Article Links

Timeline

When will this be released?

UAT Preview Window: Jul 2, 2025

Production Availability: Jul 29, 2025

Is there downtime for this release?

No.

Tax Withholding Modernization

Building on the foundational work started in Q1, we completed a series of updates in Q2 to streamline and simplify the tax withholding card experience for both administrators and employees. These enhancements aim to reduce friction in submitting tax information and improve overall usability. Key improvements include:

- Field Simplification: Removed non-essential fields that did not add value for employees or employers.

- Improved Field Labels: Updated field names to be clearer, intuitive, and user-friendly.

- Centralized Data Entry: Shifted certain fields to be managed at the employer or global level, minimizing the need to enter the same information for each employee.

This concludes our efforts to optimize the tax withholding flow, delivering a cleaner, faster, and more efficient experience. The states and territories affected are outlined below. We have also provided a screenshot of what the experience looked like before the change, as well as what it will look like after the change. We have only provided screenshots for current clients.

States

| Nevada | Rhode Island |

| New Jersey | South Carolina |

| New Mexico | Tennessee |

| New York | Texas |

| North Carolina | Utah |

| North Dakota | Vermont |

| Northern Mariana Islands | Virgin Islands |

| Ohio | Virginia |

| Oklahoma | Washington |

| Oregon | West Virginia |

| Pennsylvania | Wisconsin |

| Puerto Rico | Wyoming |

Territories

| American Samoa |

| Guam |

| The Commonwealth of the Northern Mariana Islands (CNMI) |

| Puerto Rico |

| The US Virgin Islands (USVI) |

We have outlined the differences for each of the states where we currently have clients. We have not included states that are non-withholding states (Texas, Tennessee, Nevada) because there will be no impact on their withholding cards.

