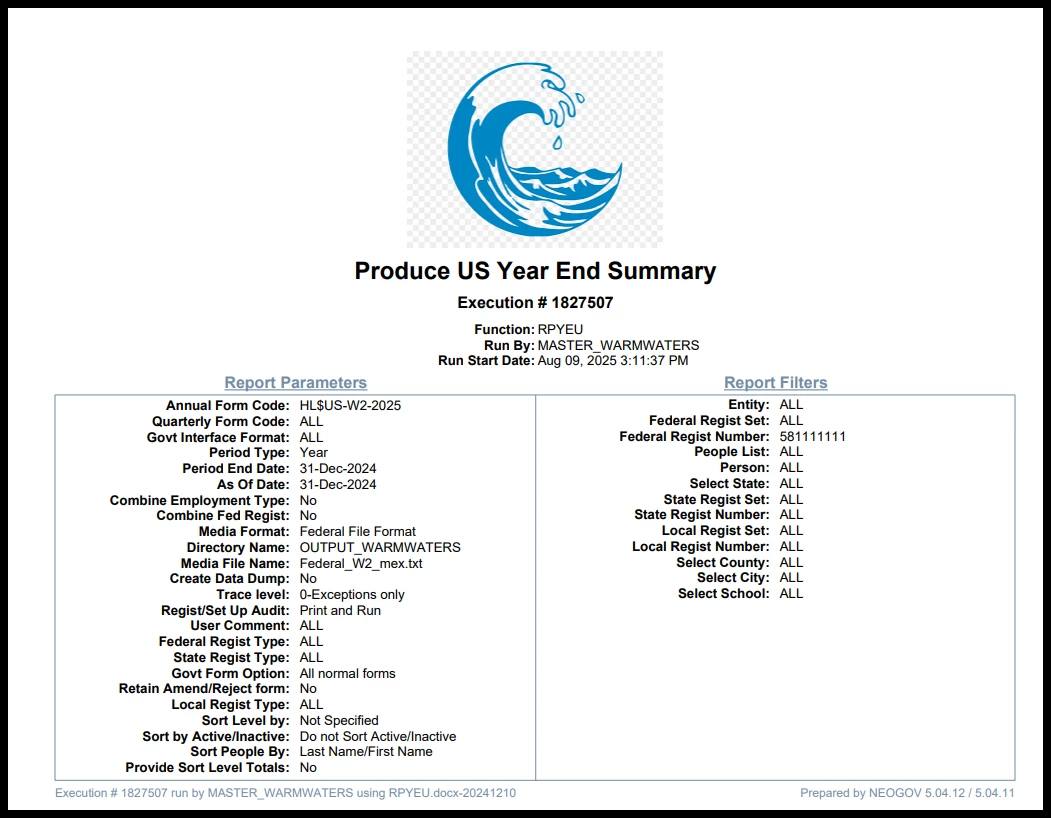

When you run the RPYEU (Produce US Year End Summary)—using "Generate New W-2’s," "Regenerate Totals," or "Finalized W-2’s" from the Payroll Compliance Dashboard—the system retrieves workers' addresses based on the "As of Date."

Primary Value

Previously, the system used the address valid at the end of the previous year, which could lead to W‑2s being sent to outdated addresses. This change helps reduce the risk of sending W‑2s to the wrong address.

Audience

Administrator

Examples

A worker updated their address on January 10, 2025, and the W‑2s were created on January 20, 2025. With this change, the system uses the January 20 date as the address date, ensuring the most recent address is used.

W-2 Corrections Dashboard

A W-2c (Corrected Wage and Tax Statement) is used when an employer needs to fix errors on an employee’s original W-2. For example, suppose an employer mistakenly reported the wrong Social Security wages or withholding in Box 4 on the original W-2. The employer would file a W-2c to correct that amount and would provide a copy to both the employee and the Social Security Administration. This ensures the employee’s records accurately reflect their wages and taxes withheld, helping them file correct tax returns and avoid complications with the IRS.

We have added a new W-2 Corrections Dashboard within the Payroll Compliance Hub. This dashboard simplifies the correction workflow by providing a single, convenient hub where you can easily select, process, and finalize W-2c forms. It also lets you handle multiple W-2c submissions for the same employee within a single year, taking into account any prior W-2c corrections.

Value

The primary value lies in streamlining and centralizing the correction process, which can save time, reduce errors, and help maintain regulatory compliance. Specifically:

- One-stop processing: Having a single dashboard for W-2 corrections simplifies workflows by gathering all necessary steps in one place, eliminating the need to navigate multiple pages or systems.

- Batch processing: The ability to select one or more employees and run in preview or finalized mode means payroll teams can address corrections more efficiently, rather than having to update each employee record individually.

- Flexibility for multiple corrections: Allowing multiple W-2c forms in the same reporting year provides greater accuracy when additional errors or changes are discovered after the first correction is made. This flexibility helps ensure employees’ tax records remain accurate, even if multiple rounds of corrections are required.

Audience

Administrator - New Hub

Employee - Can now have more than one W-2c.

Examples

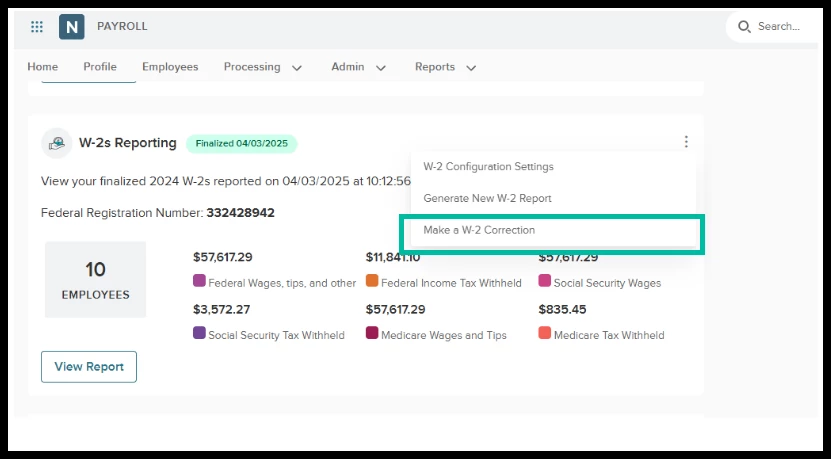

The new W-2 Correction Dashboard is located in the Payroll Compliance Hub. To create a W-2c, select the related action for the applicable W-2 reporting year. After choosing Make a W-2 Correction, you’ll be directed to the new W-2 Correction Dashboard.