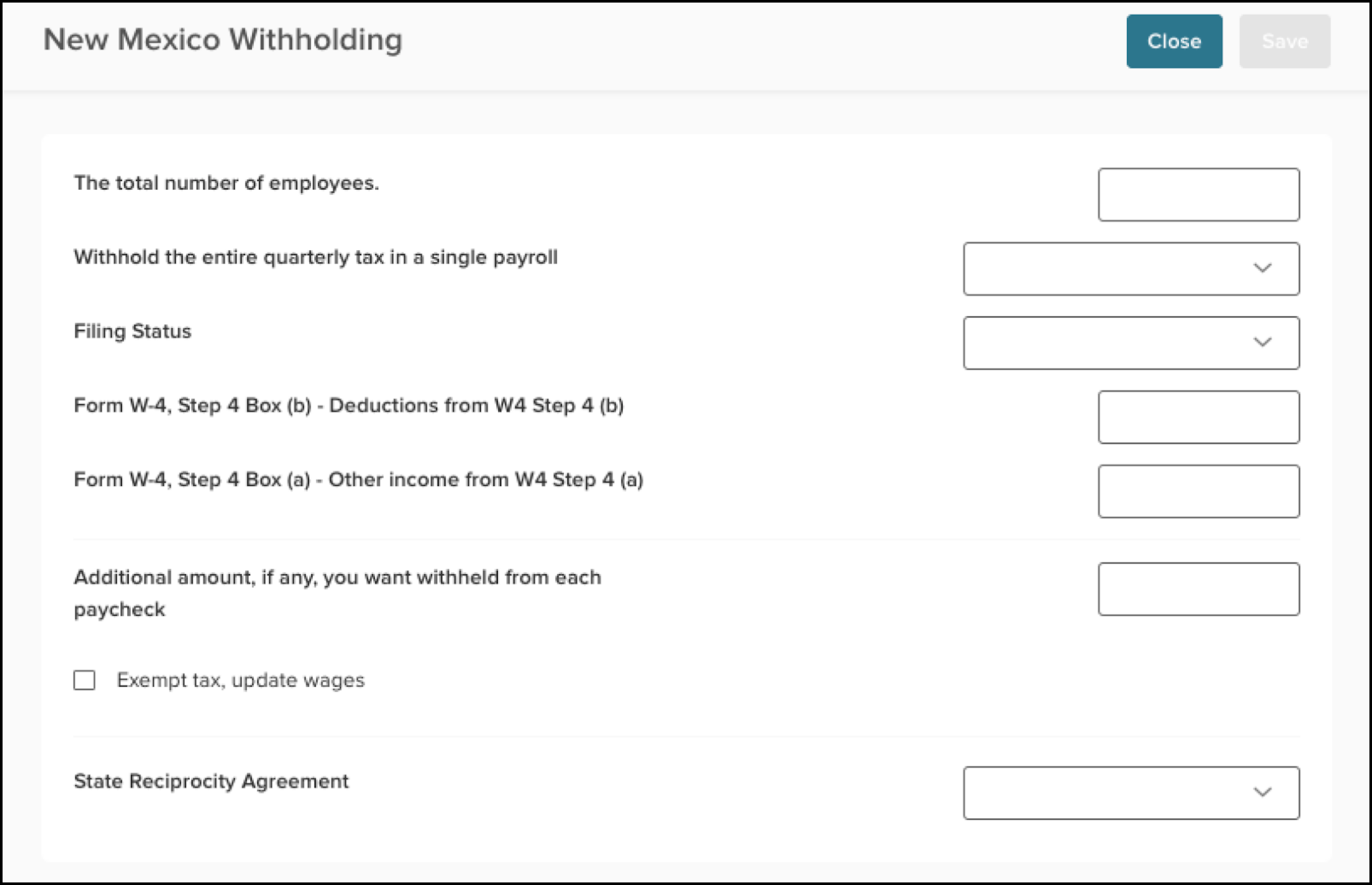

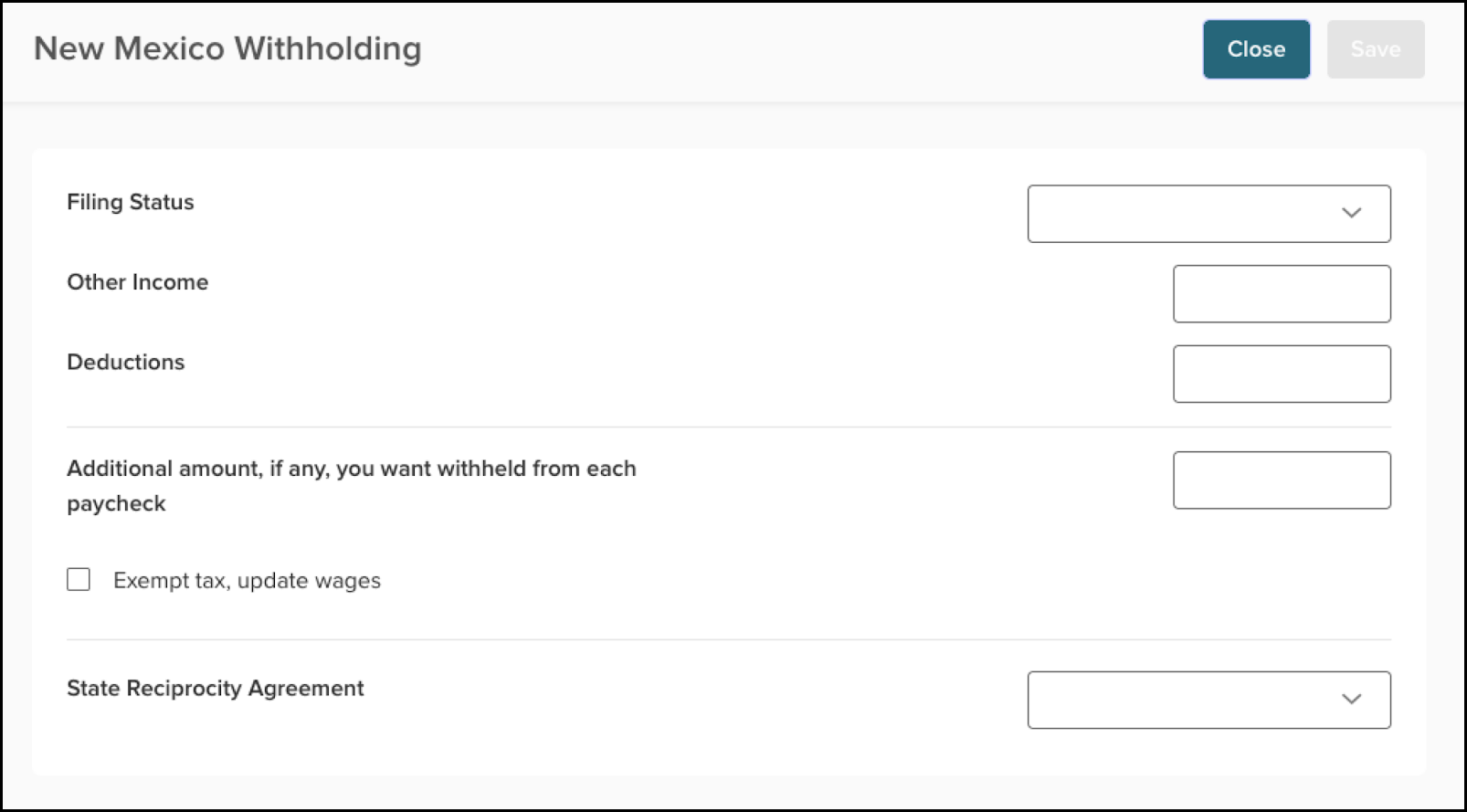

New Mexico

Current

Future

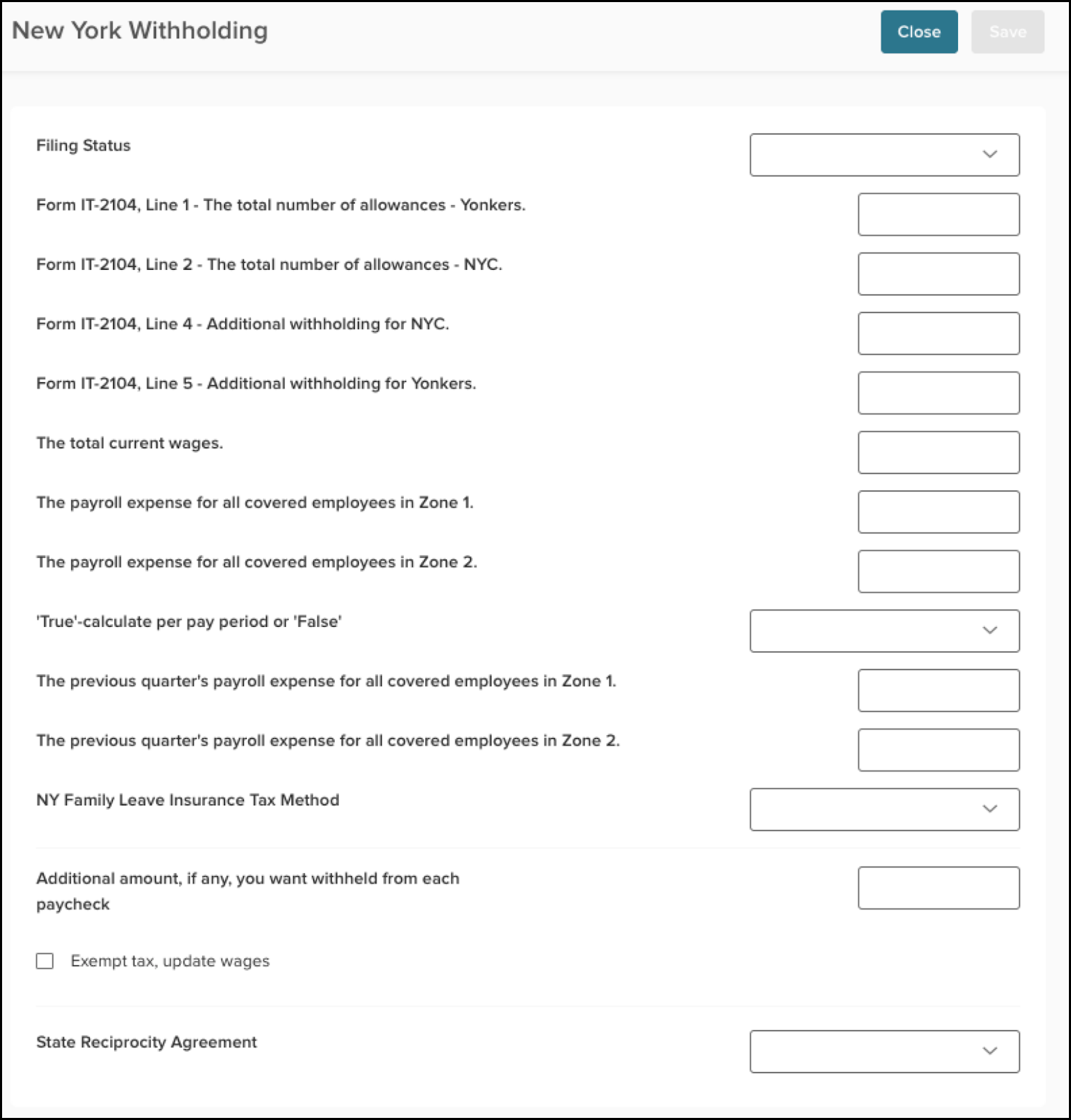

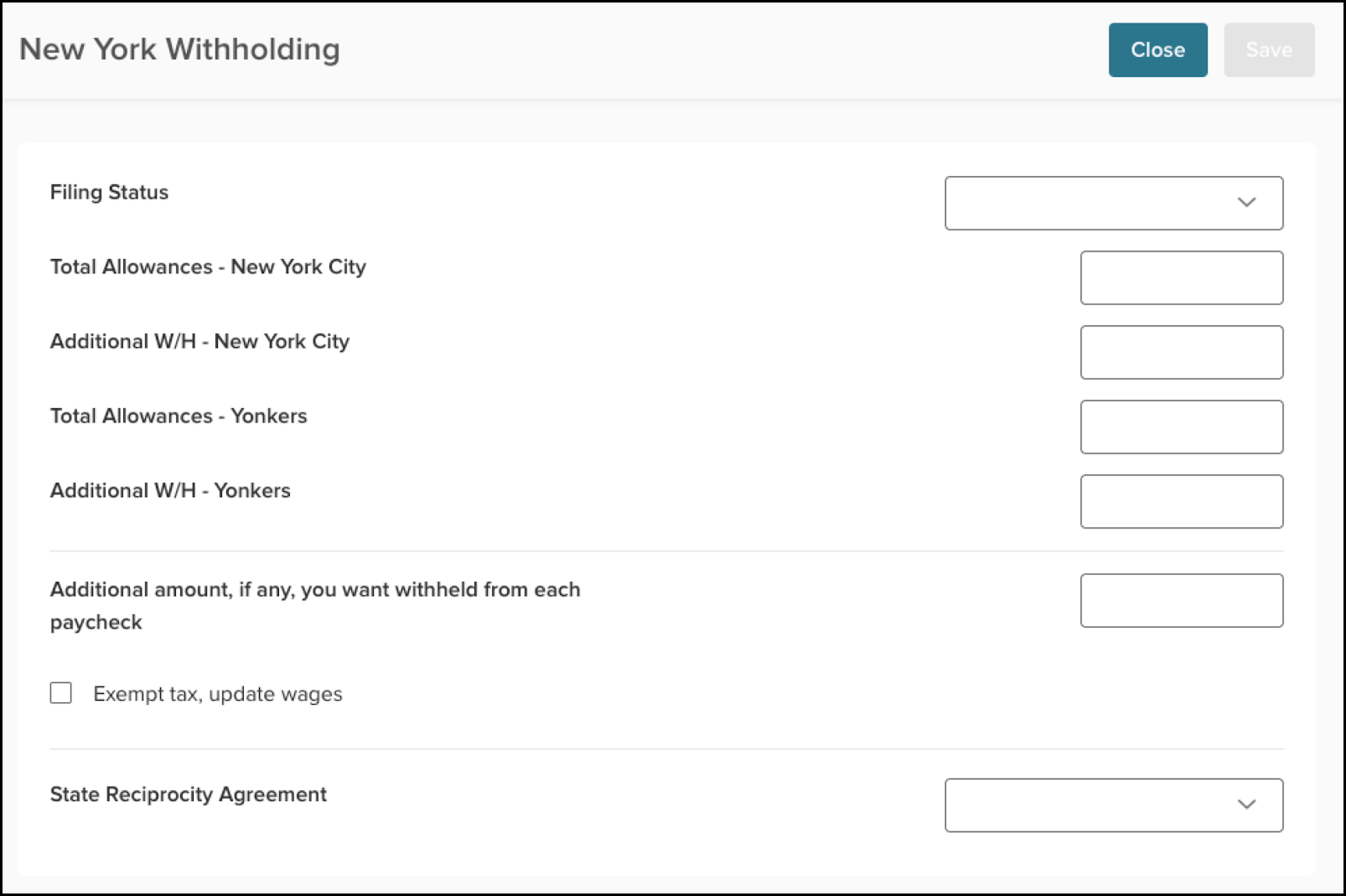

New York

Current

Future

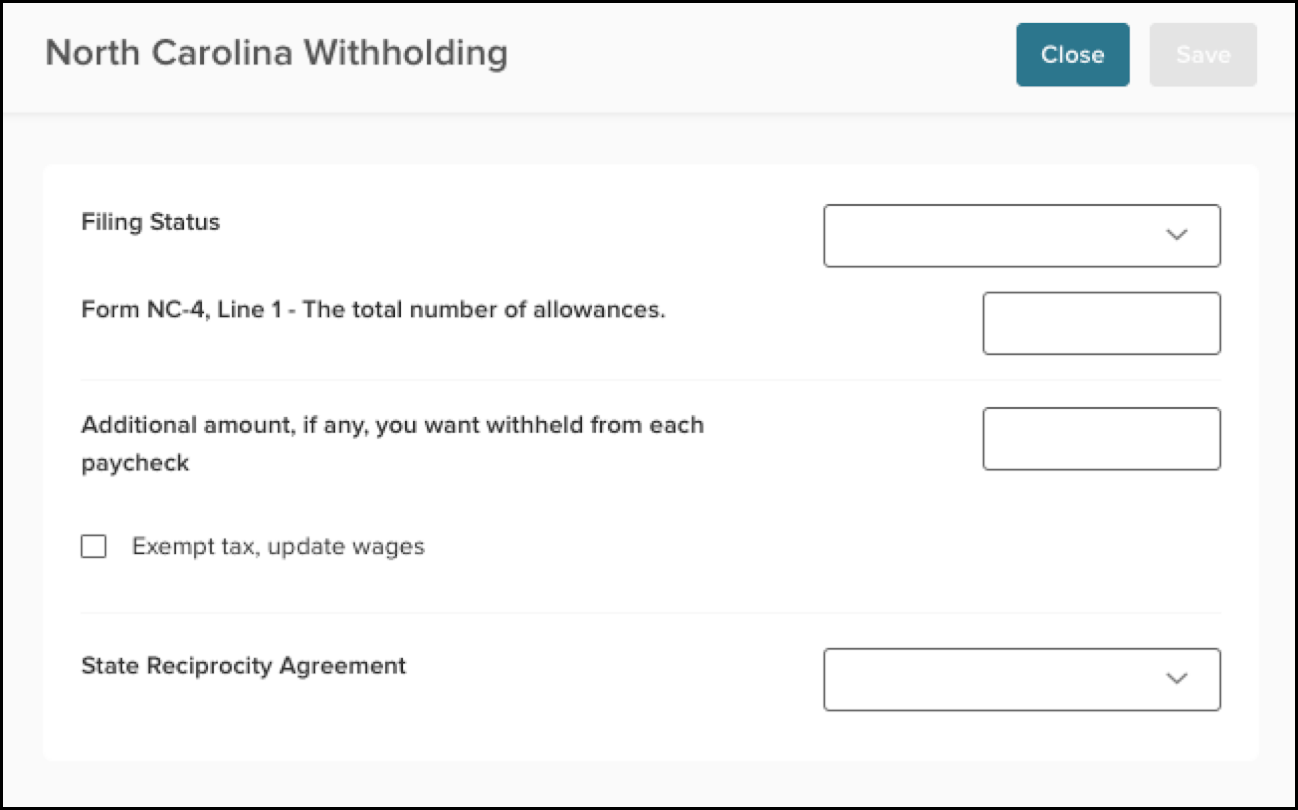

North Carolina

Current

Future

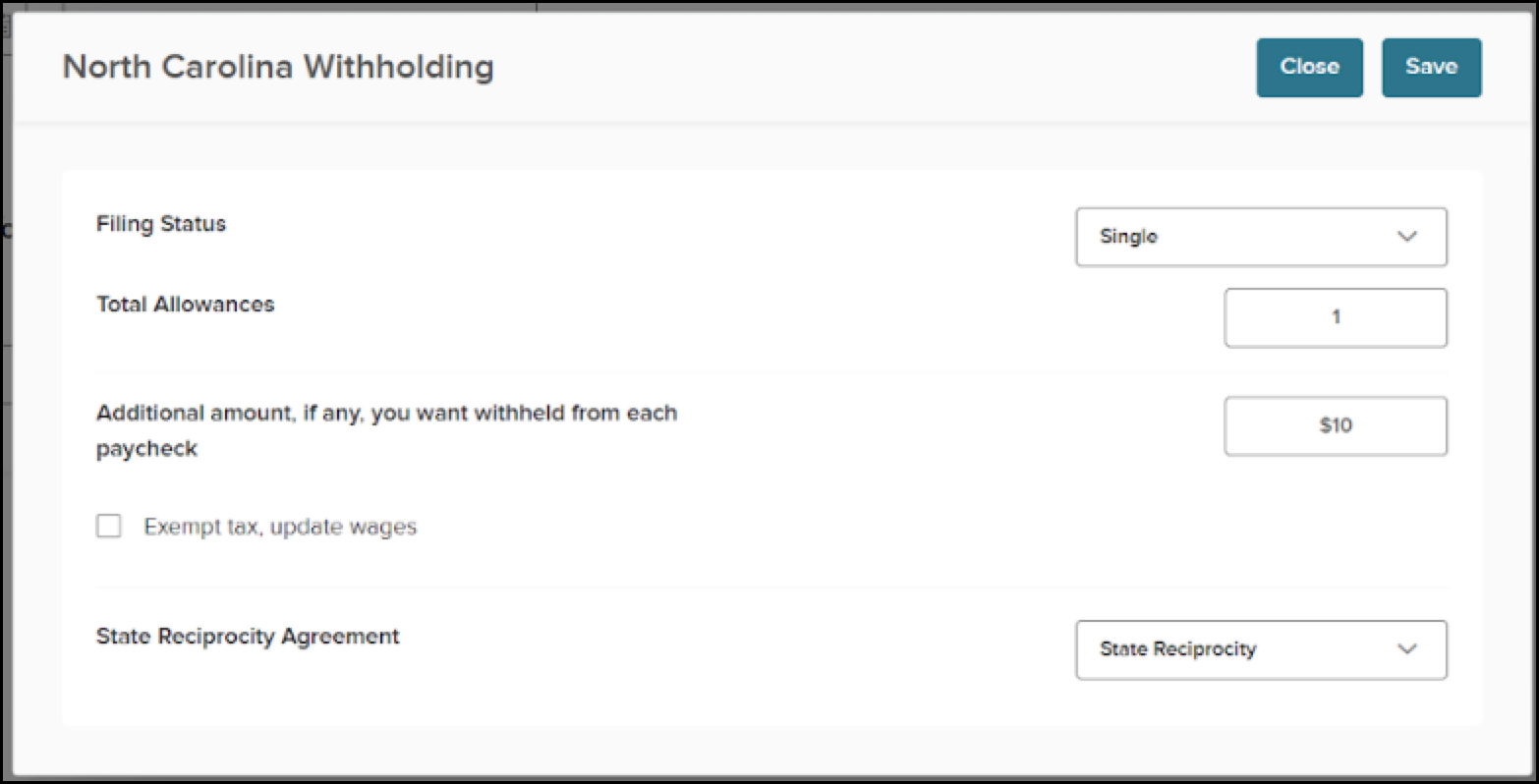

North Dakota

Future

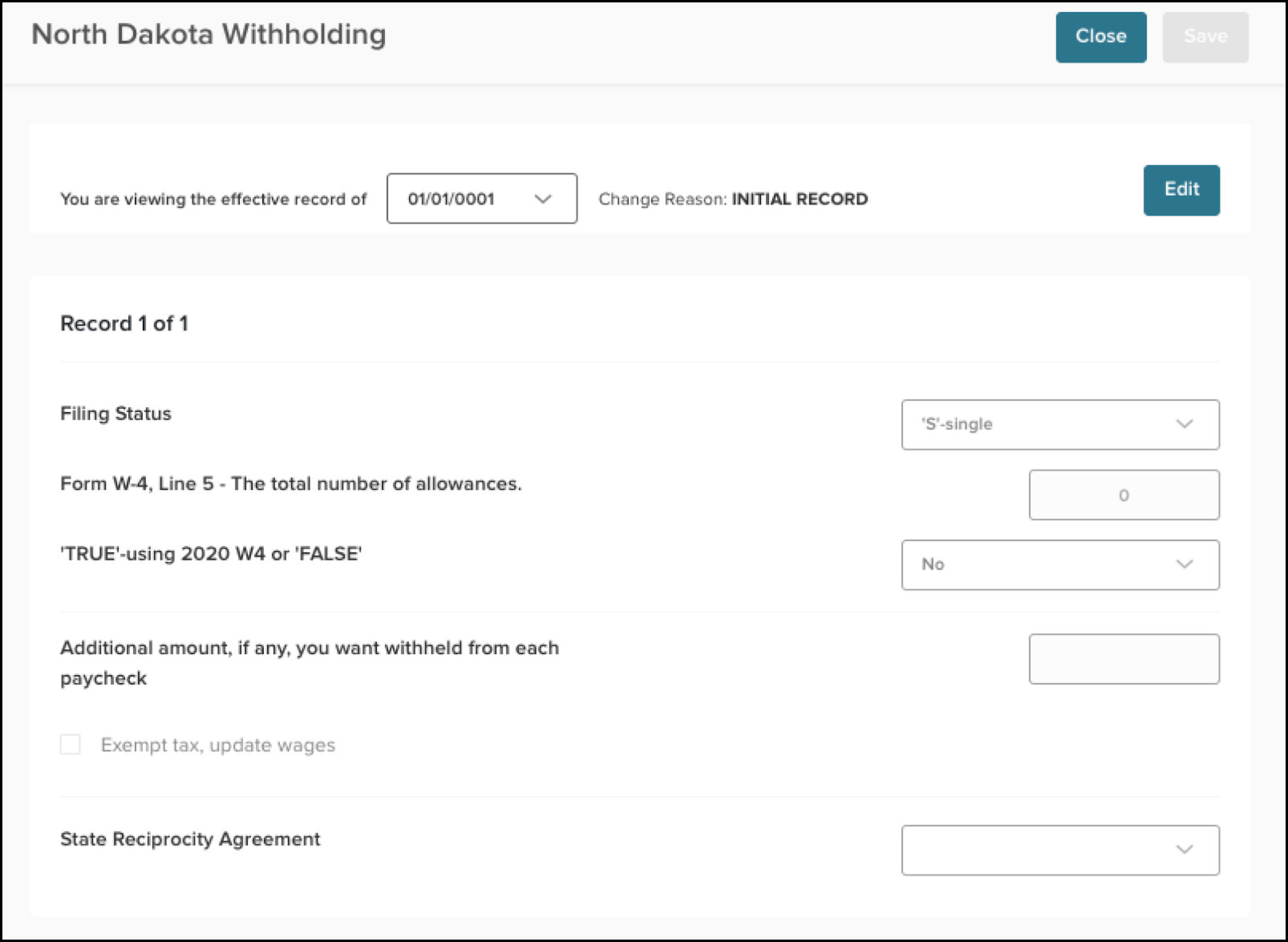

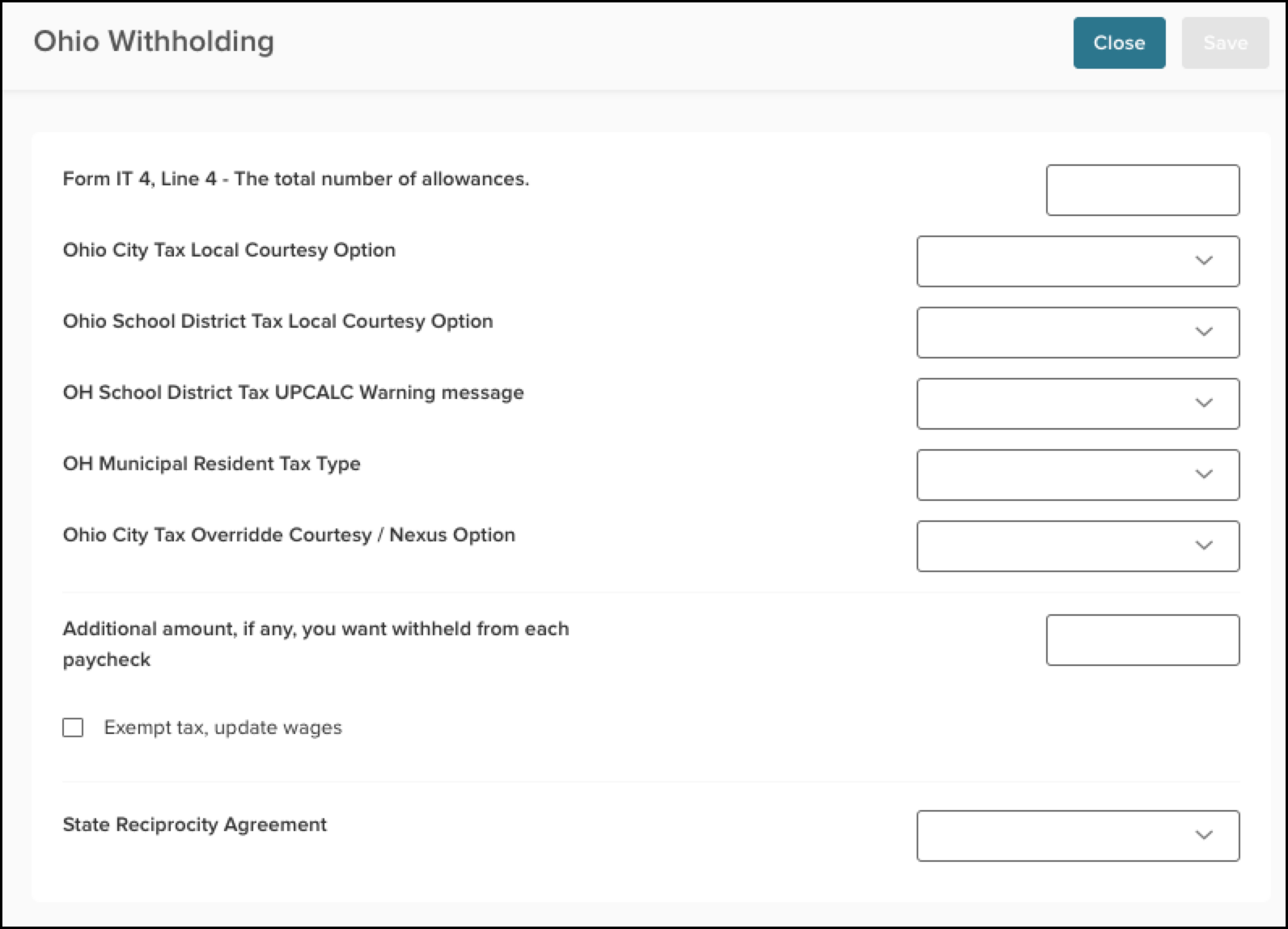

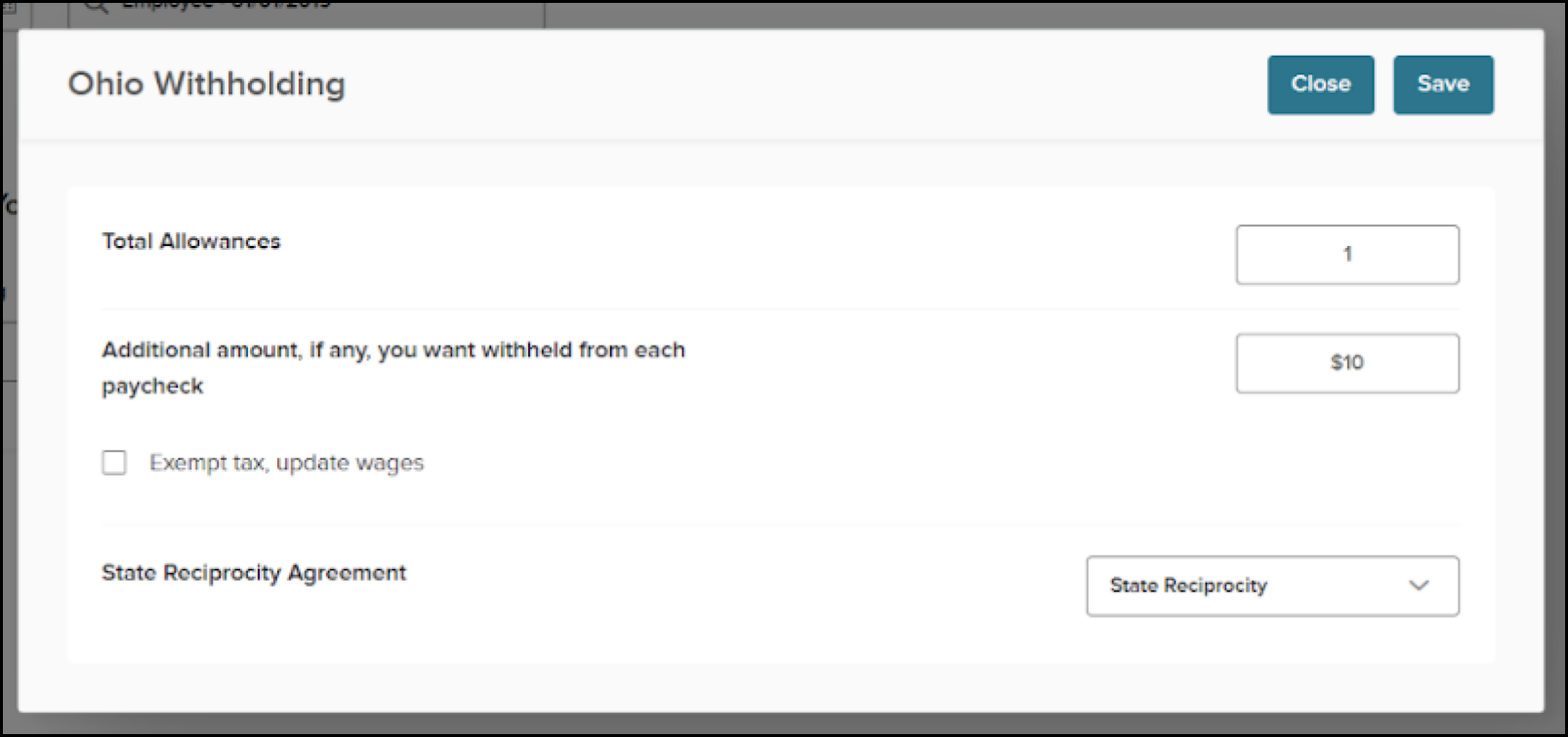

Ohio

Current

Future

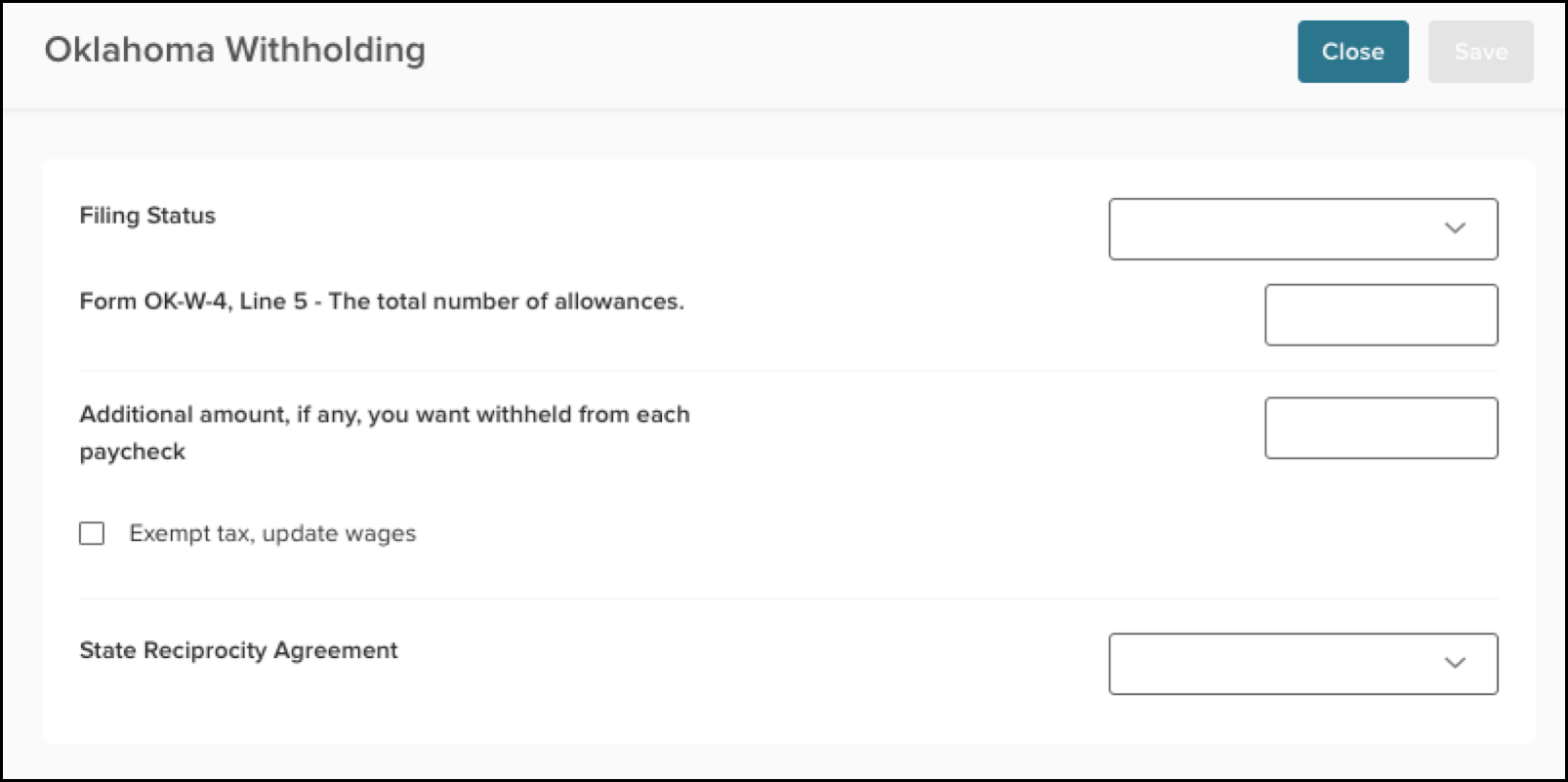

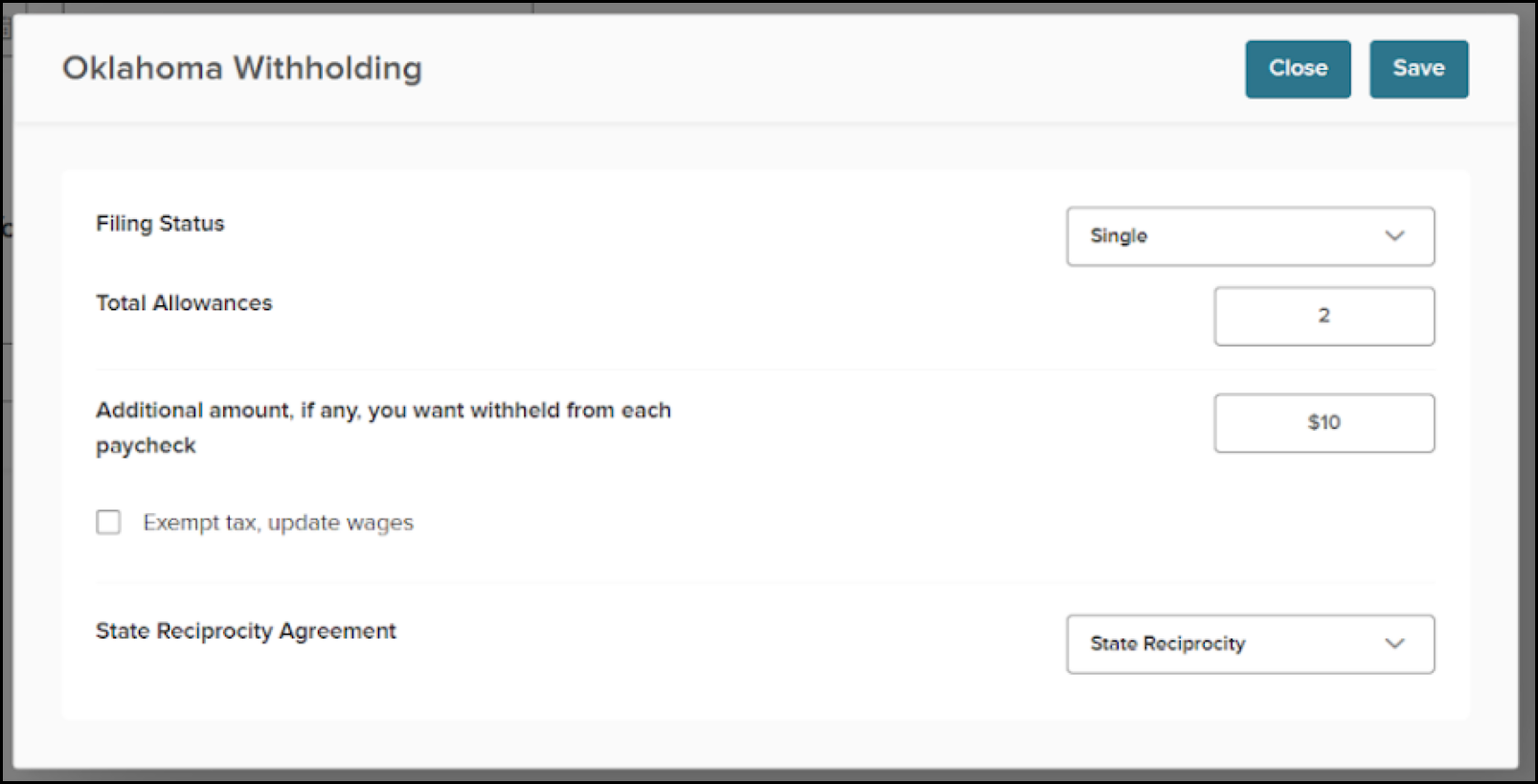

Oklahoma

Current

Future

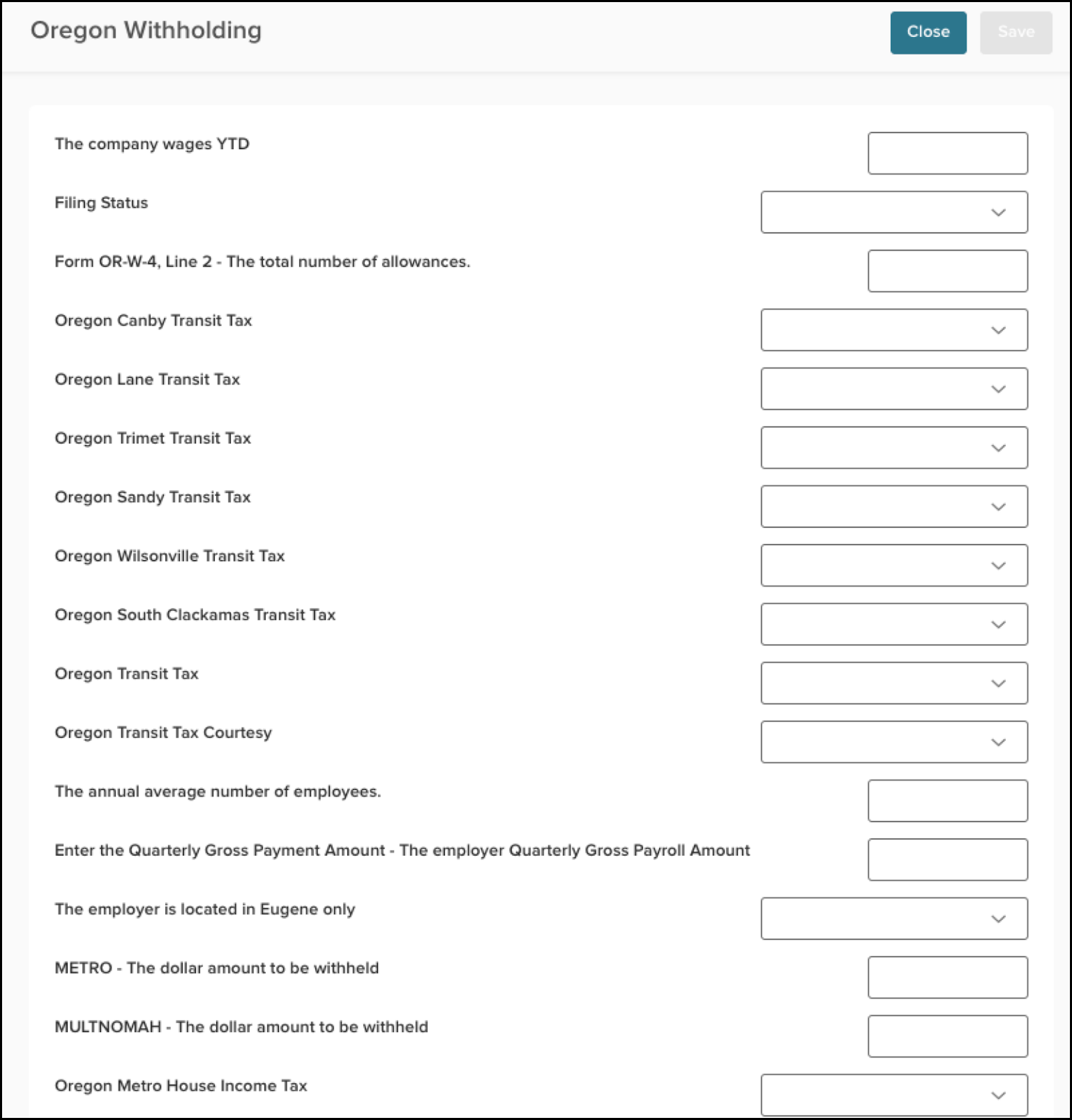

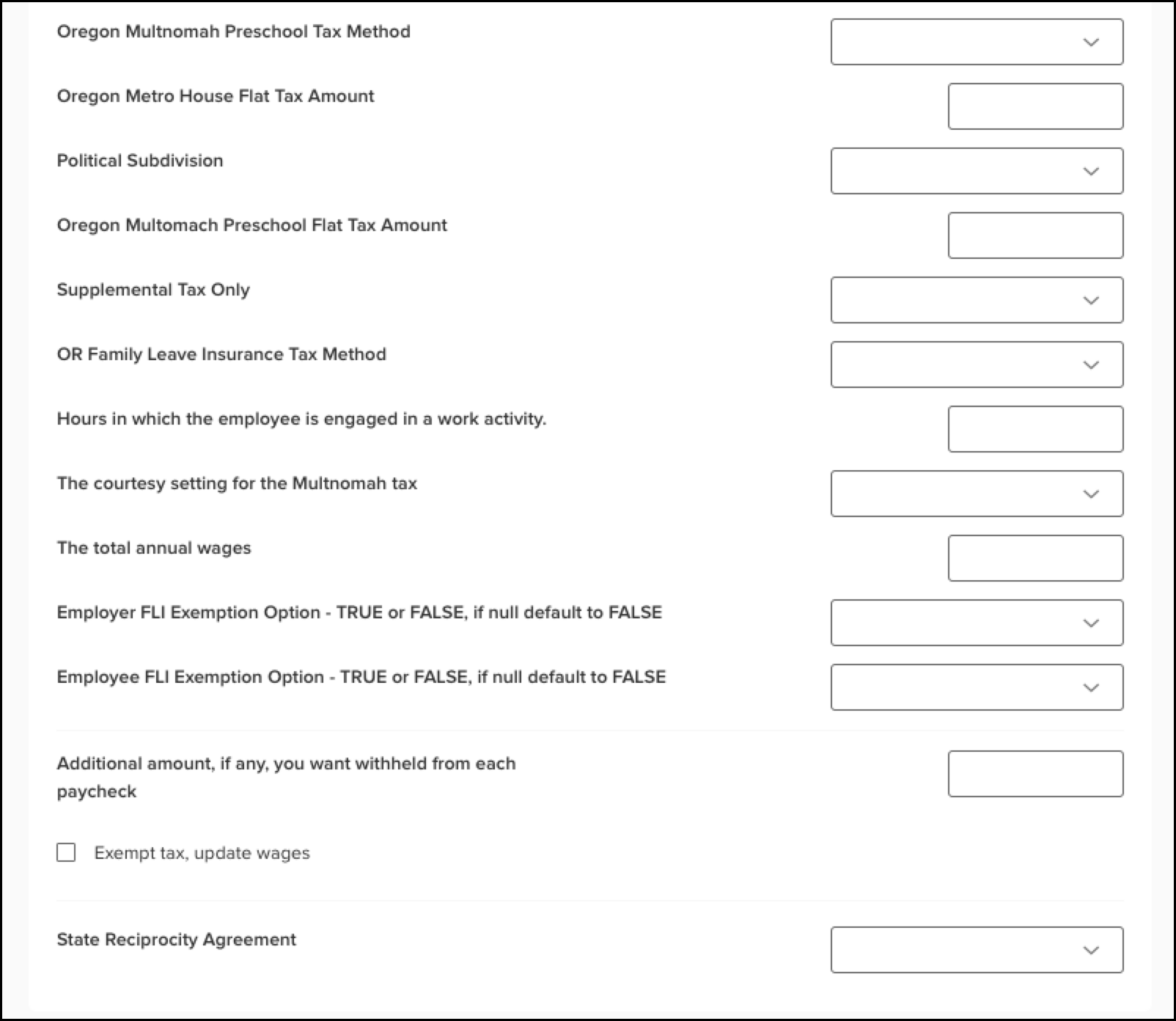

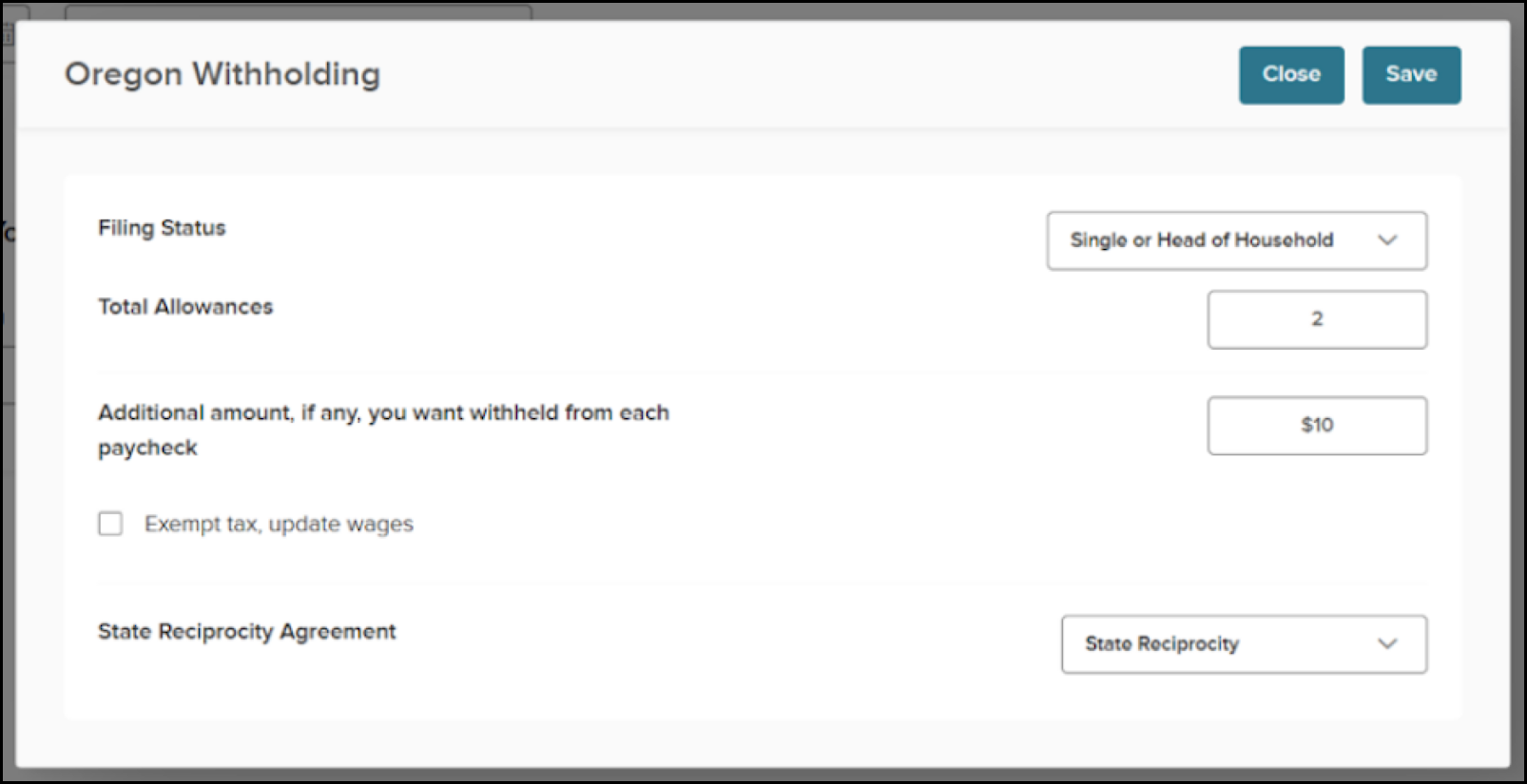

Oregon

Current

Future

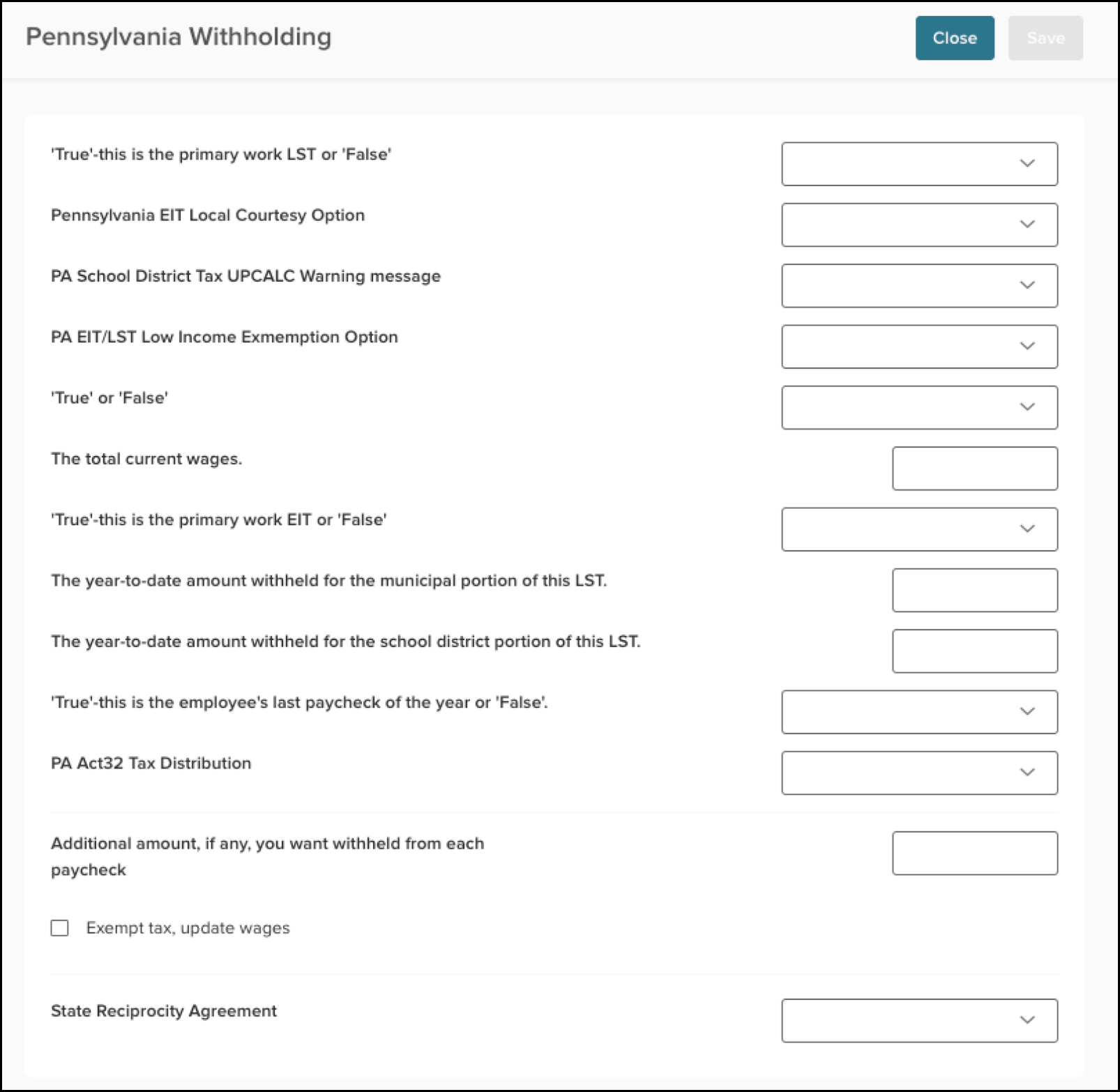

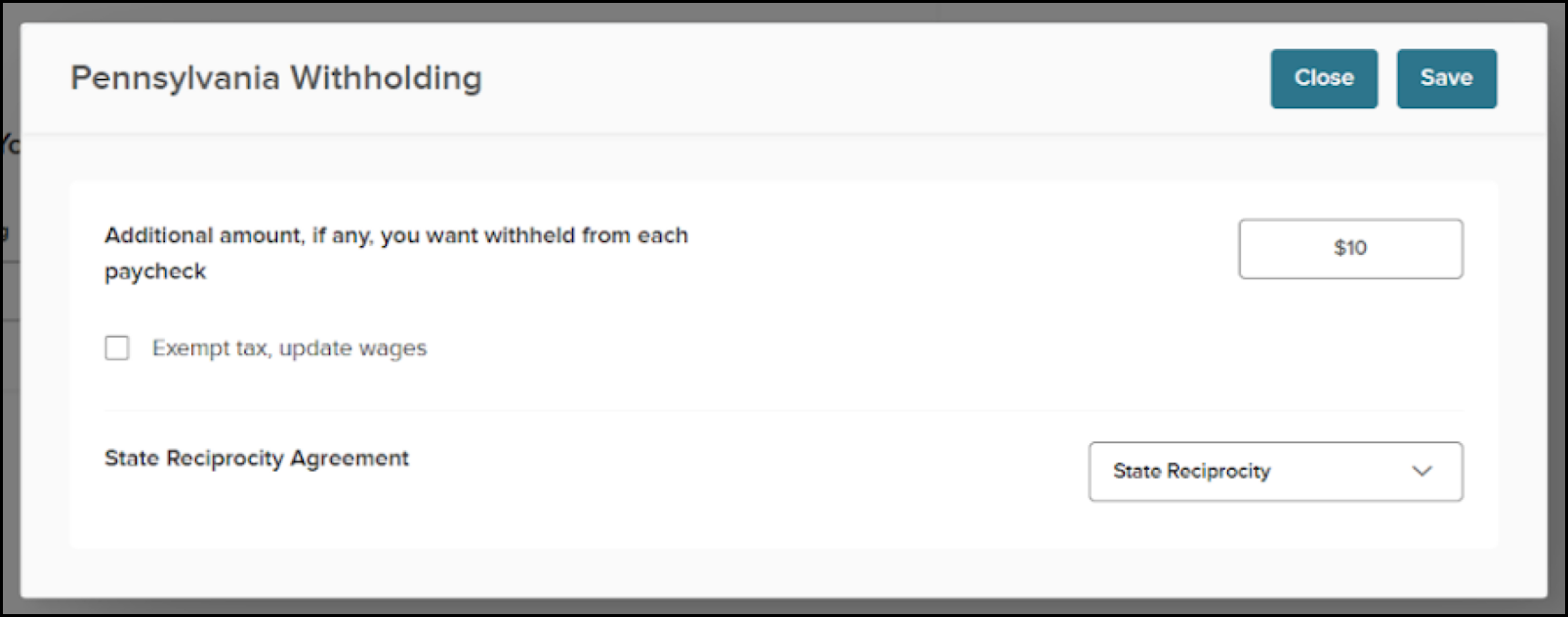

Pennsylvania