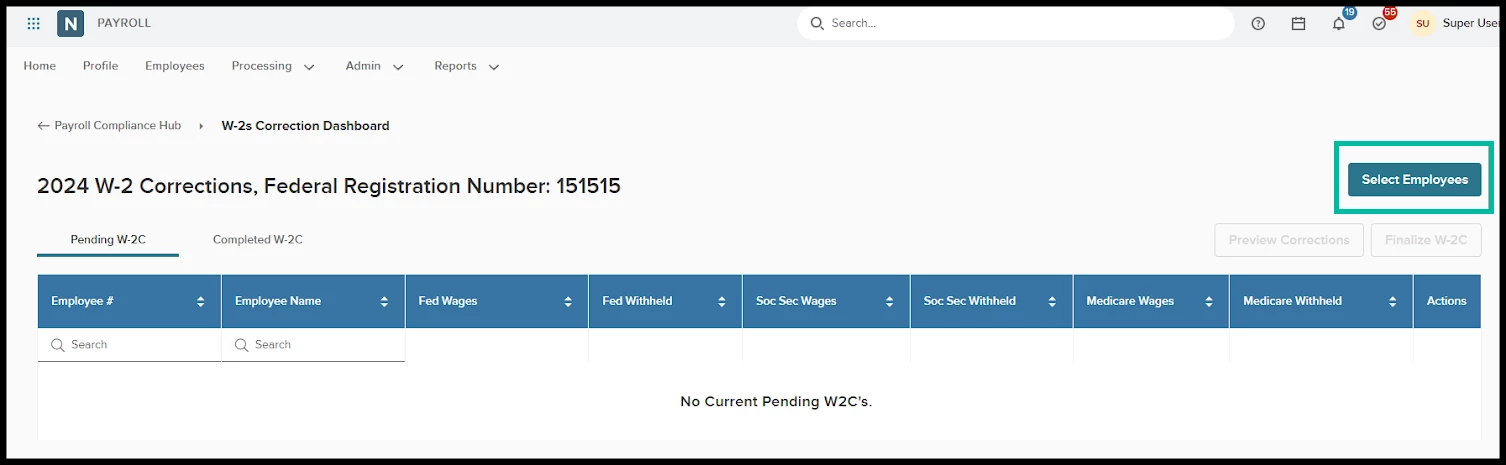

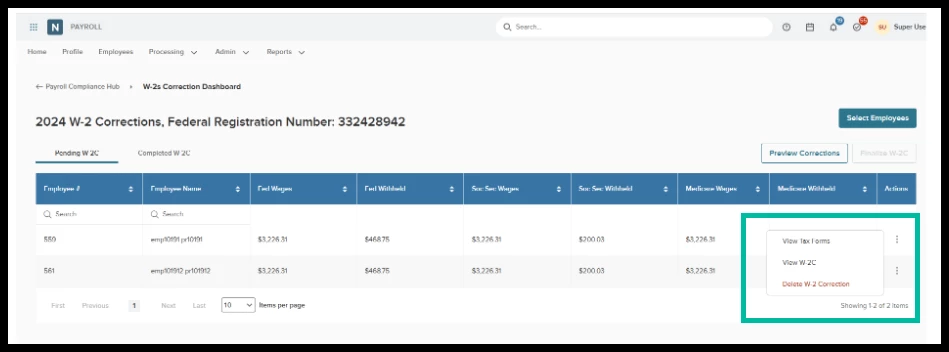

Upon entering the dashboard, you will see two tabs: Pending W-2c and Completed W-2c. By default, you will land on the Pending W-2c tab, where you’ll find a Select Employees button.