Current

Future

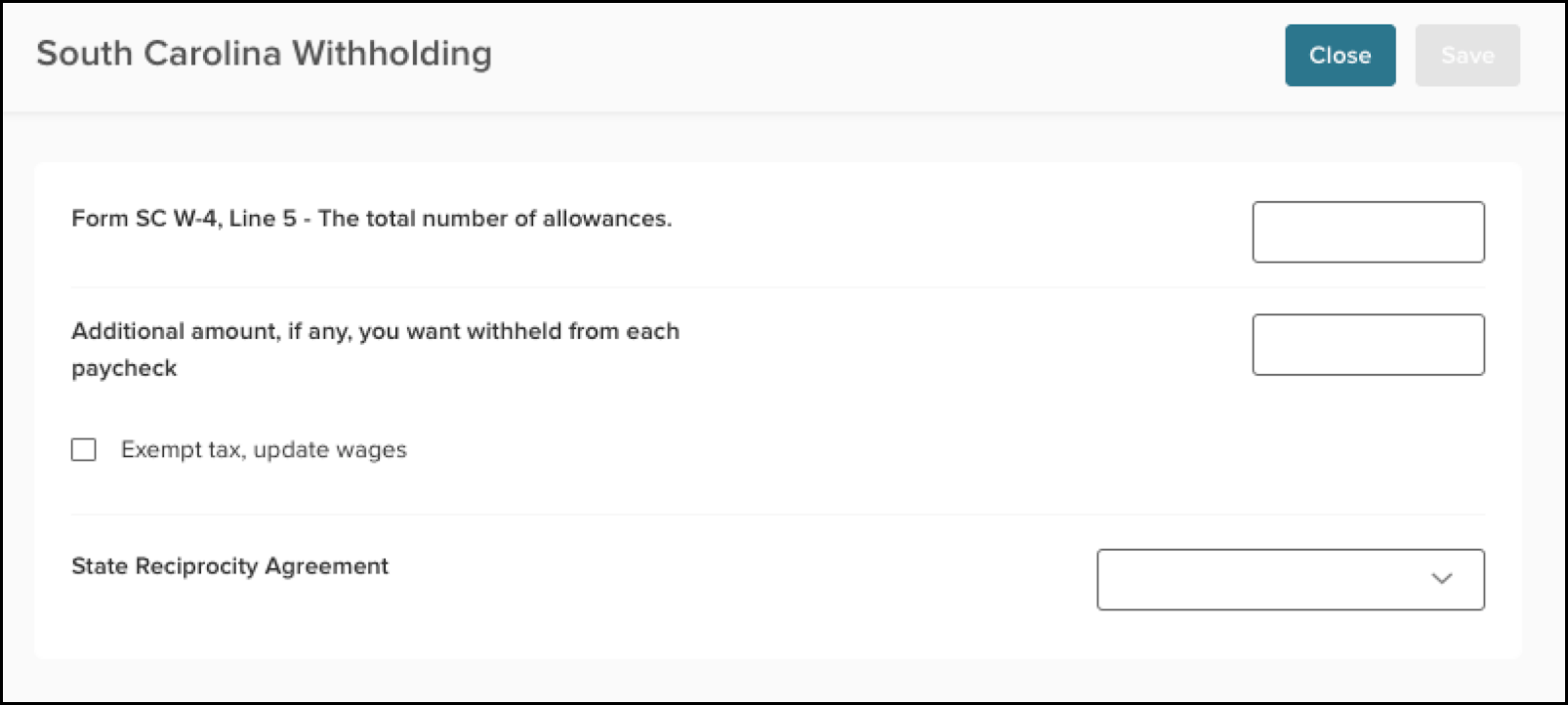

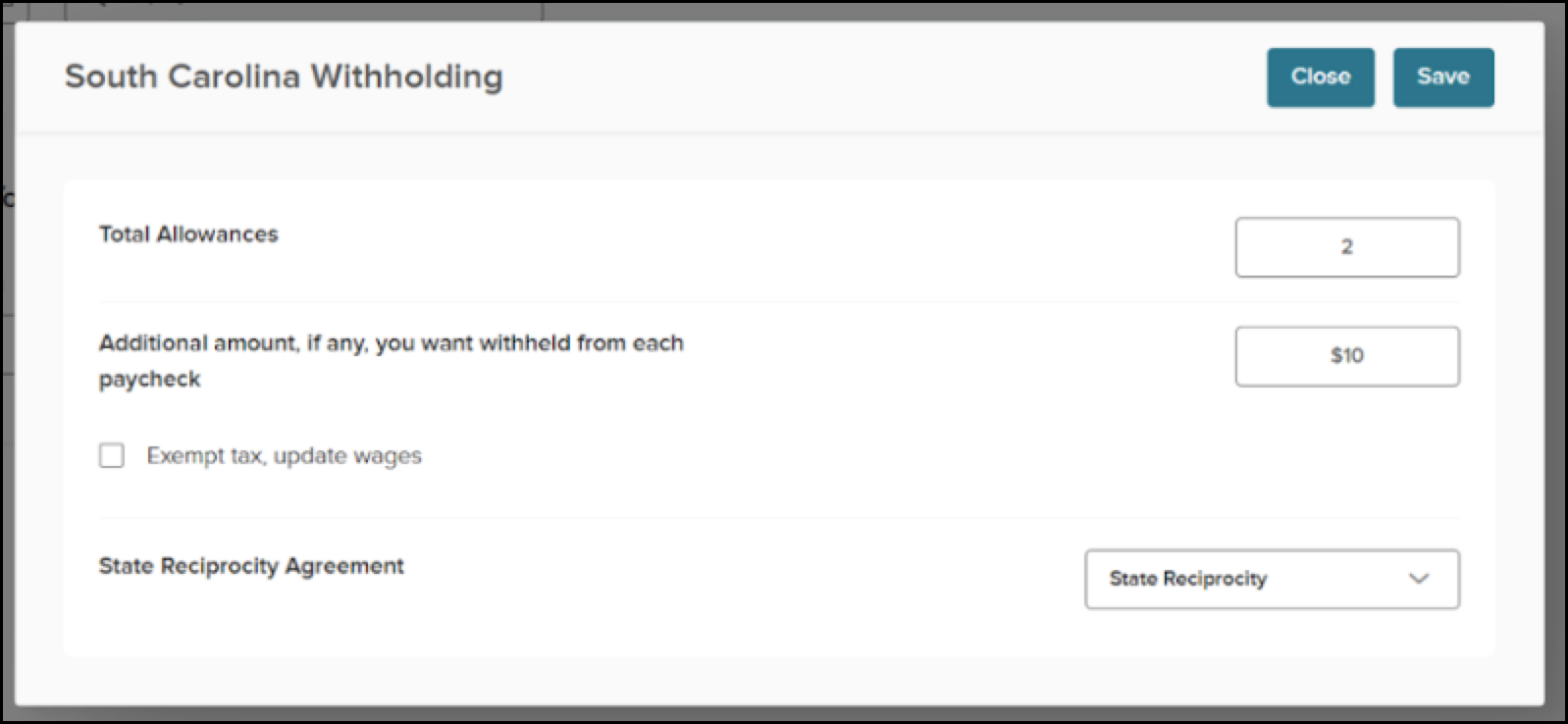

South Carolina

Current

Future

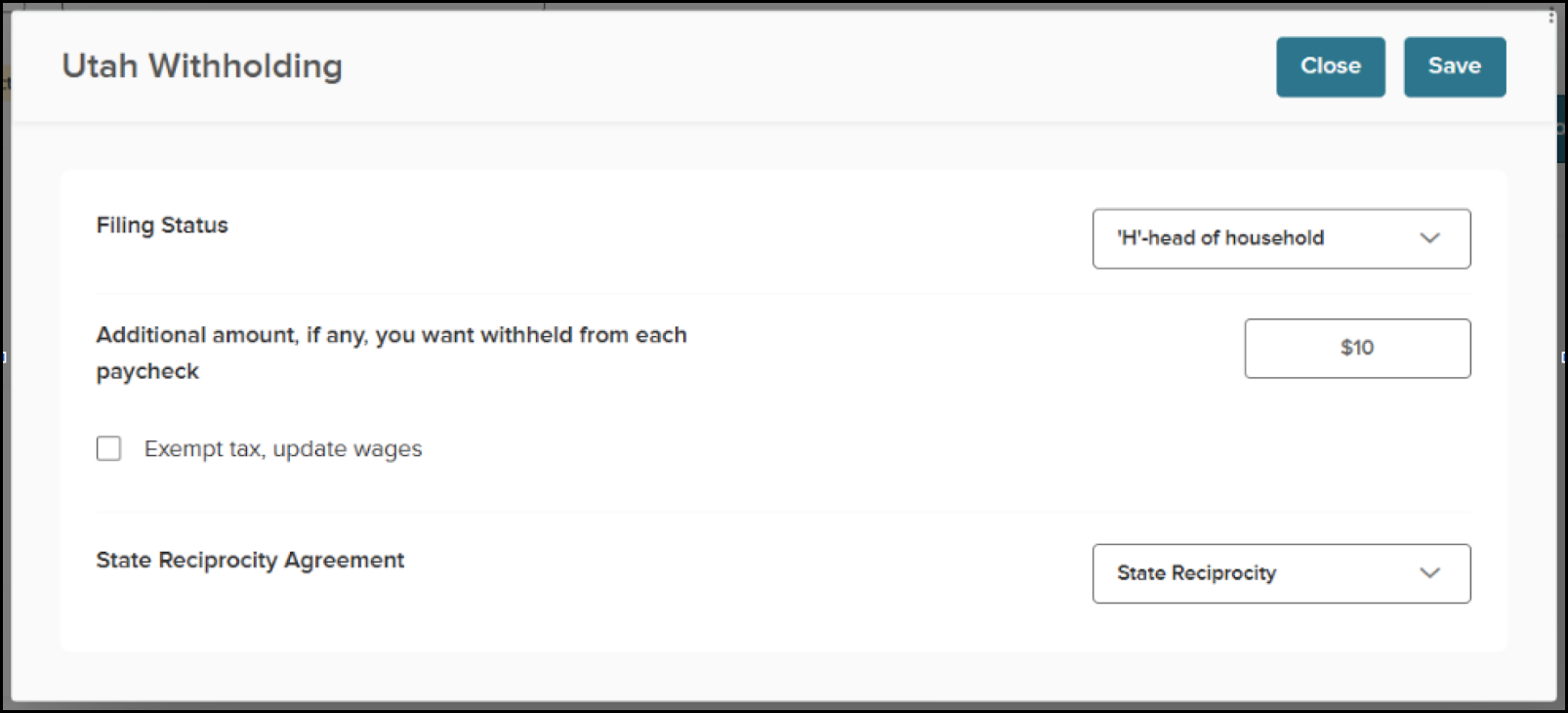

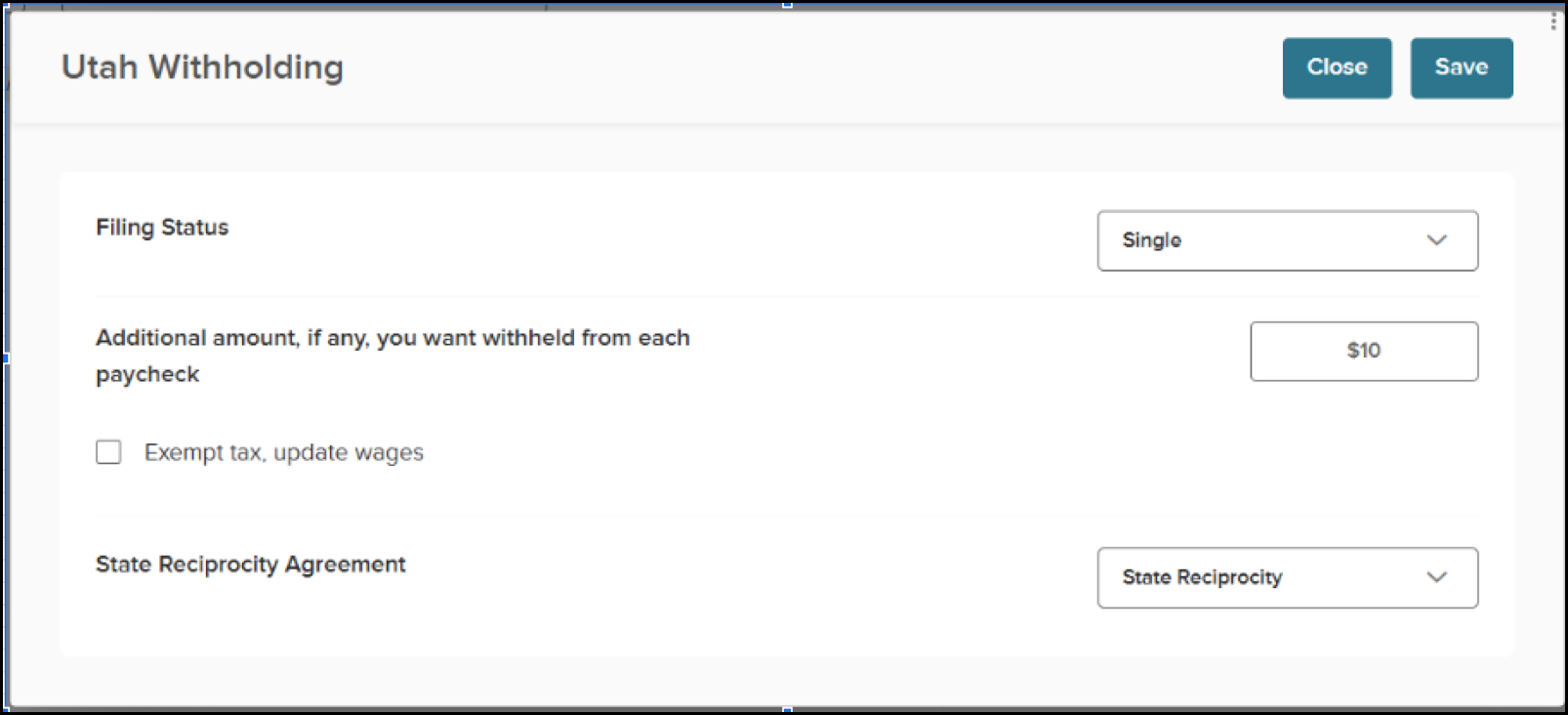

Utah

Current

Future

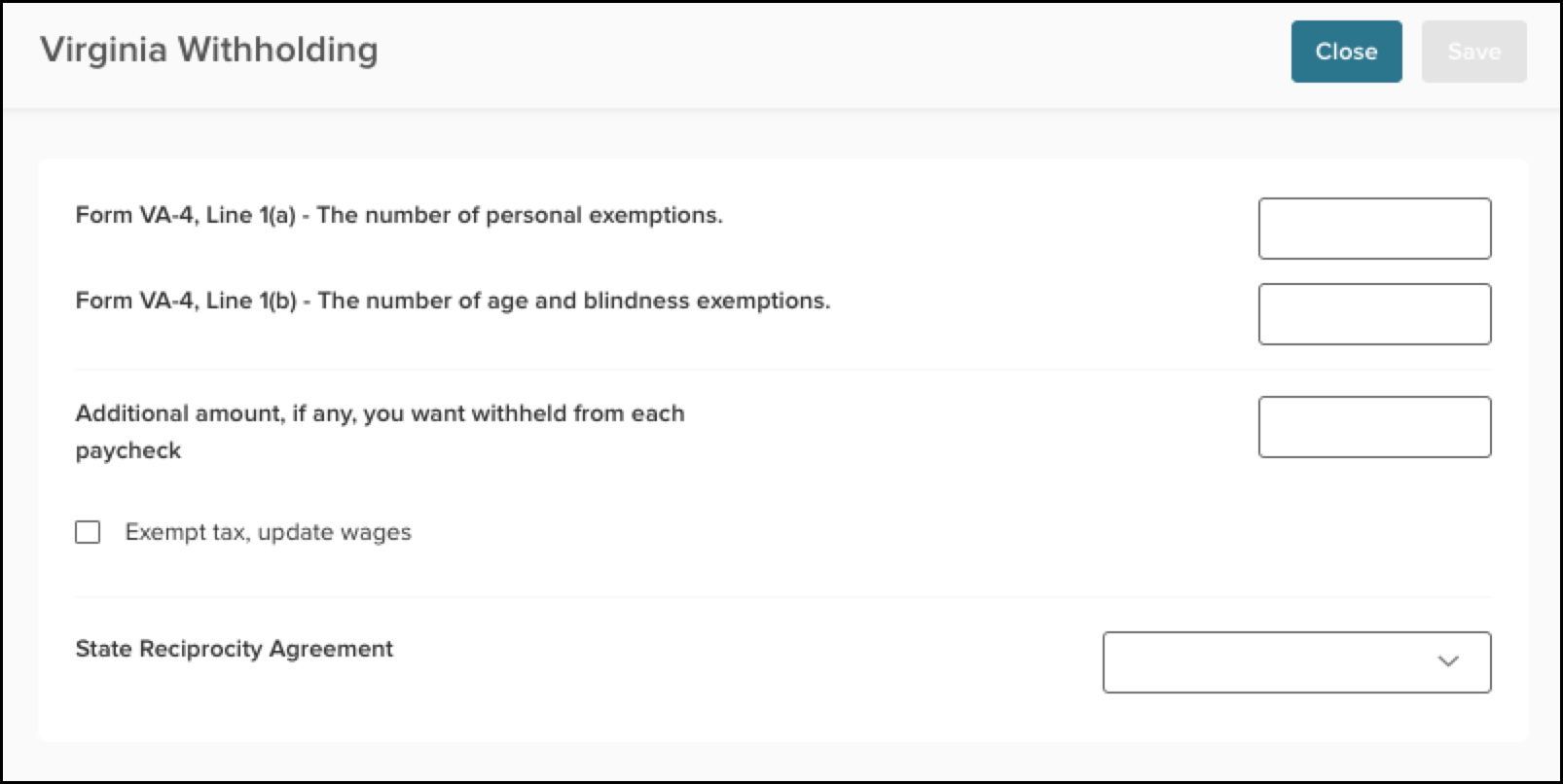

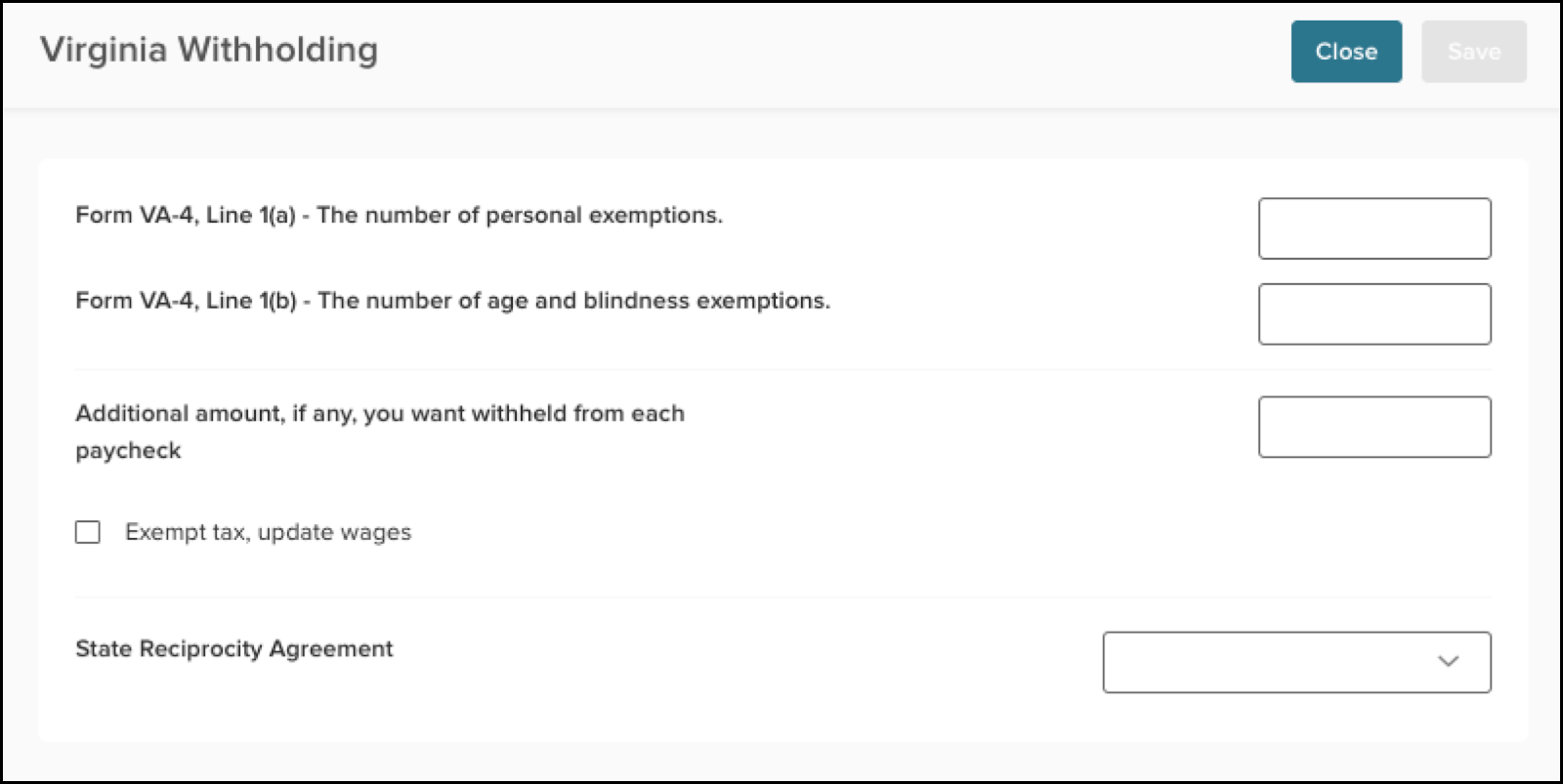

Virginia

Current

Future

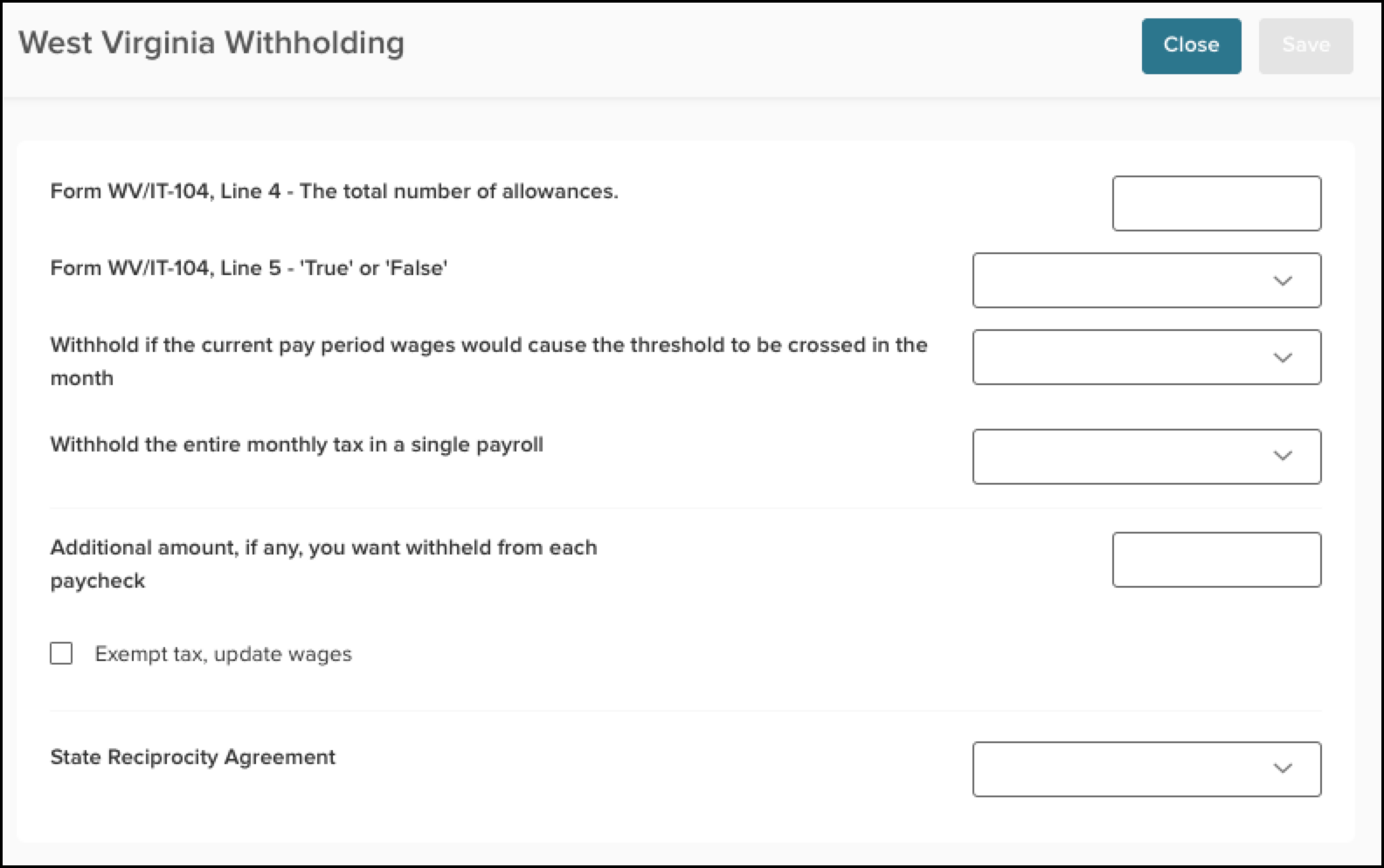

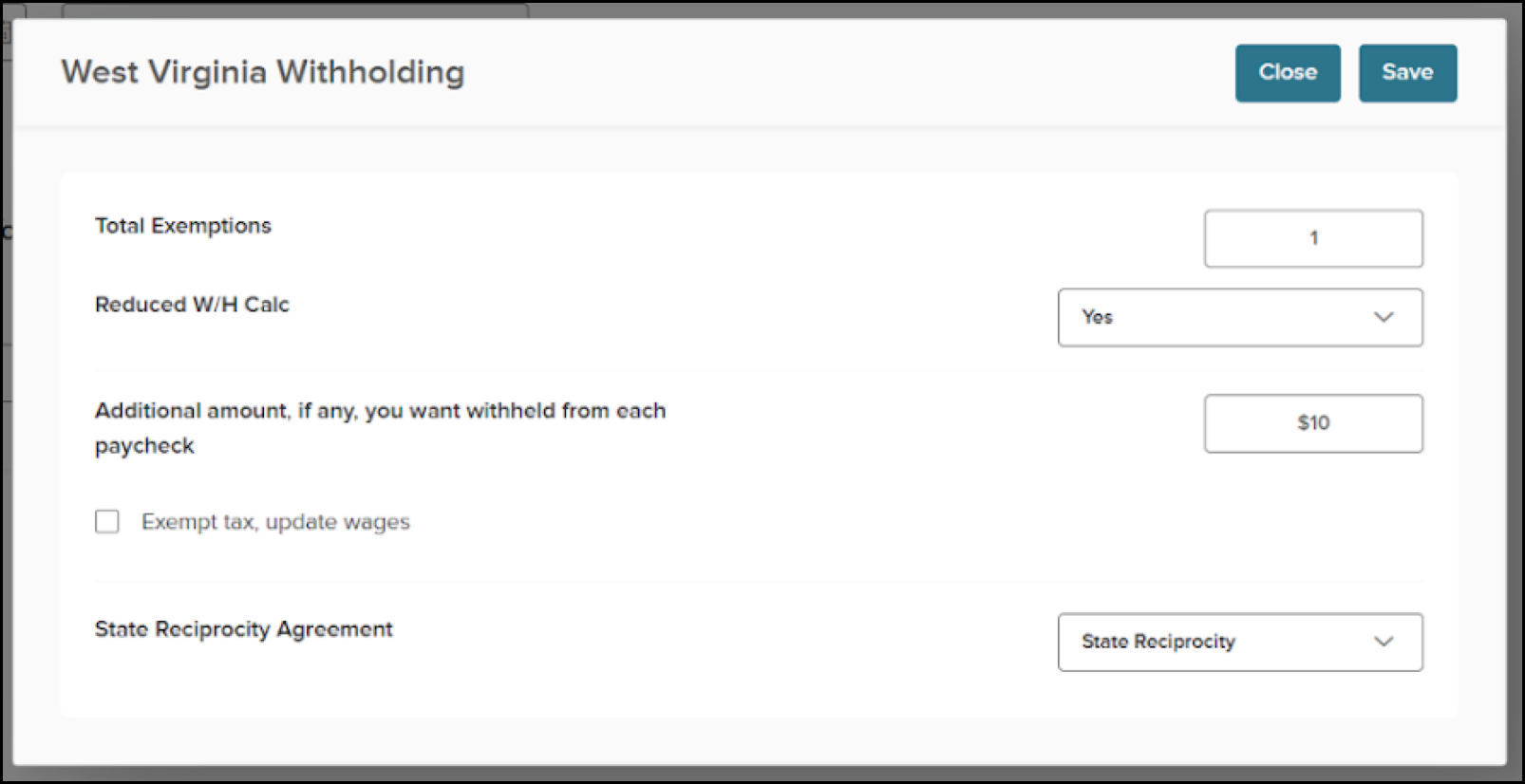

West Virginia

Current

Future

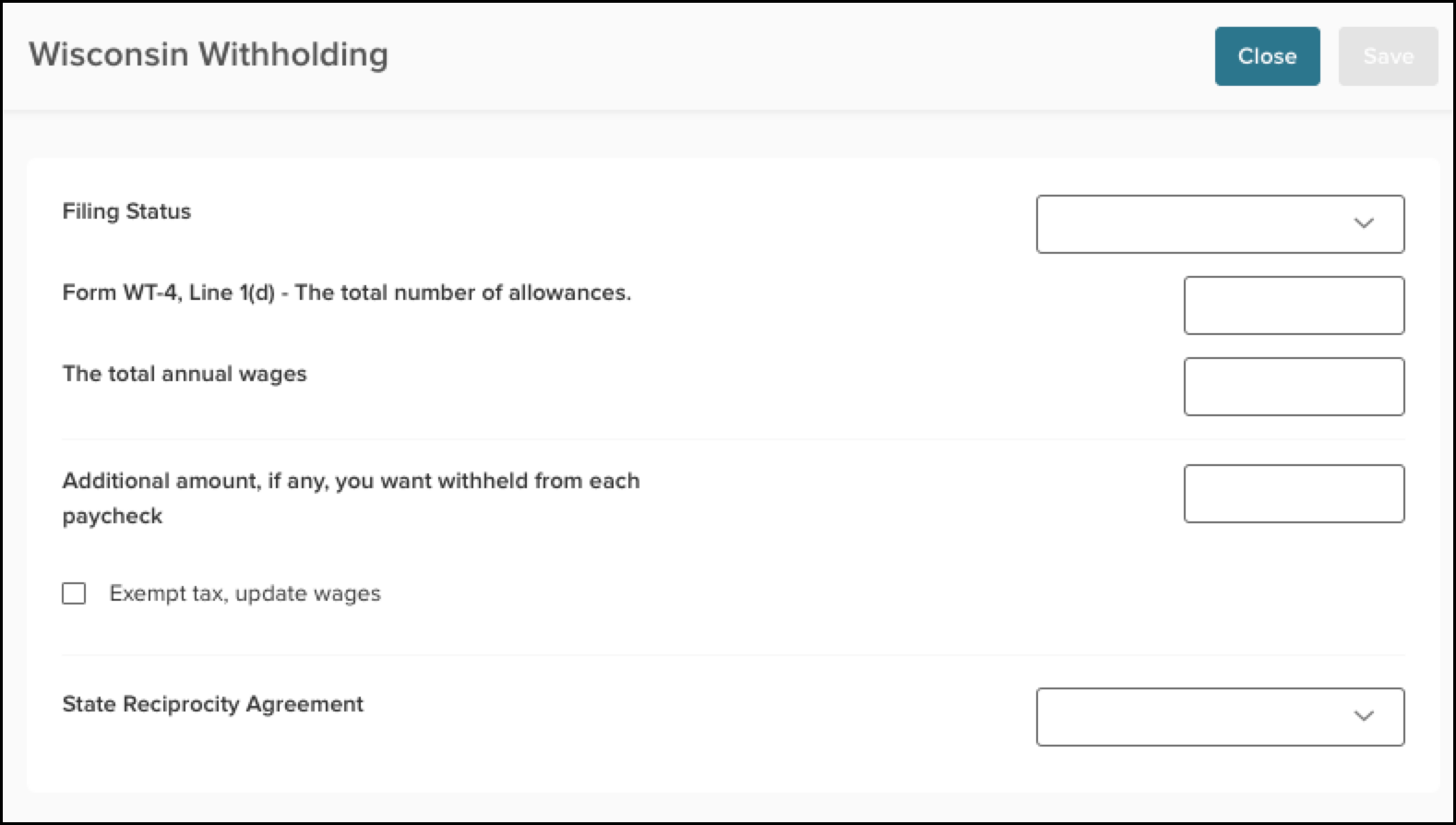

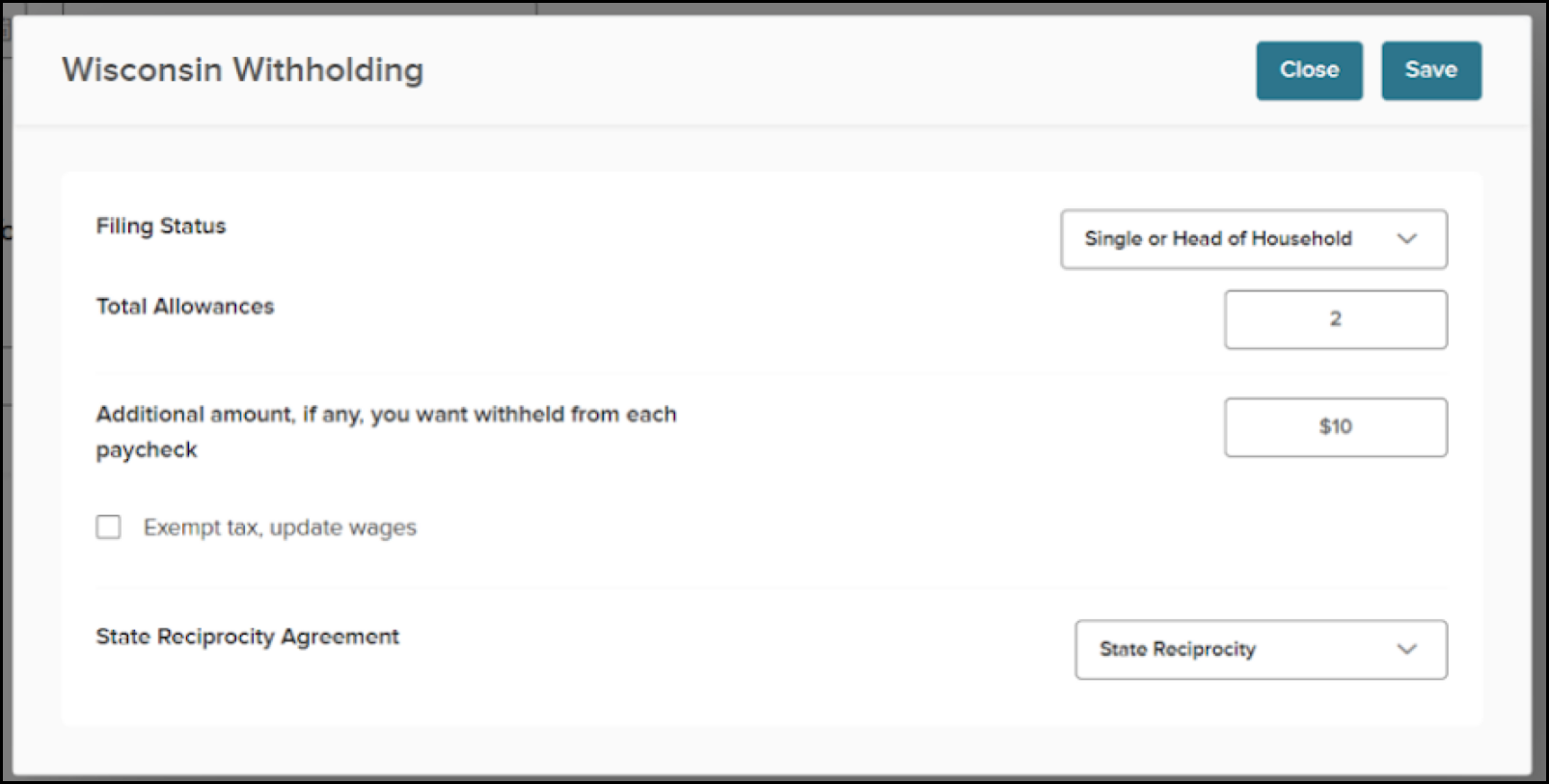

Wisconsin

Current

Future

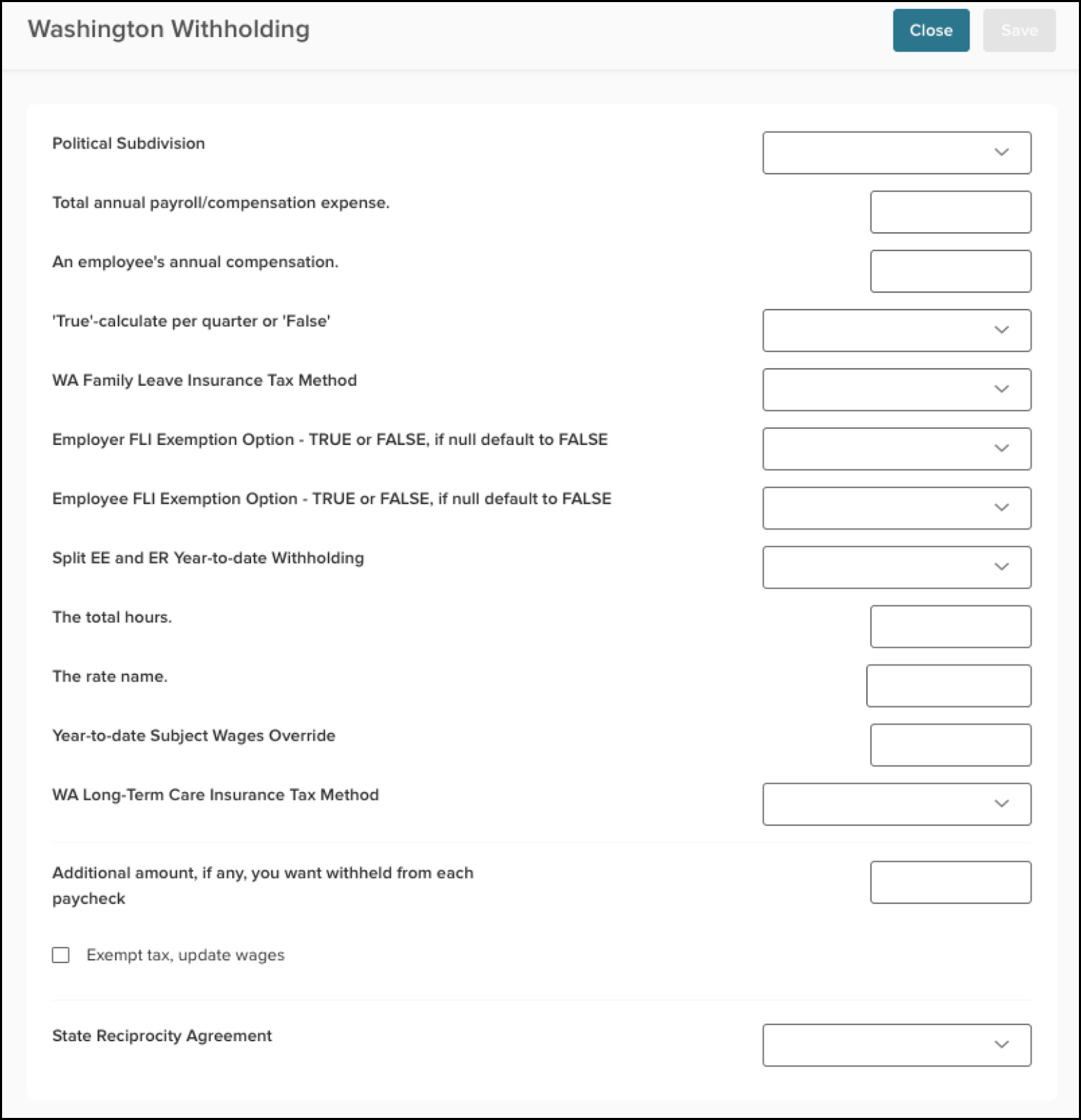

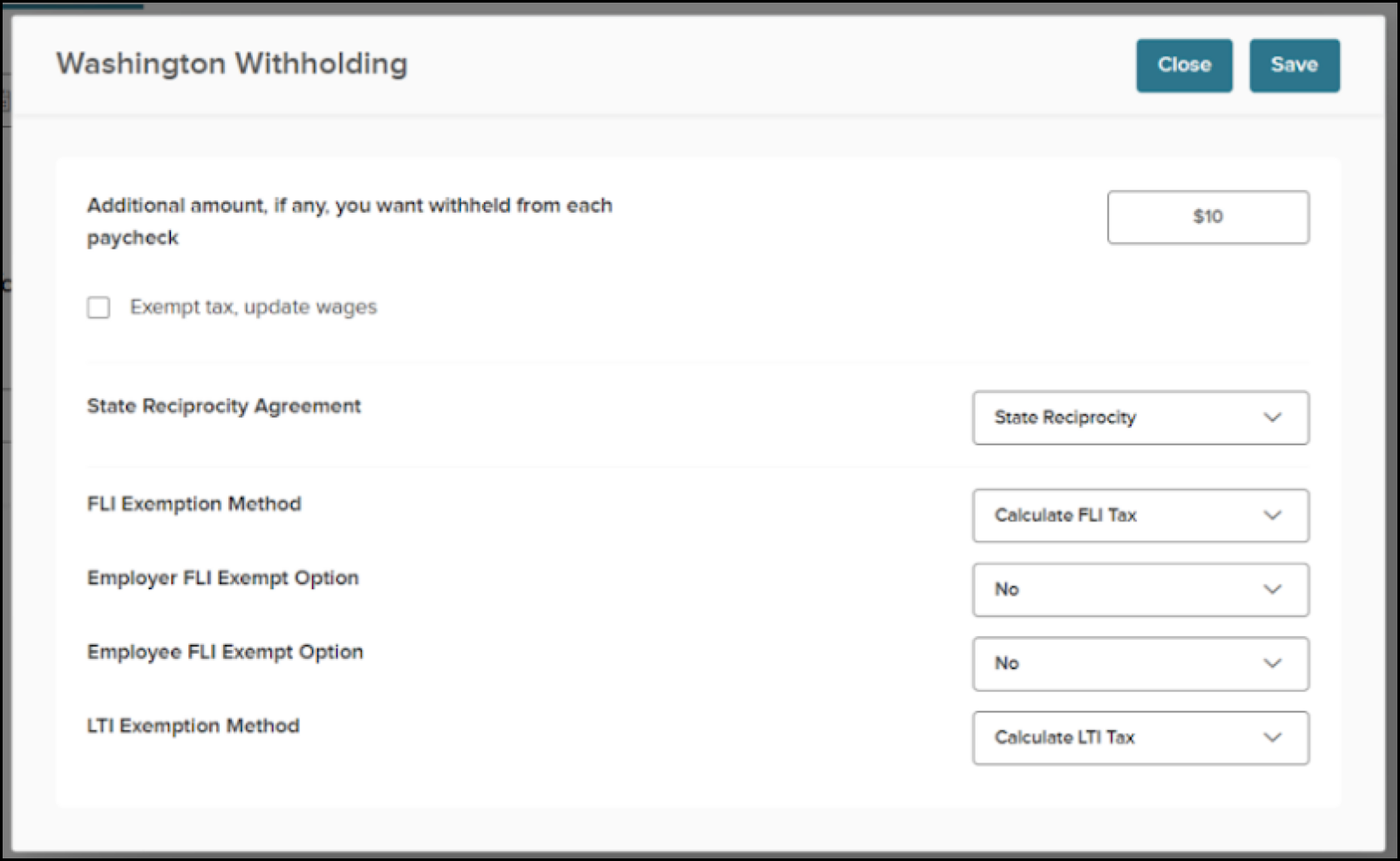

Washington

Current

Future

Support added for Delaware Paid Leave

For companies in Delaware, a new field has been added to the state Tax Withholding Card to identify whether an employee is eligible for the Delaware Paid Leave program. This parameter has three valid inputs:

- ELIGIBLE: This indicates that the employee is eligible for the program. This represents the default existing behavior for Delaware Paid Leave. This is the default value that will be used if the parameter is not set, so you will see no change in calculation results unless you intentionally set the parameter.

- RECLASSIFIED: This indicates whether an employee is eligible and has out-of-state wages. Both Delaware wages and any out-of-state wages set will be used when calculating the tax, rather than only Delaware wages.

- WAIVED: This indicates that the employee and employer have reached an agreement whereby the employee has been waived from the program. Both the employee and employer portions of Delaware Paid Leave will return $0 in tax.

Subject wages will remain the same as those of eligible employees (for reporting and tracking purposes). Although it is Employer Family Leave Insurance, the benefit eligibility is based on the agreement between the employer and employee; therefore, this will be visible on the Employee’s Tax Withholding card and default to ‘ELIGIBLE’.

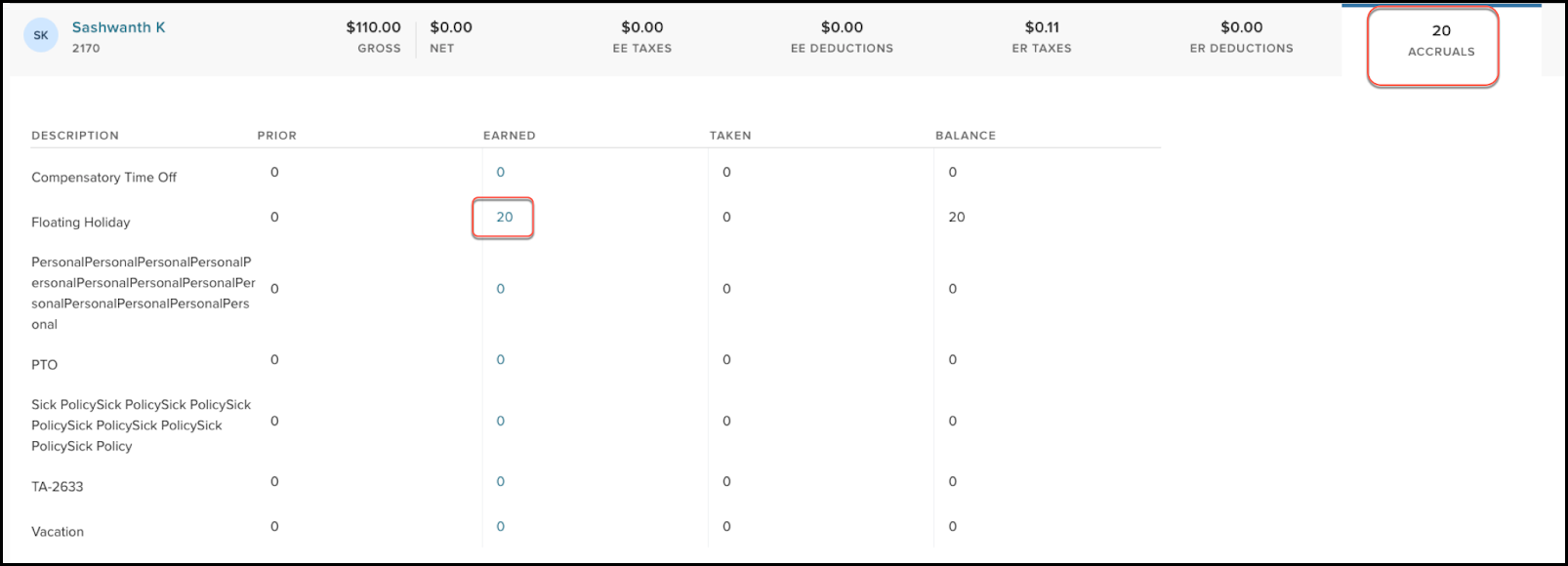

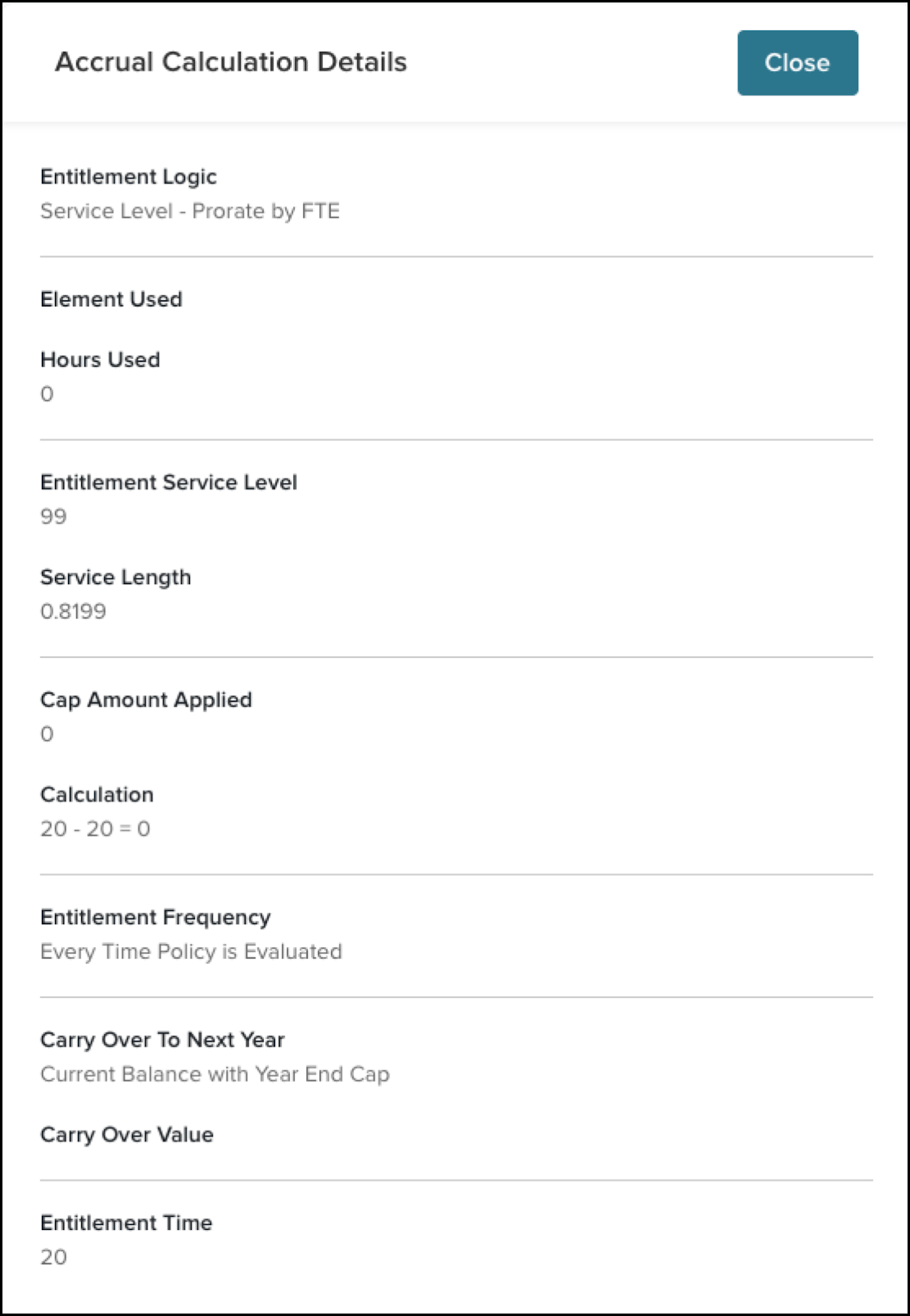

Displaying Earned Accrual Details

Users can now click on the Earned amount within the Accrual section of each pay header to view a detailed breakdown of the accrual calculation. This includes the inputs and configuration from the Time and Attendance system that were used to generate the final earned amounts.

By surfacing this information directly within the pay header, we're empowering users to better understand and verify their accruals, reducing confusion and support requests while increasing confidence in payroll accuracy.

To view this feature:

- Click on an individual pay header

- Click on the Accrual section

- Click on the hyperlinked number in the Earned column

- This will open up a separate window that outlines the following details:

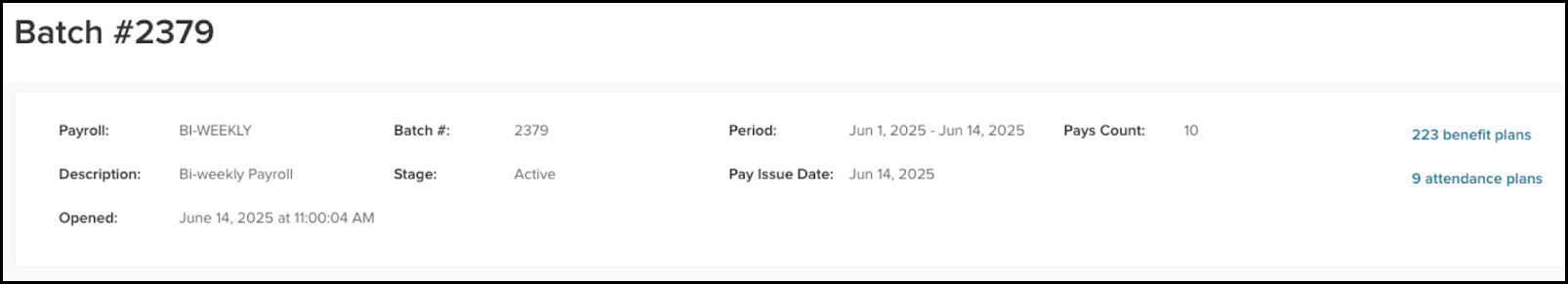

Date and Time Stamp of when a Batch Opened

To help users ensure the accuracy and completeness of payroll data, we've added a new Opened field to the top of each Pay Batch. This timestamp indicates when the batch was created.

With this added visibility, users can more easily:

- Verify that all items in the batch are suitable for the specified time frame.

- Identify any missing transactions that should have been included.

This enhancement improves auditability and reduces the risk of processing incomplete or incorrect batches, ultimately supporting more reliable payroll operations.

Enhancements to Deductions and Earnings Screens

We have made usability enhancements to the Deductions and Earnings Screens (Super_IPPDL and Super_IPPEL) to address some of the feedback we have received from users. The following is a list of enhancements.

Duplicate Pay Component

To save time and reduce repetitive data entry, we've added the ability to duplicate existing Pay Components.

Administrators frequently create similar components with only minor differences. With the new Duplicate Component action, available at the end of each Pay Component row, users can now quickly generate a new component pre-filled with the original’s details.

The new component will have blank values for Code, Abbreviation, and Description, allowing users to customize these unique identifiers while preserving the rest of the configuration.