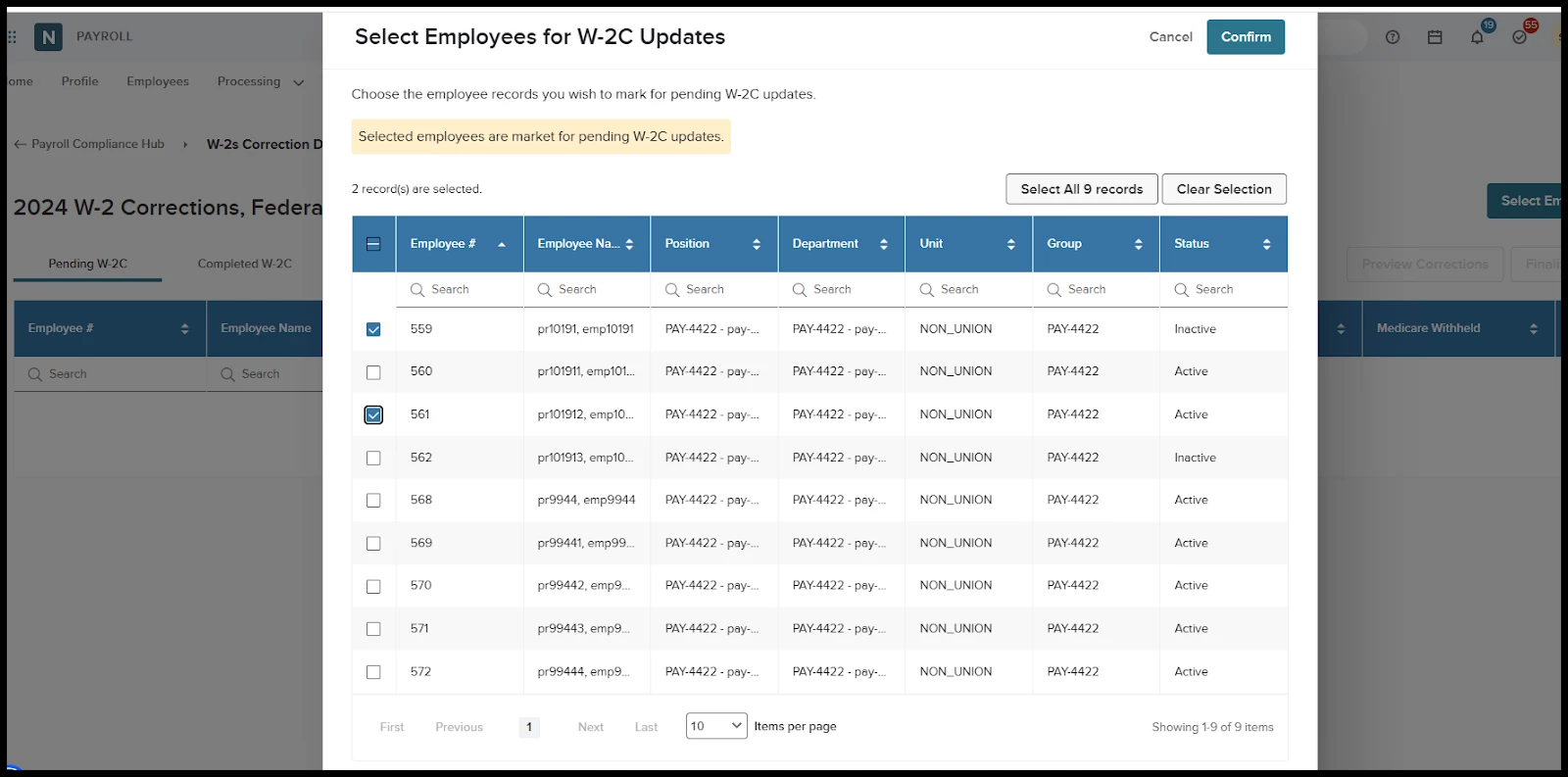

A pop-up window will appear, allowing you to select the employees for whom you’d like to run a W-2c. The list you see includes employees for whom the agency has issued a W-2 for the specified year.

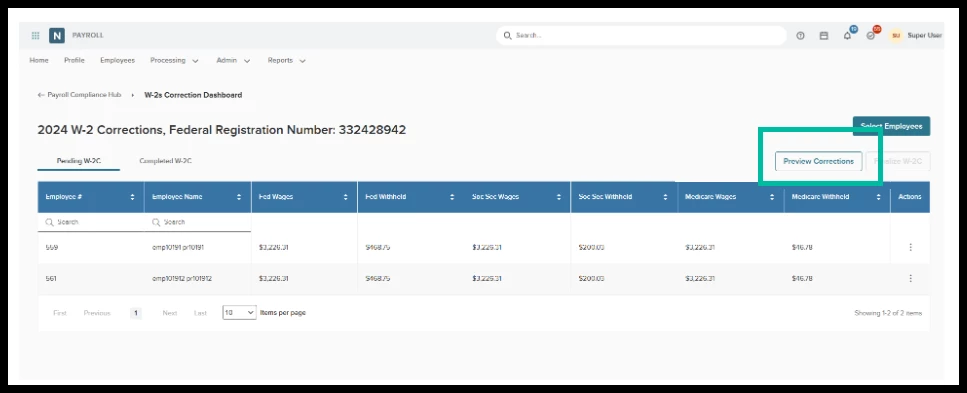

After selecting your employees, you will return to the Pending page. At this stage, you must run Preview Corrections to generate the W-2c’s. Please note that if you run Preview Corrections and then select additional employees and pull them into the Pending page, you will need to run Preview Corrections again.

On the Pending tab, you’ll see three related actions. First, selecting View Tax Forms takes you to the Employees Tax Forms Page, where you can review the employee’s W-2 or any other W-2c forms they have. Next, you can remove the employee from the Pending tab by choosing Delete W-2 Correction. Finally, if you have run Preview Corrections, you can view the generated W-2c form.

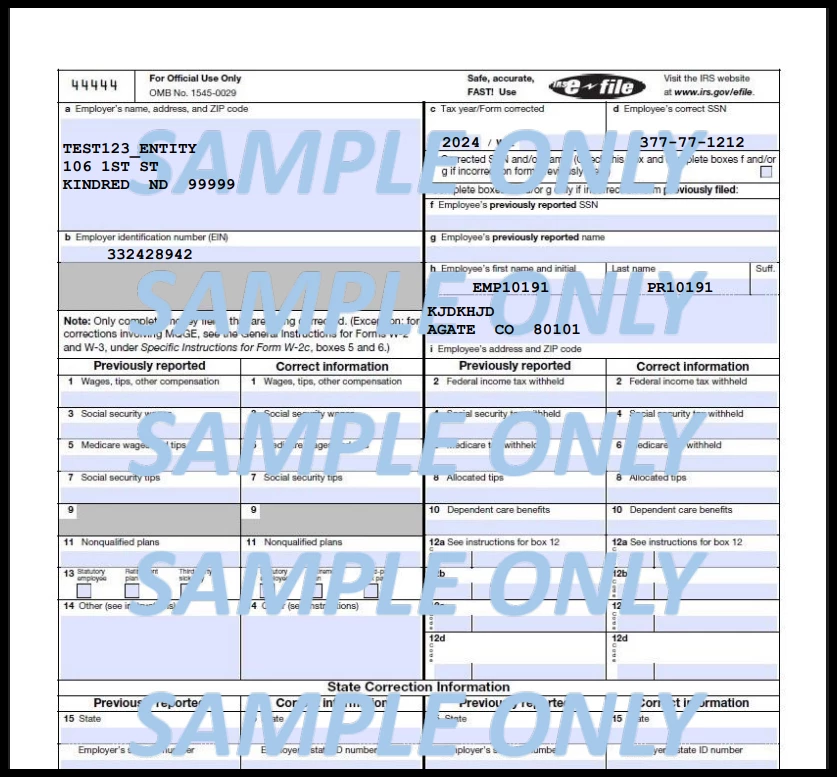

When your W-2c forms are run in Preview mode, they are watermarked to show they’re only samples. This ensures employees won’t receive a W-2c that isn’t yet finalized.