This enhancement streamlines setup, reduces errors, and accelerates payroll configuration tasks.

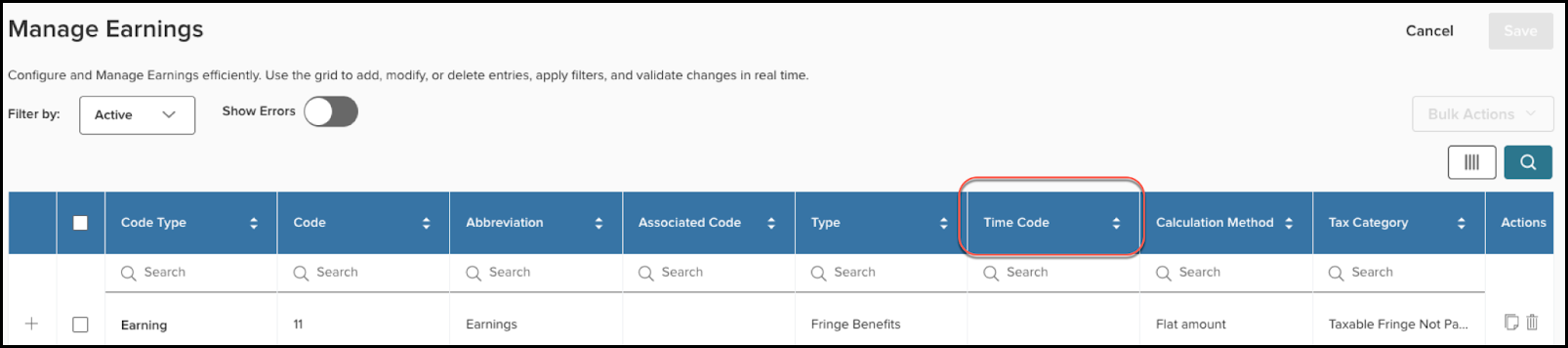

Time Code moved to the right of Type

The Time Code column has been moved to the right of the Type column because it is typically a field that users would fill in based on their decision regarding the Type.

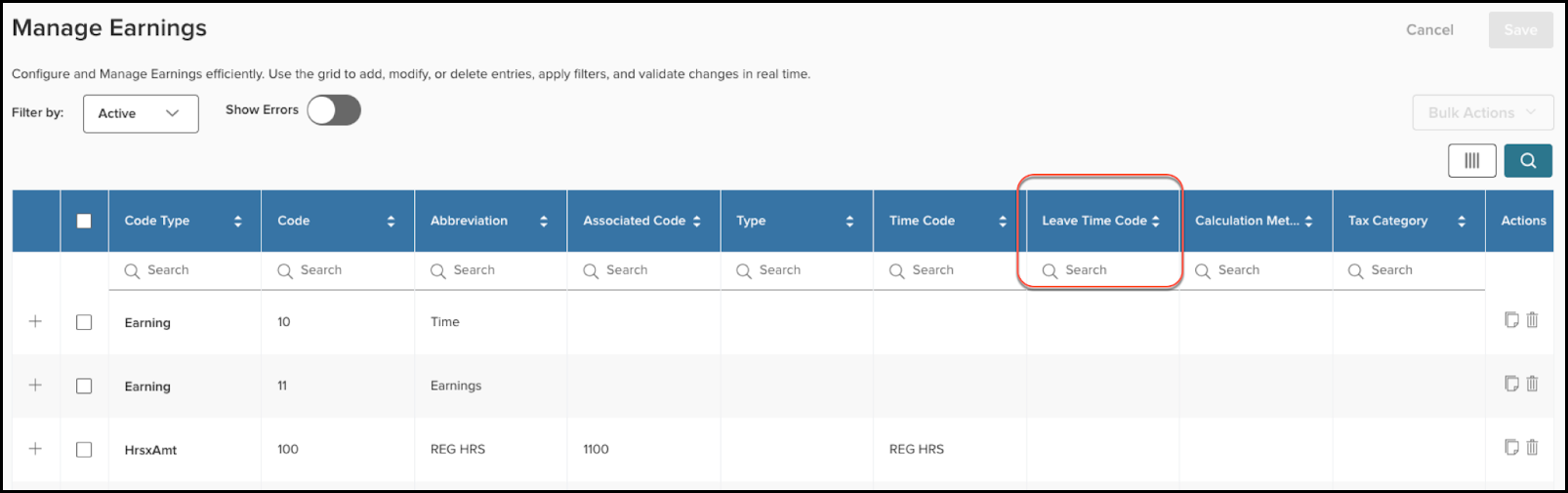

Leave Time Code Column Header

To reduce confusion and improve usability when configuring Pay Components, we've made the Leave Time Code field more visible and accessible.

Previously, this field was only available within the expanded details of each Pay Component row, which led to issues, especially when the Type was set to Leave Taken. In that case, the Leave Time Code becomes required, and users often don’t realize why they couldn’t save their component.

To address this, the Leave Time Code is now displayed as a new column in the main grid, placed between Time Code and Calculation Method. It becomes required only when the Type is set to Leave Taken.

This update enhances form clarity, reduces user errors, and ensures that Pay Component data is complete and accurate.

Persistent Filters/Paging on Deductions and Earnings Grid

We’ve enhanced the Deductions/Earnings grid experience by introducing persistent filters and paging, based on direct user feedback.

Previously, when users applied filters or navigated to a specific page in the grid, those settings were lost after saving or cancelling an edit. The grid would refresh and reset to the first page, forcing users to reapply filters and scroll back, particularly frustrating when making multiple edits in sequence.

With this update, your filters and page selections are retained even after:

- Saving a change

- Cancelling an edit

Now, when the grid refreshes, it will preserve your view, keeping you on the same page and maintaining any applied filters. This improvement streamlines editing workflows, reduces repetitive actions, and creates a smoother, more efficient user experience.

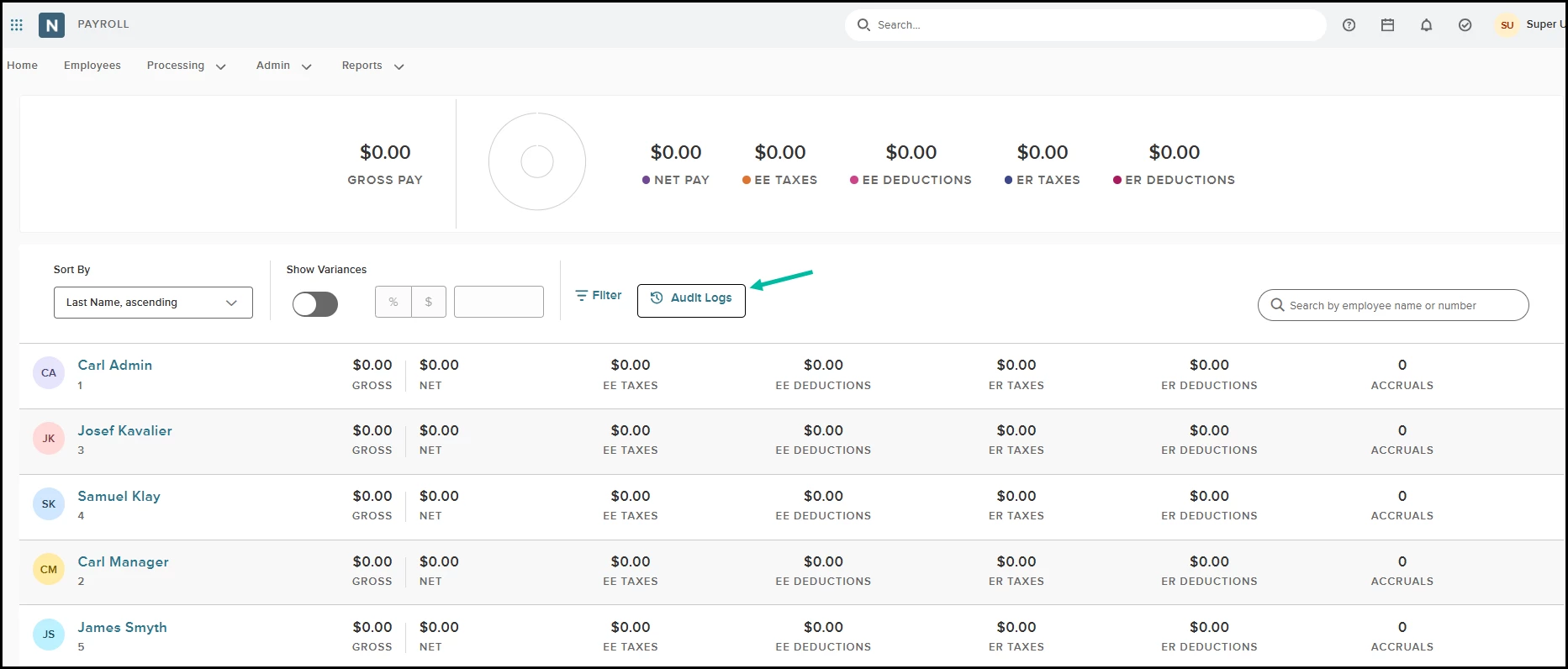

Audit on Payroll Batches

To enhance transparency and accountability in payroll processing, we’ve introduced comprehensive audit logs for active payroll batches. These logs allow users to track who made a change, when it was made, and what was changed, providing critical insight into the history of payroll data.

This feature is especially valuable when investigating unexpected results or verifying how a specific data state was reached.

Audit logs are now available in the following areas:

- Batch-Level Audit Log

Captures and displays any deleted headers within the batch, helping users track removed items for auditing and compliance purposes. This will be available at the top of the batch.

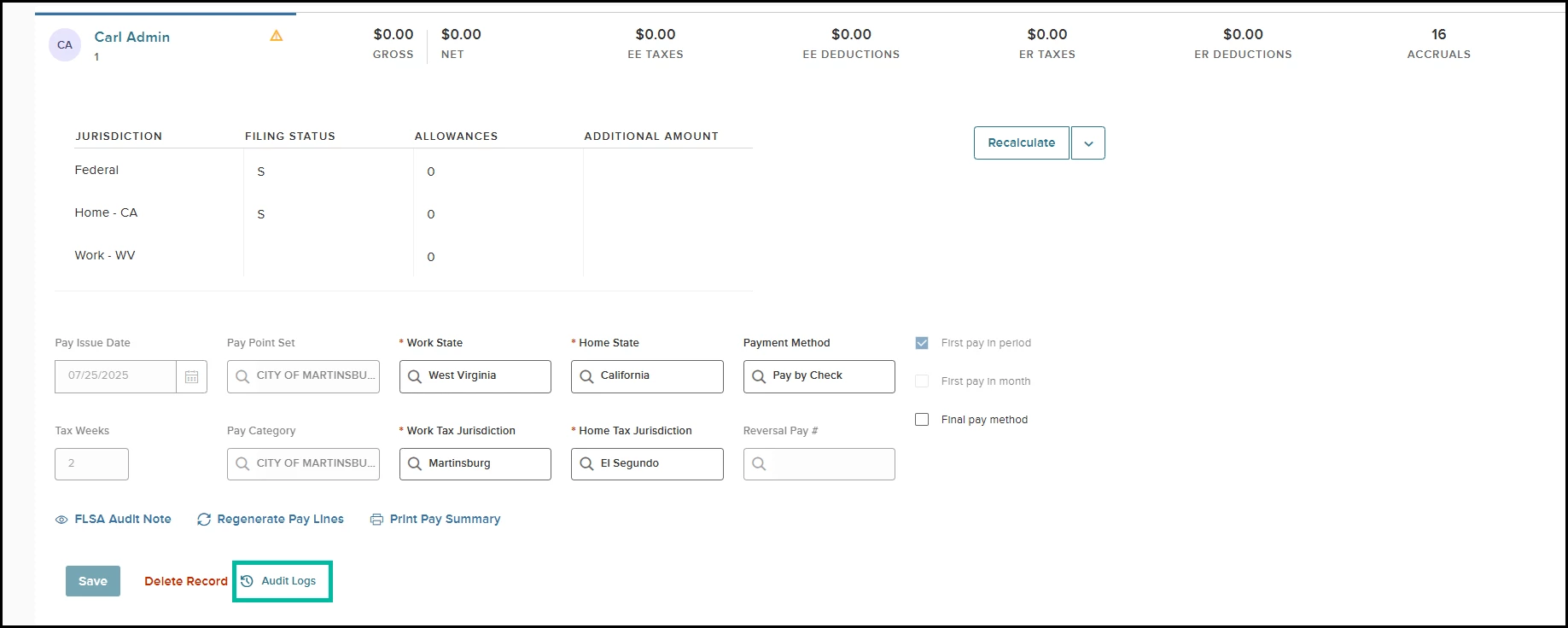

- Header Details Audit Log

Tracks changes to key detail fields for each header, including:- Work State

- Work Tax Jurisdiction

- Home State

- Home Tax Jurisdiction

- Payment Method

- Final Pay Method

You can see this on the bottom of the details tab.

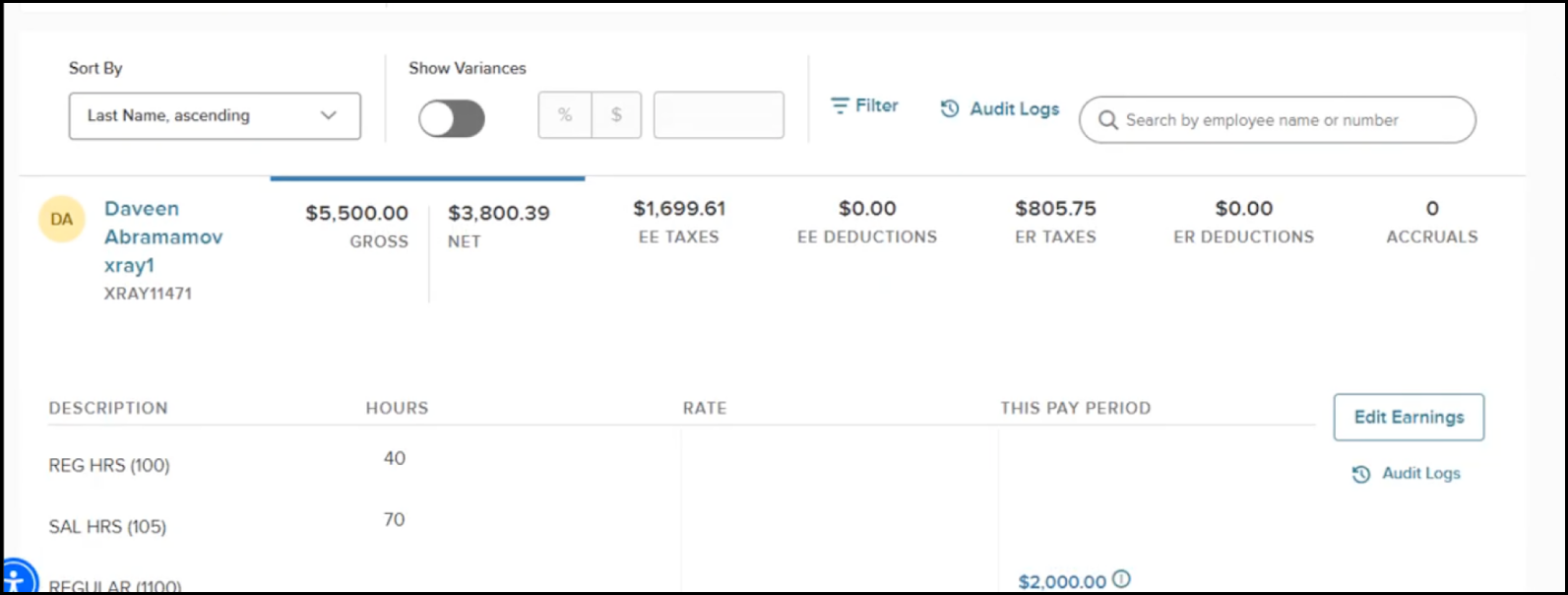

- Header Pay Line Audit Log

Logs all changes made to pay lines within a specific header, providing a complete history of modifications to compensation details.

You can see this on the right side of each section for the corresponding amount type.

With this update, users can manage payroll changes more confidently, investigate discrepancies, and maintain a reliable record of activity for audit and support purposes. These audit logs will not capture any system-initiated changes.

Appendix: Bugs Resolved

No additional bug fixes outside of the maintenance releases. Please refer to the maintenance release notes for summative details

Functional

| Scenario When Issue Encountered | Issue Resolved |

| None with this release. | 0 |

508(C) Compliance

| Screen(s) | Count of Bugs Resolved |

| None with this release. | 0 |

Related Resources

- Article: April 2025 Release Notes

- Article: May 2025 Release Notes

- Article: June 2025 Release Notes