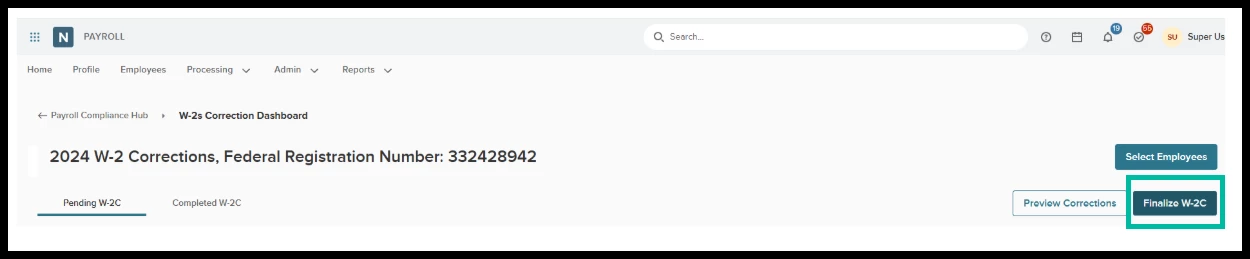

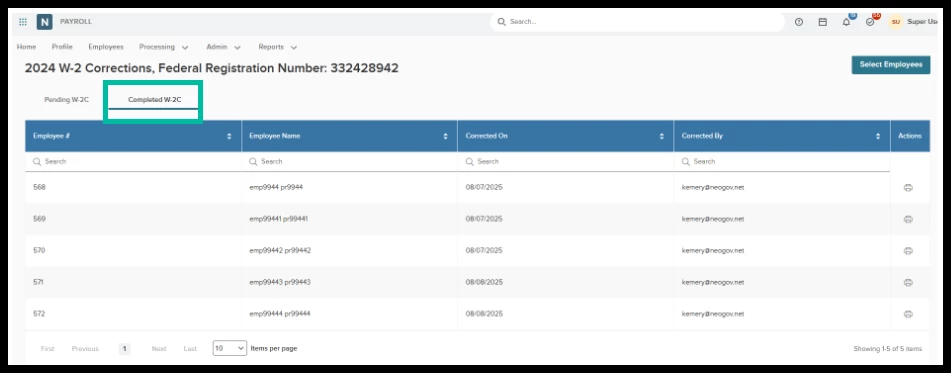

When you’re satisfied with the previewed results, select Finalize W-2C, This action generates the US Year-End Summary report and the final W-2c forms, then moves those employees to the Completed W-2C tab, where their records remain. The administrator can also retrieve a copy from the employees’ Tax Forms page, and employees can access theirs through Employee Self Service.

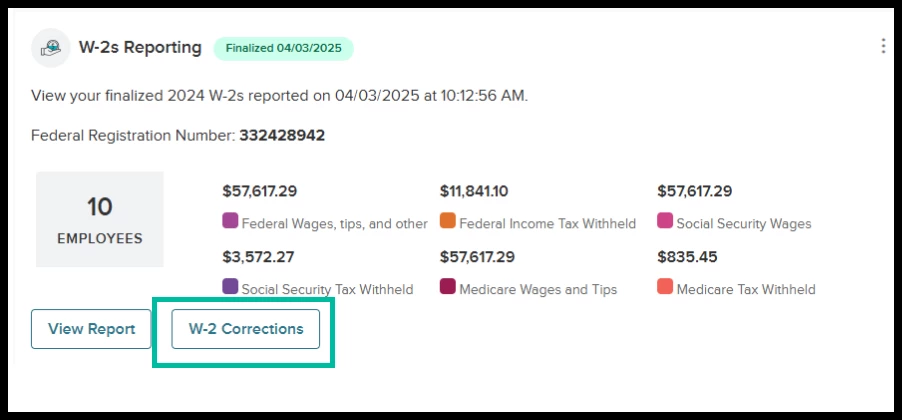

Once you’ve finalized your W-2c and left the processing center, you can still view the completed forms by returning and selecting the “W-2 Corrections” button on the agency’s W-2 reporting page.

Appendix: Bugs Resolved

No additional bug fixes outside of the maintenance releases. Please refer to the maintenance release notes for summative details

Related Resources

-

Article: Coming soon!